Macy's 2010 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2010 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

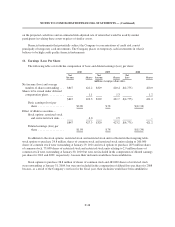

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

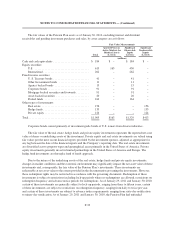

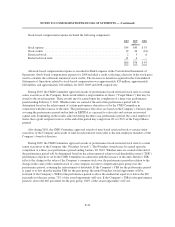

The fair value of stock-options granted during 2010, 2009 and 2008 and the weighted average assumptions

used to estimate the fair value are as follows:

2010 2009 2008

Weighted average grant date fair value of stock options granted

during the period ........................................... $ 7.34 $ 2.51 $ 7.42

Dividend yield ............................................... 1.0% 2.3% 2.2%

Expected volatility ............................................ 37.6% 36.4% 36.2%

Risk-free interest rate ......................................... 2.7% 1.9% 2.7%

Expected life ................................................ 5.5years 5.4 years 5.3 years

The fair value of each stock option grant is estimated on the date of grant using the Black-Scholes option-

pricing model. The Company estimates the expected volatility and expected option life assumption consistent

with ASC Topic 718, “Compensation – Stock Compensation.” The expected volatility of the Company’s

common stock at the date of grant is estimated based on a historic volatility rate and the expected option life is

calculated based on historical stock option experience as the best estimate of future exercise patterns. The

dividend yield assumption is based on historical and anticipated dividend payouts. The risk-free interest rate

assumption is based on observed interest rates consistent with the expected life of each stock option grant. The

Company uses historical data to estimate pre-vesting option forfeitures and records stock-based compensation

expense only for those awards that are expected to vest. Compensation expense is recorded for all stock options

expected to vest based on the amortization of the fair value at the date of grant on a straight-line basis primarily

over the vesting period of the options.

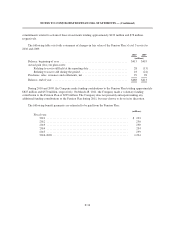

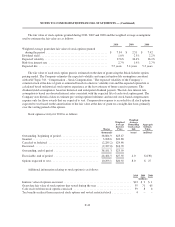

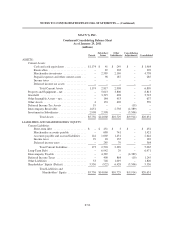

Stock option activity for 2010 is as follows:

Shares

Weighted

Average

Exercise

Price

Weighted

Average

Remaining

Contractual

Life

Aggregate

Intrinsic

Value

(thousands) (years) (millions)

Outstanding, beginning of period .......................... 38,804.9 $25.47

Granted .............................................. 3,908.6 $20.88

Canceled or forfeited ................................... (2,285.2) $24.46

Exercised ............................................. (2,327.0) $16.70

Outstanding, end of period ............................... 38,101.3 $25.59

Exercisable, end of period ............................... 26,404.5 $27.92 4.0 $(130)

Options expected to vest ................................. 10,293.1 $20.35 8.0 $ 27

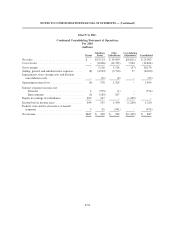

Additional information relating to stock options is as follows:

2010 2009 2008

(millions)

Intrinsic value of options exercised ............................................... $13 $ 2 $ 1

Grant date fair value of stock options that vested during the year ........................ 55 71 65

Cash received from stock options exercised ........................................ 39 8 6

Tax benefits realized from exercised stock options and vested restricted stock ............. 4 – –

F-43