Kraft 2008 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2008 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Item 14. Principal Accountant Fees and Services.

Information about our principal accountant fees is in our 2007 Proxy Statement under the heading, “Audit Committee Matters - Independent Auditor Fees,” and

information about the Audit Committee’s pre-approval policies and procedures is in our 2007 Proxy Statement under the heading, “Audit Committee Matters -

Pre-Approval Policies.” All of this information is incorporated by reference into this Annual Report.

PART IV

Item 15. Exhibits and Financial Statement Schedules.

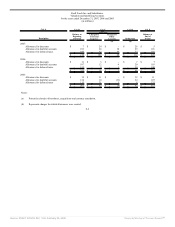

(a) Index to Consolidated Financial Statements and Schedules

Page

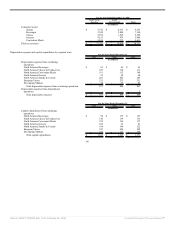

Consolidated Statements of Earnings for the years ended December 31, 2007, 2006 and 2005 45

Consolidated Balance Sheets at December 31, 2007 and 2006 46

Consolidated Statements of Shareholders’ Equity for the years ended December 31, 2007, 2006 and 2005 47

Consolidated Statements of Cash Flows for the years ended December 31, 2007, 2006 and 2005 48

Notes to Consolidated Financial Statements 49

Report of Management on Internal Control over Financial Reporting 83

Report of Independent Registered Public Accounting Firm 84

Report of Independent Registered Public Accounting Firm on Financial Statement Schedule S-1

Financial Statement Schedule - Valuation and Qualifying Accounts S-2

Schedules other than those listed above have been omitted either because such schedules are not required or are not applicable.

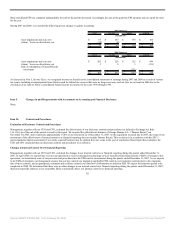

(b) The following exhibits are filed as part of, or incorporated by reference into, this Annual Report:

2.1

RMT Transaction Agreement, among the Registrant, Cable Holdco, Inc., Ralcorp Holdings, Inc. and Ralcorp Mailman LLC., dated as of

November 15, 2007. (1)

2.2 *Master Sale and Purchase Agreement between Groupe Danone S.A. and Kraft Foods Global, Inc., dated October 29, 2007. (2)

3.1 Articles of Incorporation of the Registrant. (3)

3.2 Articles of Amendment to the Articles of Incorporation of the Registrant. (3)

3.3 Registrant’s Amended and Restated By-Laws.

4.1

The Registrant agrees to furnish copies of any instruments defining the rights of holders of long-term debt of the Registrant and its consolidated

subsidiaries that does not exceed 10 percent of the total assets of the Registrant and its consolidated subsidiaries to the Commission upon request.

4.2

Indenture, dated as of October 17, 2001, by and between the Registrant and The Bank of New York (as successor trustee to The Chase Manhattan

Bank), as trustee, as supplemented. (4)

10.1

Agreement by and among the Registrant, Trian Fund Management, L.P. and the other entities and persons signatory thereto, dated November 7,

2007. (5)

10.2 $4.5 Billion 5-Year Revolving Credit Agreement, dated as of April 15, 2005. (6)

10.3

Credit Agreement relating to a EURO 5,300,000,000 Bridge Loan Agreement, among Registrant and Goldman Sachs Credit Partners L.P.,

JPMorgan Chase Bank, N.A., Credit Suisse, Cayman Islands Branch, HSBC Bank USA, National Association, UBS Securities LLC and Societe

Generale dated as of October 12, 2007. (2)

10.4 Agreement Relating to United Biscuits Southern Europe, dated as of July 8, 2006. (7)

10.5

*Master Professional Services Agreement between Kraft Foods Global, Inc. and Electronic Data Systems Services Corporation dated as of April 27,

2006. (7)

10.6 Tax Sharing Agreement by and between Altria Group, Inc and the Registrant, dated as of March 30, 2007. (8)

10.7 + Kraft Foods Inc. 2005 Performance Incentive Plan. (9)

10.8 + Form of Kraft Foods Inc. 2005 Performance Incentive Plan Restricted Stock Agreement (Executive Sign-on). (2)

10.9 + Form of Kraft Foods Inc. 2005 Performance Incentive Plan Restricted Stock Agreement.

10.10 + Form of Kraft Foods Inc. 2005 Performance Incentive Plan Non-Qualified US Stock Option Award Agreement.

10.11 + Kraft Foods Inc. Supplemental Benefits Plan I (including First Amendment adding Supplement A). (10)

10.12 + Kraft Foods Inc. Supplemental Benefits Plan II. (10)

86

Source: KRAFT FOODS INC, 10-K, February 25, 2008 Powered by Morningstar® Document Research℠