Macy's 2010 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2010 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

estimates and judgments. Both the estimates of the fair value of the Company’s reporting units and the allocation

of the estimated fair value of the reporting units to their net assets are based on the best information available to

the Company’s management as of the date of the assessment.

The use of different assumptions, estimates or judgments in either step of the goodwill impairment testing

process, including with respect to the estimated future cash flows of the Company’s reporting units, the discount

rate used to discount such estimated cash flows to their net present value, the reasonableness of the resultant

implied control premium relative to the Company’s market capitalization, and the appraised fair value of the

reporting units’ tangible and intangible assets and liabilities, could materially increase or decrease the fair value

of the reporting unit and/or its net assets and, accordingly, could materially increase or decrease any related

impairment charge.

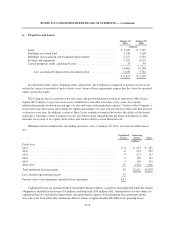

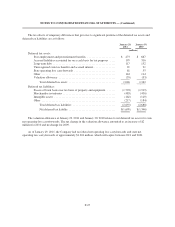

4. Receivables

Receivables were $392 million at January 29, 2011, compared to $358 million at January 30, 2010.

In connection with the sales of credit card accounts and related receivable balances, the Company and

Citibank entered into a long-term marketing and servicing alliance pursuant to the terms of a Credit Card

Program Agreement (the “Program Agreement”) with an initial term of 10 years expiring on July 17, 2016 and,

unless terminated by either party as of the expiration of the initial term, an additional renewal term of three

years. The Program Agreement provides for, among other things, (i) the ownership by Citibank of the accounts

purchased by Citibank, (ii) the ownership by Citibank of new accounts opened by the Company’s customers,

(iii) the provision of credit by Citibank to the holders of the credit cards associated with the foregoing accounts,

(iv) the servicing of the foregoing accounts, and (v) the allocation between Citibank and the Company of the

economic benefits and burdens associated with the foregoing and other aspects of the alliance.

Pursuant to the Program Agreement, the Company continues to provide certain servicing functions related to

the accounts and related receivables owned by Citibank and receives compensation from Citibank for these

services. The amounts earned under the Program Agreement related to the servicing functions are deemed

adequate compensation and, accordingly, no servicing asset or liability has been recorded on the Consolidated

Balance Sheets.

Amounts received under the Program Agreement were $528 million for 2010, $525 million for 2009 and

$594 million for 2008, and are treated as reductions of SG&A expenses on the Consolidated Statements of

Operations. The Company’s earnings from credit operations, net of servicing expenses, were $332 million for

2010, $323 million for 2009, and $372 million for 2008.

5. Inventories

Merchandise inventories were $4,758 million at January 29, 2011, compared to $4,615 million at

January 30, 2010. At these dates, the cost of inventories using the LIFO method approximated the cost of such

inventories using the FIFO method. The application of the LIFO method did not impact cost of sales for 2010,

2009 or 2008.

F-17