Macy's 2010 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2010 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

are intended to minimize shrinkage. Physical inventories are taken at all store locations for substantially all

merchandise categories approximately three weeks before the end of the fiscal year. Shrinkage is estimated as a

percentage of sales at interim periods and for this approximate three-week period, based on historical shrinkage

rates.

The Company receives certain allowances from various vendors in support of the merchandise it purchases

for resale. The Company receives certain allowances as reimbursement for markdowns taken and/or to support

the gross margins earned in connection with the sales of merchandise. These allowances are generally credited to

cost of sales at the time the merchandise is sold in accordance with ASC Subtopic 605-50, “Customer Payments

and Incentives.” The Company also receives advertising allowances from more than 1,000 of its merchandise

vendors pursuant to cooperative advertising programs, with some vendors participating in multiple programs.

These allowances represent reimbursements by vendors of costs incurred by the Company to promote the

vendors’ merchandise and are netted against advertising and promotional costs when the related costs are

incurred in accordance with ASC Subtopic 605-50. Advertising allowances in excess of costs incurred are

recorded as a reduction of merchandise costs and, ultimately, through cost of sales when the merchandise is sold.

Advertising and promotional costs, net of cooperative advertising allowances, amounted to $1,072 million

for 2010, $1,087 million for 2009 and $1,239 million for 2008. Cooperative advertising allowances that offset

advertising and promotional costs were approximately $345 million for 2010, $298 million for 2009 and $372

million for 2008. Department store non-direct response advertising and promotional costs are expensed either as

incurred or the first time the advertising occurs. Direct response advertising and promotional costs are deferred

and expensed over the period during which the sales are expected to occur, generally one to four months.

The arrangements pursuant to which the Company’s vendors provide allowances, while binding, are

generally informal in nature and one year or less in duration. The terms and conditions of these arrangements

vary significantly from vendor to vendor and are influenced by, among other things, the type of merchandise to

be supported.

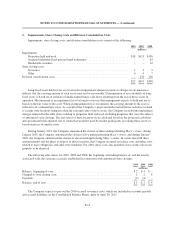

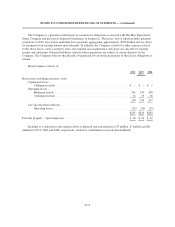

Depreciation of owned properties is provided primarily on a straight-line basis over the estimated asset

lives, which range from fifteen to fifty years for buildings and building equipment and three to fifteen years for

fixtures and equipment. Real estate taxes and interest on construction in progress and land under development are

capitalized. Amounts capitalized are amortized over the estimated lives of the related depreciable assets. The

Company receives contributions from developers and merchandise vendors to fund building improvement and

the construction of vendor shops. Such contributions are netted against the capital expenditures.

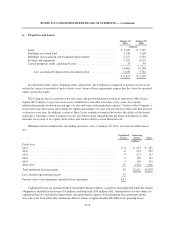

Buildings on leased land and leasehold improvements are amortized over the shorter of their economic lives

or the lease term, beginning on the date the asset is put into use. The Company receives contributions from

landlords to fund buildings and leasehold improvements. Such contributions are recorded as deferred rent and

amortized as reductions to lease expense over the lease term.

The Company recognizes operating lease minimum rentals on a straight-line basis over the lease term.

Executory costs such as real estate taxes and maintenance, and contingent rentals such as those based on a

percentage of sales are recognized as incurred.

The lease term, which includes all renewal periods that are considered to be reasonably assured, begins on

the date the Company has access to the leased property.

F-10