Macy's 2010 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2010 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Macy’s and the continued strong performance at Bloomingdale’s. The net income for 2010 includes the impact of

$25 million of impairments and store closing costs. The net income for 2009 included the impact of $391 million

of impairments, store closing costs and division consolidation costs.

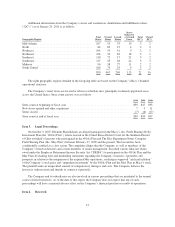

Net sales for 2010 totaled $25,003 million, compared to net sales of $23,489 million for 2009, an increase of

$1,514 million or 6.4%. On a comparable store basis, net sales for 2010 were up 4.6% compared to 2009. Sales

from the Company’s Internet businesses in 2010 increased 28.7% compared to 2009 and positively affected the

Company’s 2010 comparable store sales by 0.9%. The Company has realized continued success in the My

Macy’s localization strategy. Geographically, sales in 2010 were strongest in Florida and the upper Midwest. By

family of business, sales in 2010 were strongest in updated women’s apparel, particularly the Company’s I-N-C

brand, jewelry and watches, men’s apparel and accessories, luggage, furniture and mattresses. Sales of the

Company’s private label brands continued to be strong and represented approximately 20% of net sales in the

Macy’s-branded stores in 2010. Sales in 2010 were less strong in traditional women’s sportswear. The Company

calculates comparable store sales as sales from stores in operation throughout 2009 and 2010 and all net Internet

sales. Stores undergoing remodeling, expansion or relocation remain in the comparable store sales calculation

unless the store is closed for a significant period of time. Definitions and calculations of comparable store sales

differ among companies in the retail industry.

Cost of sales was $14,824 million or 59.3% of net sales for 2010, compared to $13,973 million or 59.5% of

net sales for 2009, an increase of $851 million. The improved cost of sales rate reflects the benefit of good

inventory management throughout 2010. The valuation of merchandise inventories on the last-in, first-out basis

did not impact cost of sales in either period.

SG&A expenses were $8,260 million or 33.0% of net sales for 2010, compared to $8,062 million or 34.3%

of net sales for 2009, an increase of $198 million. The SG&A rate as a percent of net sales was lower in 2010, as

compared to 2009, reflecting an increase in net sales. SG&A expenses in 2010 increased due to higher selling

costs as a result of stronger sales, higher workers’ compensation and general liability insurance costs, higher

pension and supplementary retirement plan expense, and higher costs in support of the Company’s omnichannel

operations, partially offset by lower depreciation and amortization expense, lower stock-based compensation

expense, higher income from credit operations and lower advertising expense. Workers’ compensation and

general liability insurance costs were $148 million for 2010, compared to $124 million for 2009. Pension and

supplementary retirement plan expense amounted to $144 million for 2010, compared to $110 million for 2009.

Depreciation and amortization expense was $1,150 million for 2010, compared to $1,210 million for 2009.

Stock-based compensation expense was $66 million for 2010, compared to $76 million for 2009. Income from

credit operations was $332 million in 2010 as compared to $323 million in 2009. Advertising expense, net of

cooperative advertising allowances, was $1,072 million for 2010 compared to $1,087 million for 2009.

Impairments, store closing costs and division consolidation costs for 2010 amounted to $25 million and

included $18 million of asset impairment charges and $7 million of other costs and expenses related to the store

closings announced in January 2011.

Impairments, store closing costs and division consolidation costs for 2009 amounted to $391 million and

included $115 million of asset impairment charges, $6 million of other costs and expenses related to the store

closings announced in January 2010, and $270 million of restructuring-related costs and expenses associated with

the division consolidation and localization initiatives, primarily severance and other human resource-related

costs.

Net interest expense was $574 million for 2010, compared to $556 million for 2009, an increase of $18

million. The increase in net interest expense is primarily due to approximately $66 million of expenses associated

with the early retirement of approximately $1,000 million of outstanding debt during 2010, partially offset by

lower levels of borrowings due primarily to such early retirement of outstanding debt.

18