Macy's 2010 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2010 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

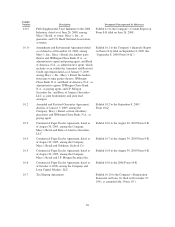

Exhibit

Number Description Document if Incorporated by Reference

10.27 Executive Deferred Compensation Plan * Exhibit 10.30 to the 2008 Form 10-K

10.28 Macy’s, Inc. Profit Sharing 401(k) Investment

Plan (the “Plan”) (amending and restating the

Macy’s, Inc. Profit Sharing 401(k) Investment

Plan and The May Department Stores Company

Profit Sharing Plan), effective as of September 1,

2008 *

Exhibit 10.31 to the 2008 Form 10-K

10.28.1 First Amendment to the Plan regarding matching

rate with respect to the Plan’s 2009 plan year,

effective as of January 1, 2009 *

10.28.2 Second Amendment to the Plan regarding certain

rollover requirements added by the Pension

Protection Act of 2006, restated effective as of

January 1, 2008 *

10.28.3 Third Amendment to the Plan regarding

matching rate with respect to the Plan’s 2010

plan year, effective January 1, 2010 *

10.28.4 Fourth Amendment to the Plan regarding

deferral percentage and average actual

contribution limits, effective January 1, 2010 *

10.28.5 Fifth Amendment to the Plan regarding the

Heroes Earnings Assistance and Relief Tax Act

of 2008, effective as of January 1, 2008 *

10.28.6 Sixth Amendment to the Plan regarding

matching rate with respect to the Plan’s plan

year on or after January 1, 2011, effective as of

January 1, 2011 *

10.28.7 Seventh Amendment to the Plan regarding name

change of the Plan effective as of April 1, 2011 *

10.29 Director Deferred Compensation Plan * Exhibit 10.33 to the 2008 Form 10-K

10.30 Stock Credit Plan for 2006 – 2007 of Federated

Department Stores, Inc. *

Exhibit 10.43 to the 2005 Form 10-K

10.30.1 Stock Credit Plan for 2008 – 2009 of Macy’s,

Inc. (as amended as of August 22, 2008) *

Exhibit 10.1 to the August 2, 2008 Form 10-Q

10.31 Macy’s, Inc. 2009 Omnibus Incentive

Compensation Plan *

Appendix B to the Company’s Proxy Statement

dated April 1, 2009

10.32 Change in Control Plan, effective November 1,

2009 *

Exhibit 10.2 to the December 7, 2009 Form 10-Q

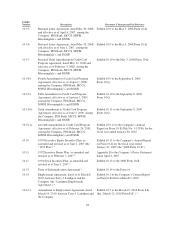

10.33 Time Sharing Agreement between Macy’s, Inc.

and Terry J. Lundgren, dated March 25, 2011 *

21 Subsidiaries

23 Consent of KPMG LLP

24 Powers of Attorney

31.1 Certification of Chief Executive Officer pursuant

to Rule 13a-14(a)

40