Macy's 2010 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2010 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

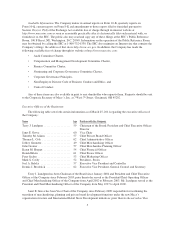

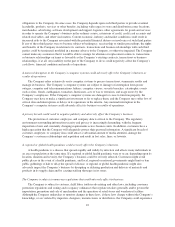

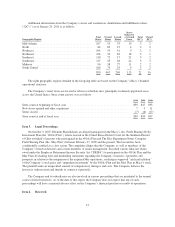

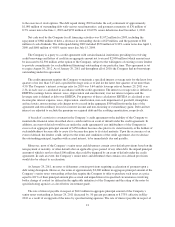

Additional information about the Company’s stores and warehouses, distribution and fulfillment centers

(“DC’s”) as of January 29, 2011 is as follows:

Geographic Region

Total

Stores

Owned

Stores

Leased

Stores

Stores

Subject to

a Ground

Lease

Total

DC’s

Owned

DC’s

Mid-Atlantic ...................................... 107 55 33 19 3 2

North ............................................ 84 65 15 4 2 2

Northeast ......................................... 104 54 41 9 2 2

Northwest ........................................ 126 39 69 18 3 1

Southeast ......................................... 110 72 17 21 3 2

Southwest ........................................ 117 45 48 24 3 3

Midwest ......................................... 96 58 27 11 2 2

South Central ..................................... 106 79 18 9 3 2

850 467 268 115 21 16

The eight geographic regions detailed in the foregoing table are based on the Company’s Macy’s branded

operational structure.

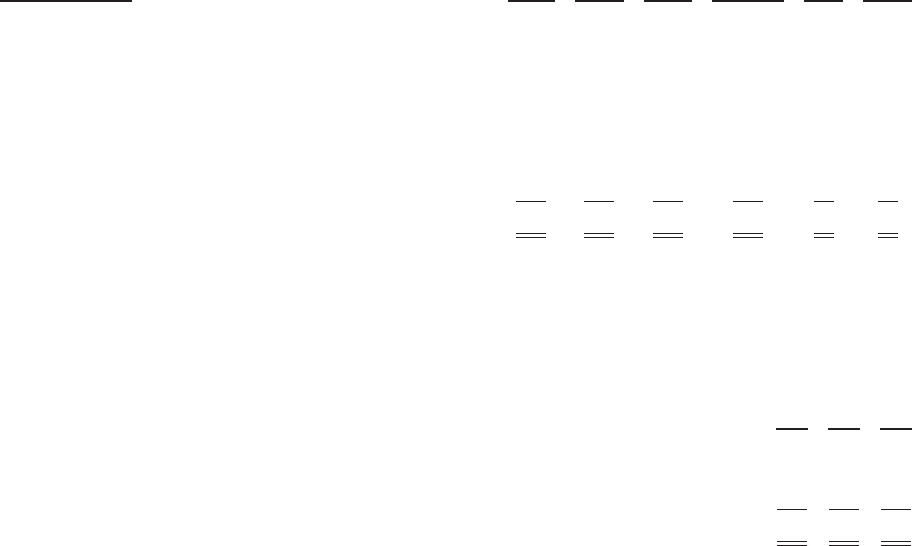

The Company’s retail stores are located at urban or suburban sites, principally in densely populated areas

across the United States. Store count activity was as follows:

2010 2009 2008

Store count at beginning of fiscal year ............................................ 850 847 853

New stores opened and other expansions .......................................... 7 9 11

Stores closed ................................................................ (7) (6) (17)

Store count at end of fiscal year .................................................. 850 850 847

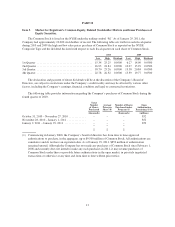

Item 3. Legal Proceedings.

On October 3, 2007, Ebrahim Shanehchian, an alleged participant in the Macy’s, Inc. Profit Sharing 401(k)

Investment Plan (the “401(k) Plan”), filed a lawsuit in the United States District Court for the Southern District

of Ohio on behalf of persons who participated in the 401(k) Plan and The May Department Stores Company

Profit Sharing Plan (the “May Plan”) between February 27, 2005 and the present. The lawsuit has been

conditionally certified as a class action. The complaint alleges that the Company, as well as members of the

Company’s board of directors and certain members of senior management, breached various fiduciary duties

owed under the Employee Retirement Income Security Act (“ERISA”) to participants in the 401(k) Plan and the

May Plan, by making false and misleading statements regarding the Company’s business, operations and

prospects in relation to the integration of the acquired May operations, resulting in supposed “artificial inflation”

of the Company’s stock price and “imprudent investment” by the 401(k) Plan and the May Plan in Macy’s stock.

The plaintiff seeks an unspecified amount of compensatory damages and costs. The Company believes the

lawsuit is without merit and intends to contest it vigorously.

The Company and its subsidiaries are also involved in various proceedings that are incidental to the normal

course of their businesses. As of the date of this report, the Company does not expect that any of such

proceedings will have a material adverse effect on the Company’s financial position or results of operations.

Item 4. Reserved.

12