Macy's 2010 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2010 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Company’s operations are impacted by competitive pressures from department stores, specialty stores,

mass merchandisers and all other retail channels. The Company’s operations are also impacted by general

consumer spending levels, including the impact of general economic conditions, consumer disposable income

levels, consumer confidence levels, the availability, cost and level of consumer debt, the costs of basic necessities

and other goods and the effects of weather or natural disasters and other factors over which the Company has

little or no control.

Throughout 2008 and into 2009, consumer spending levels were adversely affected by a number of factors,

including substantial declines in the level of general economic activity and real estate and investment values,

substantial increases in consumer pessimism, unemployment and the costs of basic necessities, and a significant

tightening of consumer credit. These conditions adversely affected, and to varying degrees continue to adversely

affect, the amount of funds that consumers are willing and able to spend for discretionary purchases, including

purchases of some of the merchandise offered by the Company. These conditions also adversely affected the

projected future cash flows attributable to the Company’s operations, including the projected future cash flows

assumed in connection with the acquisition of The May Department Stores Company (“May”), resulting in the

Company recording in the fourth quarter of 2008 a reduction in the carrying value of its goodwill, and a related

non-cash impairment charge, in the amount of $5,382 million. The Company experienced significantly higher

sales growth and steady gross margin and cash flow in 2010, and therefore is optimistic about the improvement

in current and future economic conditions.

The effects of economic conditions have been, and may continue to be, experienced differently, or at

different times, in the various geographic regions in which the Company operates, in relation to the different

types of merchandise that the Company offers for sale, or in relation to the Company’s Macy’s-branded and

Bloomingdale’s-branded operations. All economic conditions, however, ultimately affect the Company’s overall

operations. Based on its assessment of current and anticipated market conditions and its recent performance, the

Company is assuming that its comparable store sales in 2011 will increase approximately 3% from 2010 levels.

The discussion in this Item 7 should be read in conjunction with our Consolidated Financial Statements and

the related notes included elsewhere in this report. The discussion in this Item 7 contains forward-looking

statements that reflect the Company’s plans, estimates and beliefs. The Company’s actual results could materially

differ from those discussed in these forward-looking statements. Factors that could cause or contribute to those

differences include, but are not limited to, those discussed below and elsewhere in this report, particularly in

“Risk Factors” and “Forward-Looking Statements.”

Results of Operations

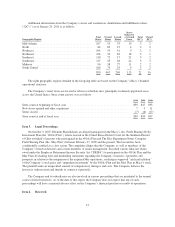

Net sales include merchandise sales, leased department income, shipping and handling fees and sales to

third party retailers. In 2010, the Company began including sales of private brand goods directly to third party

retailers and sales of excess inventory to third parties in net sales. These items were previously reported, net of

the related cost of sales, in selling, general and administrative expenses (“SG&A”) expenses. This change in

presentation had an immaterial impact on reported net sales, does not impact comparable store sales, net income

(loss) or diluted earnings (loss) per share, and was not applied retroactively to annual periods prior to fiscal 2010.

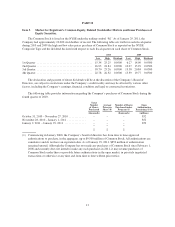

The Company changed its methodology for recording deferred state income taxes from a blended rate basis

to a separate entity basis, and has reflected the effects of such change to 2010 and all prior periods. Even though

the Company considers the change to have had only an immaterial impact on its financial condition, results of

operations and cash flows for the periods presented, the financial condition, results of operations and cash flows

for the prior periods as previously reported have been adjusted to reflect the change.

Comparison of the 52 Weeks Ended January 29, 2011 and January 30, 2010. Net income for 2010 was $847

million, compared to net income of $329 million for 2009, reflecting the benefits of the strategic initiatives at

17