Macy's 2010 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2010 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

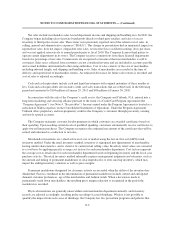

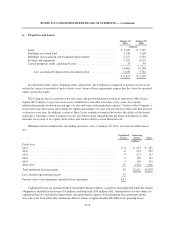

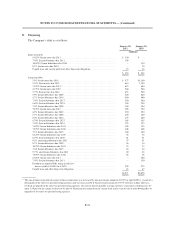

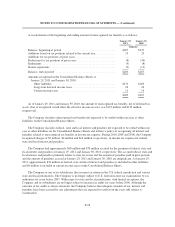

6. Properties and Leases

January 29,

2011

January 30,

2010

(millions)

Land ........................................................ $ 1,702 $ 1,719

Buildings on owned land ........................................ 5,148 5,160

Buildings on leased land and leasehold improvements ................. 2,227 2,232

Fixtures and equipment .......................................... 5,752 6,129

Leased properties under capitalized leases ........................... 33 49

14,862 15,289

Less accumulated depreciation and amortization .................. 6,049 5,782

$ 8,813 $ 9,507

In connection with various shopping center agreements, the Company is obligated to operate certain stores

within the centers for periods of up to twenty years. Some of these agreements require that the stores be operated

under a particular name.

The Company leases a portion of the real estate and personal property used in its operations. Most leases

require the Company to pay real estate taxes, maintenance and other executory costs; some also require

additional payments based on percentages of sales and some contain purchase options. Certain of the Company’s

real estate leases have terms that extend for significant numbers of years and provide for rental rates that increase

or decrease over time. In addition, certain of these leases contain covenants that restrict the ability of the tenant

(typically a subsidiary of the Company) to take specified actions (including the payment of dividends or other

amounts on account of its capital stock) unless the tenant satisfies certain financial tests.

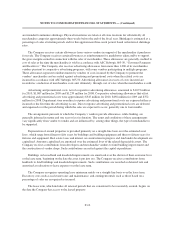

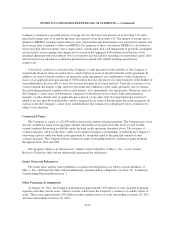

Minimum rental commitments (excluding executory costs) at January 29, 2011, for noncancellable leases

are:

Capitalized

Leases

Operating

Leases Total

(millions)

Fiscal year:

2011 ............................................................ $ 6 $ 245 $ 251

2012 ............................................................ 6 233 239

2013 ............................................................ 4 213 217

2014 ............................................................ 4 190 194

2015 ............................................................ 3 150 153

After 2015 ........................................................ 35 1,581 1,616

Total minimum lease payments ....................................... 58 $2,612 $2,670

Less amount representing interest ..................................... 25

Present value of net minimum capitalized lease payments .................. $33

Capitalized leases are included in the Consolidated Balance Sheets as property and equipment while the related

obligation is included in short-term ($3 million) and long-term ($30 million) debt. Amortization of assets subject to

capitalized leases is included in depreciation and amortization expense. Total minimum lease payments shown

above have not been reduced by minimum sublease rentals of approximately $80 million on operating leases.

F-18