Macy's 2010 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2010 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

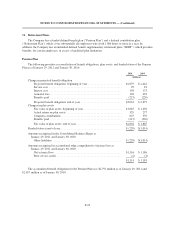

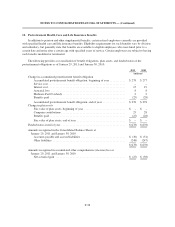

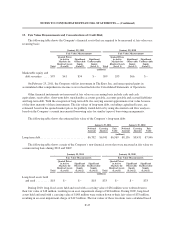

12. Postretirement Health Care and Life Insurance Benefits

In addition to pension and other supplemental benefits, certain retired employees currently are provided

with specified health care and life insurance benefits. Eligibility requirements for such benefits vary by division

and subsidiary, but generally state that benefits are available to eligible employees who were hired prior to a

certain date and retire after a certain age with specified years of service. Certain employees are subject to having

such benefits modified or terminated.

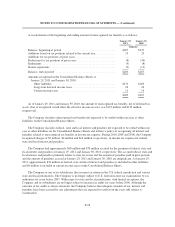

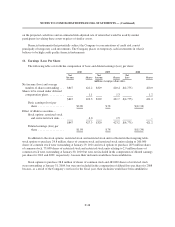

The following provides a reconciliation of benefit obligations, plan assets, and funded status of the

postretirement obligations as of January 29, 2011 and January 30, 2010:

2010 2009

(millions)

Change in accumulated postretirement benefit obligation

Accumulated postretirement benefit obligation, beginning of year ........... $278 $277

Service cost ...................................................... – –

Interest cost ...................................................... 15 19

Actuarial loss .................................................... 8 8

Medicare Part D subsidy ............................................ 2 2

Benefits paid ..................................................... (25) (28)

Accumulated postretirement benefit obligation, end of year ................ $278 $278

Change in plan assets

Fair value of plan assets, beginning of year ............................. $ – $ –

Company contributions ............................................. 25 28

Benefits paid ..................................................... (25) (28)

Fair value of plan assets, end of year .................................. $ – $ –

Funded status at end of year ............................................. $(278) $(278)

Amounts recognized in the Consolidated Balance Sheets at

January 29, 2011 and January 30, 2010

Accounts payable and accrued liabilities ............................... $ (30) $ (31)

Other liabilities ................................................... (248) (247)

$(278) $(278)

Amounts recognized in accumulated other comprehensive (income) loss at

January 29, 2011 and January 30, 2010

Net actuarial gain ................................................. $ (25) $ (38)

F-38