Macy's 2010 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2010 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

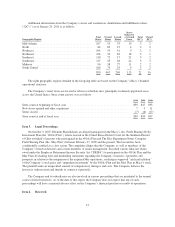

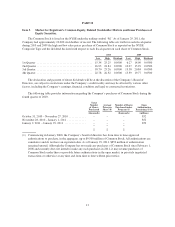

Item 6. Selected Financial Data.

The selected financial data set forth below should be read in conjunction with the Consolidated Financial

Statements and the notes thereto and the other information contained elsewhere in this report.

2010 2009** 2008** 2007 2006*

(millions, except per share data)

Consolidated Statement of Operations Data:

Net sales ...................................................... $25,003 $ 23,489 $ 24,892 $ 26,313 $ 26,970

Cost of sales ................................................... (14,824) (13,973) (15,009) (15,677) (16,019)

Inventory valuation adjustments – May integration ..................... – – – – (178)

Gross margin .................................................. 10,179 9,516 9,883 10,636 10,773

Selling, general and administrative expenses .......................... (8,260) (8,062) (8,481) (8,554) (8,678)

Impairments, store closing costs and division consolidation costs ......... (25) (391) (398) – –

Goodwill impairment charges ..................................... – – (5,382) – –

May integration costs ............................................ – – – (219) (450)

Gains on sale of accounts receivable ................................ – – – – 191

Operating income (loss) .......................................... 1,894 1,063 (4,378) 1,863 1,836

Interest expense (a) .............................................. (579) (562) (588) (579) (451)

Interest income ................................................. 5 6 28 36 61

Income (loss) from continuing operations before income taxes ........... 1,320 507 (4,938) 1,320 1,446

Federal, state and local income tax benefit (expense) ................... (473) (178) 163 (411) (458)

Income (loss) from continuing operations ............................ 847 329 (4,775) 909 988

Discontinued operations, net of income taxes (b) ...................... – – – (16) 7

Net income (loss) ............................................... $ 847 $ 329 $ (4,775) $ 893 $ 995

Basic earnings (loss) per share:

Income (loss) from continuing operations ............................ $ 2.00 $ .78 $ (11.34) $ 2.04 $ 1.83

Net income (loss) ............................................... 2.00 .78 (11.34) 2.00 1.84

Diluted earnings (loss) per share:

Income (loss) from continuing operations ............................ $ 1.98 $ .78 $ (11.34) $ 2.01 $ 1.80

Net income (loss) ............................................... 1.98 .78 (11.34) 1.97 1.81

Average number of shares outstanding .................................. 422.2 420.4 420.0 445.6 539.0

Cash dividends paid per share (c) ....................................... $ .2000 $ .2000 $ .5275 $ .5175 $ .5075

Depreciation and amortization ......................................... $ 1,150 $ 1,210 $ 1,278 $ 1,304 $ 1,265

Capital expenditures ................................................. $ 505 $ 460 $ 897 $ 1,105 $ 1,392

Balance Sheet Data (at year end):

Cash and cash equivalents ........................................ $ 1,464 $ 1,686 $ 1,385 $ 676 $ 1,294

Total assets .................................................... 20,631 21,300 22,145 27,789 29,550

Short-term debt ................................................. 454 242 966 666 650

Long-term debt ................................................. 6,971 8,456 8,733 9,087 7,847

Shareholders’ equity ............................................. 5,530 4,653 4,620 9,907 12,254

* 53 weeks

** The Company changed its methodology for recording deferred state income taxes from a blended rate basis to a separate entity basis, and

has reflected the effects of such change retroactively to fiscal 2008. Even though the Company considers the change to have had only an

immaterial impact on its financial condition, results of operations and cash flows, the financial condition, results of operations and cash

flows for the prior periods as previously reported have been adjusted to reflect the change.

(a) Interest expense in 2010 includes approximately $66 million of expenses associated with the early retirement of approximately $1,000

million of outstanding debt. Interest expense includes a gain of approximately $54 million in 2006 related to the completion of a debt

tender offer.

(b) Discontinued operations include (1) for 2007, the after-tax results of the After Hours Formalwear business, including an after-tax loss of

$7 million on the disposal of After Hours Formalwear, and (2) for 2006, the after-tax results of operations of the Lord & Taylor division

and the Bridal Group division (including David’s Bridal, After Hours Formalwear, and Priscilla of Boston), including after-tax losses of

$38 million and $18 million on the disposals of the Lord & Taylor division and the David’s Bridal and Priscilla of Boston businesses,

respectively.

(c) Cash dividends paid for 2006 have been adjusted to reflect the two-for-one stock-split effected in the form of a stock dividend distributed

on June 9, 2006.

15