Macy's 2010 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2010 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

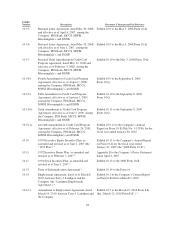

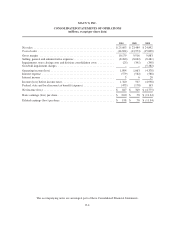

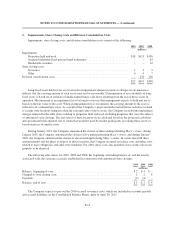

MACY’S, INC.

CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY

(millions)

Common

Stock

Additional

Paid-In

Capital

Accumulated

Equity

Treasury

Stock

Accumulated

Other

Comprehensive

Income (Loss)

Total

Shareholders’

Equity

Balance at February 2, 2008 ........................... $5 $5,609 $ 7,032 $(2,557) $(182) $ 9,907

Cumulative effect of change in methodology of deferred

state income taxes ............................... (54) (54)

Balance at February 2, 2008, as revised .................. 5 5,609 6,978 (2,557) (182) 9,853

Net loss ........................................... (4,775) (4,775)

Actuarial loss on post employment and postretirement

benefit plans, net of income tax effect of $183 million ..... (294) (294)

Unrealized loss on marketable securities, net of income

tax effect of $11 million ............................ (17) (17)

Reclassifications to net loss:

Realized loss on marketable securities, net of income

tax effect of $5 million ......................... 7 7

Net actuarial loss on post employment and

postretirement benefit plans, net of income tax

effect of $1 million .......................... 1 1

Prior service credit on post employment and

postretirement benefit plans, net of income tax

effect of $1 million ............................ (1) (1)

Total comprehensive loss ............................. (5,079)

Common stock dividends ($.5275 per share) .............. (221) (221)

Stock repurchases ................................... (1) (1)

Stock-based compensation expense ..................... 61 61

Stock issued under stock plans ......................... (7) 13 6

Deferred compensation plan distributions ................. 1 1

Balance at January 31, 2009 ........................... 5 5,663 1,982 (2,544) (486) 4,620

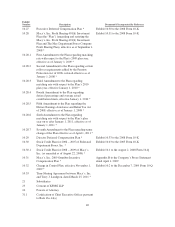

Net income ........................................ 329 329

Actuarial loss on post employment and postretirement

benefit plans, net of income tax effect of $166 million ..... (266) (266)

Unrealized gain on marketable securities, net of income

tax effect of $3 million ............................. 5 5

Reclassifications to net income:

Net actuarial gain on postretirement benefit plans,

net of income tax effect of $3 million .............. (4) (4)

Prior service credit on post employment benefit plans,

net of income tax effect of $1 million .............. (2) (2)

Total comprehensive income ......................... 62

Common stock dividends ($.20 per share) ................ (84) (84)

Stock repurchases ................................... (1) (1)

Stock-based compensation expense ..................... 50 50

Stock issued under stock plans ......................... (24) 29 5

Deferred compensation plan distributions ................. 1 1

Balance at January 30, 2010 ........................... 5 5,689 2,227 (2,515) (753) 4,653

Net income ........................................ 847 847

Actuarial loss on post employment and postretirement

benefit plans, net of income tax effect of $4 million ....... (17) (17)

Unrealized gain on marketable securities, net of income

tax effect of $3 million ........................... 5 5

Reclassifications to net income:

Net actuarial loss on postretirement benefit plans,

net of income tax effect of $23 million ............. 36 36

Prior service credit on post employment benefit plans,

net of income tax effect of $1 million .............. (1) (1)

Total comprehensive income ........................... 870

Common stock dividends ($.20 per share) ................ (84) (84)

Stock repurchases ................................... (1) (1)

Stock-based compensation expense ..................... 47 47

Stock issued under stock plans ......................... (40) 82 42

Deferred compensation plan distributions ................. 3 3

Balance at January 29, 2011 ........................... $5 $5,696 $ 2,990 $(2,431) $(730) $ 5,530

The accompanying notes are an integral part of these Consolidated Financial Statements.

F-6