Kraft 2008 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2008 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

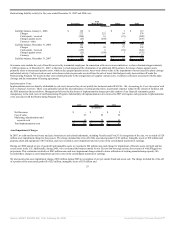

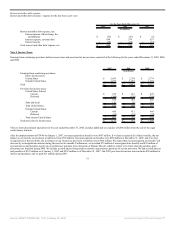

even though we believe that those existing tax positions were fully supportable. The adoption of FIN 48 resulted in an increase to shareholders’ equity as of

January 1, 2007 of $213 million and resulted from:

• a $265 million decrease in the liability for unrecognized tax benefits, comprised of $247 million in tax and $18 million in interest;

• a reduction in goodwill of $85 million; and

• an increase to federal and state deferred tax assets of $33 million.

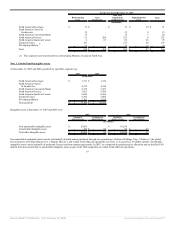

We recognize deferred tax assets for deductible temporary differences, operating loss carryforwards and tax credit carryforwards. Deferred tax assets are reduced

by a valuation allowance if it is more likely than not that some portion, or all, of the deferred tax assets will not be realized.

Stock-based compensation:

Effective January 1, 2006, we adopted SFAS No. 123 (Revised 2004), Share-Based Payment, (“SFAS No. 123(R)”) using the modified prospective method,

which requires measurement of compensation cost for all stock-based awards at fair value on date of grant and recognition of compensation over the service

periods for awards expected to vest. We determine the fair value of restricted stock and rights to receive shares of stock based on the number of shares granted

and the market value at date of grant. We determine the fair value of stock options using a modified Black-Scholes methodology.

The adoption of SFAS No. 123(R) resulted in a cumulative effect gain of $6 million, which is net of $3 million in taxes, in the consolidated statement of earnings

for the year ended December 31, 2006. The gross cumulative effect was recorded in marketing, administration and research costs for the year ended

December 31, 2006.

We elected to calculate the initial pool of tax benefits resulting from tax deductions in excess of the stock-based employee compensation expense recognized in

the statement of earnings under FASB Staff Position (“FSP”) 123(R)-3, Transition Election Related to Accounting for the Tax Effects of Share-Based Payment

Awards. Under SFAS No. 123(R), tax shortfalls occur when actual tax deductible compensation expense is less than cumulative stock-based compensation

expense recognized in the financial statements.

We previously applied the recognition and measurement principles of Accounting Principles Board Opinion No. 25, Accounting for Stock Issued to Employees,

(“APB 25”) and provided the pro forma disclosures required by SFAS No. 123, Accounting for Stock-Based Compensation (“SFAS No. 123”). No compensation

expense for employee stock options was reflected in net earnings in 2005, as all stock options granted under those plans had an exercise price equal to the market

value of the common stock on the date of the grant. Historical consolidated statements of earnings already include the compensation expense for restricted stock

and rights to receive shares of stock.

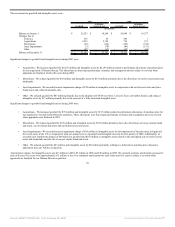

Our reported net earnings for the year ended December 31, 2005 were $2,632 million. If we had applied the fair value recognition provisions of SFAS No. 123 to

measure compensation expense for stock option awards in 2005, our total stock-based employee compensation expense, net of related tax effects, would have

been $7 million. As a result, pro forma net earnings would have been $2,625 million, and there would have been no impact to pro forma basic and diluted EPS

for the year ended December 31, 2005.

Financial instruments:

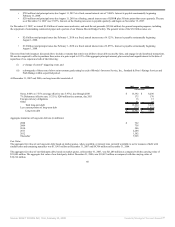

As Kraft operates globally, we use certain financial instruments to manage our foreign currency exchange rate and commodity price risks. We monitor and

manage these exposures as part of our overall risk-management program. Our risk management program focuses on the unpredictability of financial markets and

seeks to reduce the potentially adverse effects that the volatility of these markets may have on our operating results. We maintain foreign currency and

commodity price risk management strategies that seek to reduce significant, unanticipated earnings fluctuations that may arise from volatility in foreign currency

exchange rates and commodity prices, principally through the use of derivative instruments.

Financial instruments qualifying for hedge accounting must maintain a specified level of effectiveness between the hedging instrument and the item being

hedged, both at inception and throughout the hedged period. We formally document the nature of and relationships between the hedging instruments and hedged

items, as well as our risk-management objectives, strategies for undertaking the various hedge transactions and method of assessing hedge effectiveness.

Additionally, for hedges of forecasted transactions, the significant characteristics and expected terms of the forecasted transaction must be specifically identified,

and it must be probable that each forecasted transaction will occur. If we deem it probable that the forecasted transaction will not occur, we recognize the gain or

loss in earnings currently.

52

Source: KRAFT FOODS INC, 10-K, February 25, 2008 Powered by Morningstar® Document Research℠