Macy's 2010 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2010 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

The Company also has a stock credit plan. In 2006, key management personnel became eligible to earn a

stock credit grant over a two-year performance period ending February 2, 2008. There were a total of 727,629

stock credit awards outstanding as of January 29, 2011, including reinvested dividend equivalents earned during

the holding period, relating to the 2006 grant. In general, with respect to the stock credits awarded to participants

in 2006, the value of one-half of the stock credits earned plus reinvested dividend equivalents was paid in cash in

early 2010 and the value of the other half of such earned stock credits plus reinvested dividend equivalents was

paid in cash in early 2011. In 2008, key management personnel became eligible to earn a stock credit grant over a

two-year performance period ending January 30, 2010. There were a total of 1,690,716 stock credit awards

outstanding as of January 29, 2011, relating to the 2008 grant. In general, with respect to the stock credits

awarded to participants in 2008, the value of one-half of the stock credits earned plus reinvested dividend

equivalents will be paid in cash in early 2012 and the value of the other half of such earned stock credits plus

reinvested dividend equivalents will be paid in cash in early 2013. Compensation expense for stock credit awards

is recorded on a straight-line basis primarily over the vesting period and is calculated based on the ending stock

price for each reporting period. At January 29, 2011 and January 30, 2010, the liability under the stock credit

plans, which is reflected in other liabilities on the Consolidated Balance Sheets, was $52 million and $45 million,

respectively.

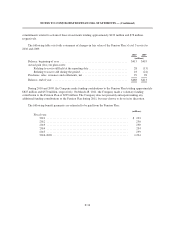

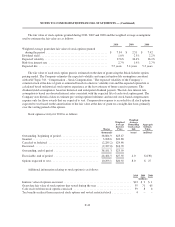

Activity related to stock credits for 2010 is as follows:

Shares

Stock credits, beginning of period ............................................ 3,267,355

Additional dividend equivalents earned ........................................ 22,339

Stock credits forfeited ...................................................... (145,404)

Stock credits distributed .................................................... (725,945)

Stock credits, end of period .................................................. 2,418,345

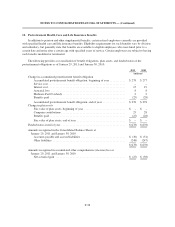

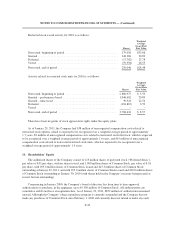

The weighted average grant date fair value of restricted stock and restricted stock units granted during 2010,

2009 and 2008 are as follows:

2010 2009 2008

Restricted stock ........................................................ $20.89 $ – $24.85

Restricted stock units .................................................... $20.95 $3.59 $ –

The fair value of the Target Shares and restricted stock awards are based on the fair value of the underlying

shares on the date of grant. The fair value of the Founders Award was determined using a Monte Carlo

simulation analysis to estimate the total shareholder return ranking of the Company among a ten-company

executive compensation peer group over the remaining performance period. The expected volatility of the

Company’s common stock at the date of grant was estimated based on a historical average volatility rate for the

approximate three-year performance period. The dividend yield assumption was based on historical and

anticipated dividend payouts. The risk-free interest rate assumption was based on observed interest rates

consistent with the approximate three-year performance measurement period.

Compensation expense is recorded for all restricted stock and restricted stock unit awards based on the

amortization of the fair market value at the date of grant over the period the restrictions lapse or over the

performance period of the performance-based restricted stock units.

F-44