Macy's 2010 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2010 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MACY’S, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

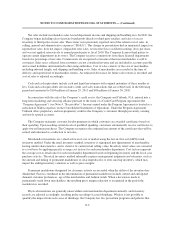

1. Organization and Summary of Significant Accounting Policies

Macy’s, Inc. and subsidiaries (the “Company”) is a retail organization operating retail stores and Internet

websites under two brands (Macy’s and Bloomingdale’s) that sell a wide range of merchandise, including men’s,

women’s and children’s apparel and accessories, cosmetics, home furnishings and other consumer goods in 45

states, the District of Columbia, Guam and Puerto Rico. As of January 29, 2011, the Company’s operations were

conducted through Macy’s, macys.com, Bloomingdale’s, bloomingdales.com and Bloomingdale’s Outlet, which

are aggregated into one reporting segment in accordance with the Financial Accounting Standards Board

(“FASB”) Accounting Standards Codification (“ASC”) Topic 280, “Segment Reporting.” The metrics used by

management to assess the performance of the Company’s operating divisions include sales trends, gross margin

rates, expense rates, and rates of earnings before interest and taxes (“EBIT”) and earnings before interest, taxes,

depreciation and amortization (“EBITDA”). The Company’s operating divisions have historically had similar

economic characteristics and are expected to have similar economic characteristics and long-term financial

performance in future periods.

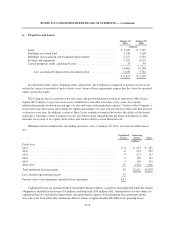

For 2010, 2009 and 2008, the following merchandise constituted the following percentages of sales:

2010 2009 2008

Feminine Accessories, Intimate Apparel, Shoes and Cosmetics ......................... 36% 36% 36%

Feminine Apparel ............................................................. 26 26 27

Men’s and Children’s .......................................................... 23 22 22

Home/Miscellaneous .......................................................... 15 16 15

100% 100% 100%

The Company’s fiscal year ends on the Saturday closest to January 31. Fiscal years 2010, 2009 and 2008

ended on January 29, 2011, January 30, 2010 and January 31, 2009, respectively. References to years in the

Consolidated Financial Statements relate to fiscal years rather than calendar years.

The Consolidated Financial Statements include the accounts of the Company and its wholly-owned

subsidiaries. The Company from time to time invests in companies engaged in complementary businesses.

Investments in companies in which the Company has the ability to exercise significant influence, but not control,

are accounted for by the equity method. All marketable equity and debt securities held by the Company are

accounted for under ASC Topic 320, “Investments – Debt and Equity Securities,” with unrealized gains and

losses on available-for-sale securities being included as a separate component of accumulated other

comprehensive income, net of income tax effect. All other investments are carried at cost. All significant

intercompany transactions have been eliminated.

The preparation of financial statements in conformity with accounting principles generally accepted in the

United States of America requires management to make estimates and assumptions that affect the reported

amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial

statements and the reported amounts of revenues and expenses during the reporting period. Such estimates and

assumptions are subject to inherent uncertainties, which may result in actual amounts differing from reported

amounts.

Certain reclassifications were made to prior years’ amounts to conform with the classifications of such

amounts for the most recent year.

F-8