Macy's 2010 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2010 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

purchases in 2011, it may resume purchases of Common Stock under these or possible future authorizations in

the open market, in privately negotiated transactions or otherwise at any time and from time to time without prior

notice.

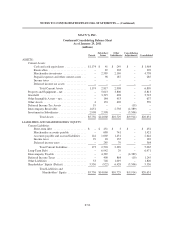

Common Stock

The holders of the Common Stock are entitled to one vote for each share held of record on all matters

submitted to a vote of shareholders. Subject to preferential rights that may be applicable to any Preferred Stock,

holders of Common Stock are entitled to receive ratably such dividends as may be declared by the Board of

Directors in its discretion, out of funds legally available therefor.

Treasury Stock

Treasury stock contains shares repurchased under the share repurchase program, shares repurchased to cover

employee tax liabilities related to stock plan activity and shares maintained in a trust related to deferred

compensation plans. Under the deferred compensation plans, shares are maintained in a trust to cover the number

estimated to be needed for distribution on account of stock credits currently outstanding.

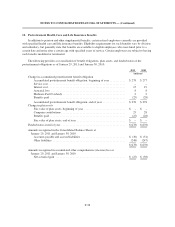

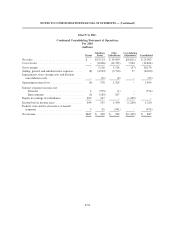

Changes in the Company’s Common Stock issued and outstanding, including shares held by the Company’s

treasury, are as follows:

Common

Stock

Issued

Treasury Stock

Common

Stock

Outstanding

Deferred

Compensation

Plans Other Total

(thousands)

Balance at February 2, 2008 ............... 495,038.5 (1,218.1) (74,075.4) (75,293.5) 419,745.0

Stock issued under stock plans ............. (157.6) 464.1 306.5 306.5

Stock repurchases:

Repurchase program ................. – –

Other ............................. (25.7) (25.7) (25.7)

Deferred compensation plan distributions ..... 58.0 58.0 58.0

Balance at January 31, 2009 ............... 495,038.5 (1,317.7) (73,637.0) (74,954.7) 420,083.8

Stock issued under stock plans ............. (105.0) 937.9 832.9 832.9

Stock repurchases:

Repurchase program ................. – –

Other ............................. (130.1) (130.1) (130.1)

Deferred compensation plan distributions ..... 56.6 56.6 56.6

Balance at January 30, 2010 ............... 495,038.5 (1,366.1) (72,829.2) (74,195.3) 420,843.2

Stock issued under stock plans ............. (48.8) 2,439.5 2,390.7 2,390.7

Stock repurchases:

Repurchase program ................. – –

Other ............................. (58.5) (58.5) (58.5)

Deferred compensation plan distributions ..... 165.9 165.9 165.9

Balance at January 29, 2011 ............... 495,038.5 (1,249.0) (70,448.2) (71,697.2) 423,341.3

F-46