Macy's 2010 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2010 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

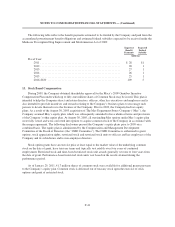

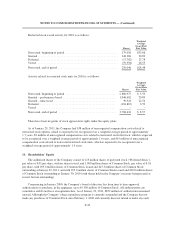

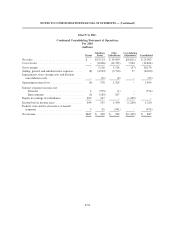

Restricted stock award activity for 2010 is as follows:

Shares

Weighted

Average

Grant Date

Fair Value

Nonvested, beginning of period ..................................... 179,056 $33.66

Granted ........................................................ 148,366 20.89

Forfeited ....................................................... (17,782) 23.78

Vested ........................................................ (59,594) 26.55

Nonvested, end of period .......................................... 250,046 $28.48

Activity related to restricted stock units for 2010 is as follows:

Shares

Weighted

Average

Grant Date

Fair Value

Nonvested, beginning of period ................................... 2,886,975 $ 3.59

Granted – performance-based ..................................... 1,046,602 20.89

Granted – time-based ........................................... 39,924 22.54

Forfeited ..................................................... (184,867) 3.59

Vested ....................................................... – –

Nonvested, end of period ........................................ 3,788,634 $ 8.57

There have been no grants of stock appreciation rights under the equity plans.

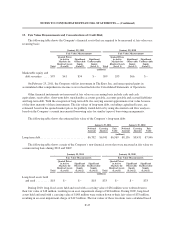

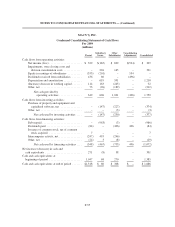

As of January 29, 2011, the Company had $38 million of unrecognized compensation costs related to

nonvested stock options, which is expected to be recognized over a weighted average period of approximately

1.7 years, $2 million of unrecognized compensation costs related to nonvested restricted stock, which is expected

to be recognized over a weighted average period of approximately 1.6 years, and $19 million of unrecognized

compensation costs related to nonvested restricted stock units, which is expected to be recognized over a

weighted average period of approximately 1.4 years.

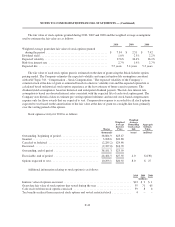

14. Shareholders’ Equity

The authorized shares of the Company consist of 125 million shares of preferred stock (“Preferred Stock”),

par value of $.01 per share, with no shares issued, and 1,000 million shares of Common Stock, par value of $.01

per share, with 495.0 million shares of Common Stock issued and 423.3 million shares of Common Stock

outstanding at January 29, 2011, and with 495.0 million shares of Common Stock issued and 420.8 million shares

of Common Stock outstanding at January 30, 2010 (with shares held in the Company’s treasury being treated as

issued, but not outstanding).

Commencing in January 2000, the Company’s board of directors has from time to time approved

authorizations to purchase, in the aggregate, up to $9,500 million of Common Stock. All authorizations are

cumulative and do not have an expiration date. As of January 29, 2011, $852 million of authorization remained

unused. Although the Company’s share repurchase program is currently suspended and the Company has not

made any purchases of Common Stock since February 1, 2008 and currently does not intend to make any such

F-45