Macy's 2010 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2010 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

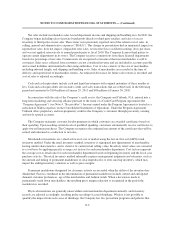

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

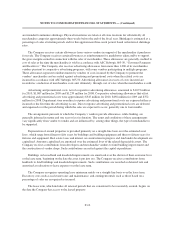

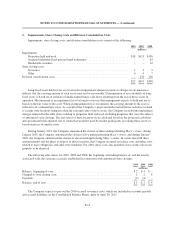

2. Impairments, Store Closing Costs and Division Consolidation Costs

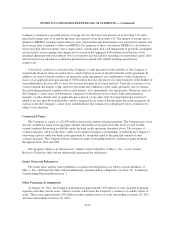

Impairments, store closing costs, and division consolidation costs consist of the following:

2010 2009 2008

(millions)

Impairments:

Properties held and used .................................................. $18 $115 $136

Acquired indefinite-lived private brand tradenames ............................ – – 63

Marketable securities .................................................... – – 12

Store closing costs:

Severance ............................................................. 1 2 4

Other ................................................................. 6 4 7

Division consolidation costs ................................................... – 270 176

$25 $391 $398

Long-lived assets held for use are reviewed for impairment whenever events or changes in circumstances

indicate that the carrying amount of such assets may not be recoverable. Determination of recoverability of long-

lived assets is based on an estimate of undiscounted future cash flows resulting from the use of those assets in

operation. Measurement of an impairment loss for long-lived assets that management expects to hold and use is

based on the fair value of the asset. When an impairment loss is recognized, the carrying amount of the asset is

reduced to its estimated fair value. As a result of the Company’s projected undiscounted future cash flows related

to certain store locations being less than the carrying value of those assets, the Company recorded the impairment

charges reflected in the table above relating to properties held and used, including properties that were the subject

of announced store closings. The fair values of these locations were calculated based on the projected cash flows

and an estimated risk-adjusted rate of return that would be used by market participants in valuing these assets or

based on prices of similar assets.

During January 2011, the Company announced the closure of three underperforming Macy’s stores; during

January 2010, the Company announced the closure of five underperforming Macy’s stores; and during January

2009, the Company announced the closure of eleven underperforming Macy’s stores. In connection with these

announcements and the plans to dispose of these locations, the Company incurred severance costs and other costs

related to lease obligations and other store liabilities. For 2010, these costs also included a loss on the sale of one

property to be disposed.

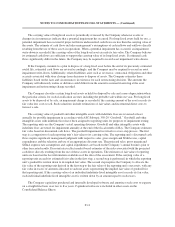

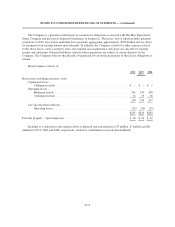

The following table shows for 2010, 2009 and 2008, the beginning and ending balance of, and the activity

associated with, the severance accruals established in connection with announced store closings:

2010 2009 2008

(millions)

Balance, beginning of year ...................................................... $2 $4 $ –

Charged to store closing costs ................................................... 1 2 4

Payments ................................................................... (2) (4) –

Balance, end of year ........................................................... $1 $2 $ 4

The Company expects to pay out the 2010 accrued severance costs, which are included in accounts payable

and accrued liabilities on the Consolidated Balance Sheets, prior to April 30, 2011.

F-14