Macy's 2010 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2010 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

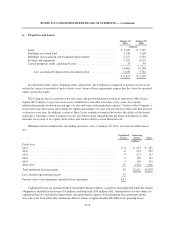

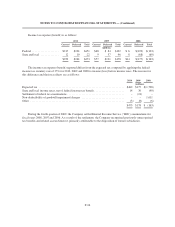

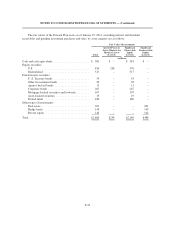

Income tax expense (benefit) is as follows:

2010 2009 2008

Current Deferred Total Current Deferred Total Current Deferred Total

(millions)

Federal ................... $217 $234 $451 $48 $ 84 $132 $ 6 $(109) $(103)

State and local ............. 12 10 22 9 37 46 8 (68) (60)

$229 $244 $473 $57 $121 $178 $14 $(177) $(163)

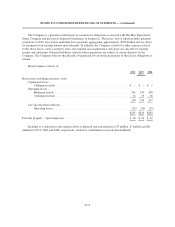

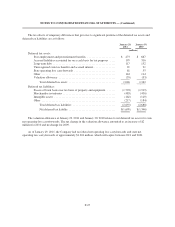

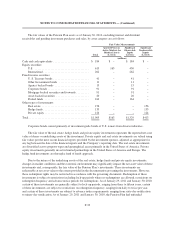

The income tax expense (benefit) reported differs from the expected tax computed by applying the federal

income tax statutory rate of 35% for 2010, 2009 and 2008 to income (loss) before income taxes. The reasons for

this difference and their tax effects are as follows:

2010 2009 2008

(millions)

Expected tax ............................................................ $462 $177 $(1,728)

State and local income taxes, net of federal income tax benefit ..................... 14 30 (40)

Settlement of federal tax examinations ........................................ – (21) –

Non-deductibility of goodwill impairment charges .............................. – – 1,611

Other .................................................................. (3) (8) (6)

$473 $178 $ (163)

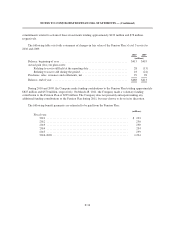

During the fourth quarter of 2009, the Company settled Internal Revenue Service (“IRS”) examinations for

fiscal years 2008, 2007 and 2006. As a result of the settlement, the Company recognized previously unrecognized

tax benefits and related accrued interest, primarily attributable to the disposition of former subsidiaries.

F-26