Kraft 2008 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2008 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

biscuit, cereal, and grocery products are grains or wheat, corn, and soybean oil. Grain costs have experienced significant cost increases as a result of burgeoning

global demand for food, livestock feed and biofuels such as ethanol and biodiesel. In 2007, grain costs on average were higher than in 2006.

During 2007, our aggregate commodity costs rose significantly as a result of higher dairy, coffee, cocoa, wheat, meat products, soybean oil and packaging costs,

partially offset by lower nut costs. For 2007, our commodity costs were approximately $1,250 million higher than 2006, following an increase of approximately

$275 million in 2006 compared to 2005. We expect the higher cost environment to continue, particularly for dairy, grains, energy and packaging.

Liquidity

We believe that our cash from operations, our existing $4.5 billion credit facility, and our authorized long-term financing will provide sufficient liquidity to meet

our working capital needs (including the cash requirements of the Restructuring Program), planned capital expenditures, future contractual obligations,

authorized share repurchases, and payment of our anticipated quarterly dividends.

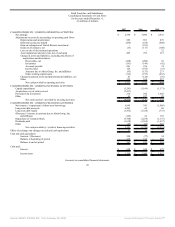

Net Cash Provided by Operating Activities:

Operating activities provided net cash of $3.6 billion in 2007, $3.7 billion in 2006 and $3.5 billion in 2005. Operating cash flows decreased in 2007 from 2006

primarily due to the $405 million tax reimbursement from Altria in 2006 related to the closure of a tax audit and increased marketing administration and research

costs. This decrease in operating cash flows was partially offset by lower working capital costs of $225 million primarily due to lower income tax payments and

the $305 million tax transfer from Altria for the federal tax contingencies held by them, less the impact of federal reserves reversed due to the adoption of FIN

48. The transfer from Altria is reflected within other in our consolidated statements of cash flows.

The increase in 2006 operating cash flows from 2005 is due primarily to the previously discussed tax reimbursement from Altria in 2006 related to the closure of

a tax audit and higher earnings, partially offset by a decrease in amounts due to Altria and higher pension contributions.

Net Cash Provided by (Used in) Investing Activities:

One element of our growth strategy is to strengthen our brand portfolios and/or expand our geographic reach through disciplined programs of selective

acquisitions and divestitures. We are constantly reviewing potential acquisition candidates and from time to time sell businesses to accelerate the shift in our

portfolio toward businesses - whether global, regional or local - that offer us a sustainable competitive advantage. The impact of future acquisitions or

divestitures could have a material impact on our cash flows.

Net cash used in investing activities was $8.4 billion during 2007 and $116 million during 2006, as compared with net cash provided by investing activities of

$525 million in 2005. The increase in cash used in investing activities in 2007 primarily related to the Danone Biscuit acquisition and lower proceeds from

divestitures. On November 30, 2007, we acquired the global biscuit business of Groupe Danone S.A. for approximately €5.1 billion (approximately $7.6 billion)

in cash subject to purchase price adjustments.

During 2007, we received proceeds of $216 million from the sales of our flavored water and juice brand assets and related trademarks, our sugar confectionery

assets in Romania and related trademarks and our hot cereal assets and trademarks. During 2006, we received proceeds of $946 million from the sales of our rice

brand and assets, pet snacks brand and assets, industrial coconut assets, certain Canadian assets, a small U.S. biscuit brand and a U.S. coffee plant. During 2005,

we received proceeds of $1,668 million from the sales of our sugar confectionery business, fruit snacks assets, U.K. desserts assets, U.S. yogurt assets, a small

operation in Colombia, a small equity investment in Turkey and a minor trademark in Mexico.

Capital expenditures, which were funded by operating activities, were $1.2 billion in each of the last three years. The 2007 capital expenditures were primarily to

modernize manufacturing facilities, implement the Restructuring Program, and support new product and productivity initiatives. We expect 2008 capital

expenditures to be in line with 2007 expenditures, including capital expenditures required for the Restructuring Program and systems investments. We expect to

fund these expenditures from operations.

Net Cash Used in Financing Activities:

During 2007, we received $5.1 billion net cash in financing activities, compared with $3.7 billion that we used during 2006. The increase in net cash provided by

financing activities is due primarily to the $3.5 billion and $3.0 billion long-term debt offerings

38

Source: KRAFT FOODS INC, 10-K, February 25, 2008 Powered by Morningstar® Document Research℠