Kraft 2008 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2008 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

currency. These unfavorabilities were partially offset by the gain on the redemption of our UB investment, the impact of the UB acquisition and lower fixed

manufacturing costs.

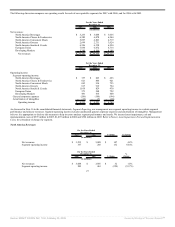

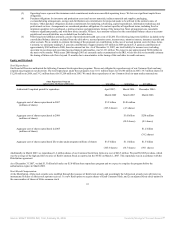

Developing Markets

For the Years Ended

December 31,

$ change

% change

2007 2006

(in millions)

Net revenues $ 5,348 $ 4,566 $ 782 17.1%

Segment operating income 491 416 75 18.0%

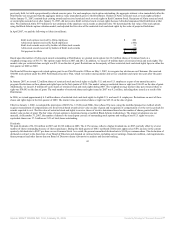

For the Years Ended

December 31,

$ change

% change

2006 2005

(in millions)

Net revenues $ 4,566 $ 4,106 $ 460 11.2%

Segment operating income 416 400 16 4.0%

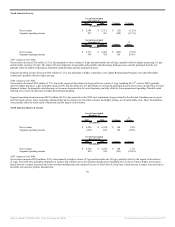

2007 compared with 2006:

Net revenues increased $782 million (17.1%), due primarily to favorable currency (5.4 pp), higher net pricing (5.1 pp), higher volume (4.0 pp), and favorable

mix (2.4 pp). In Eastern Europe, Middle East & Africa, net revenues increased due to higher pricing and growth in coffee and chocolate in Russia, Romania and

Ukraine, and in refreshment beverages and snacks for the Middle East & Africa. In Latin America, net revenues increased due to higher pricing and favorable

volume/mix, particularly in Brazil, Venezuela and Argentina. In Asia Pacific, net revenues increased due to volume growth in China and Southeast Asia.

Segment operating income increased $75 million (18.0%), due primarily to higher pricing, favorable volume/mix, lower Restructuring Program costs, favorable

currency and a 2006 asset impairment charge related to the biscuits assets in Egypt. These favorable variances were partially offset by higher marketing,

administration and research costs (including higher marketing support costs) and higher commodity costs.

2006 compared with 2005:

Net revenues increased $460 million (11.2%), due to favorable volume/mix (5.2 pp, including the 53rd week in 2005), higher pricing (4.4 pp) and favorable

currency (2.1 pp), partially offset by the impact of divestitures (0.5 pp). In Eastern Europe, Middle East & Africa, net revenues increased due to volume growth

and higher pricing in coffee and chocolate in Russia, Romania, Ukraine and Bulgaria. In Latin America, net revenues increased due to higher pricing and

favorable volume/mix, particularly in Brazil, Venezuela and Argentina. In Asia Pacific, net revenues increased due to volume growth and higher pricing in China

and Southeast Asia, partially offset by volume declines in Australia and New Zealand.

Segment operating income increased $16 million (4.0%), due primarily to higher pricing, net of unfavorable costs, favorable volume/mix (including the

53rd week in 2005) and favorable currency partially offset by higher marketing, administration and research costs, higher Restructuring Program costs, higher

fixed manufacturing costs and an asset impairment charge related to biscuits assets in Egypt.

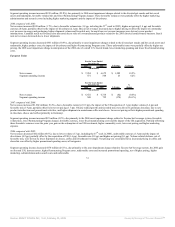

Critical Accounting Policies

Note 1, Summary of Significant Accounting Policies, to the consolidated financial statements includes a summary of the significant accounting policies we used

to prepare our consolidated financial statements. We prepare our financial statements in conformity with accounting principles generally accepted in the United

States of America (“U.S. GAAP”), which require us to make certain elections as to our accounting policy, estimates and assumptions that affect the reported

amounts of assets and liabilities, the disclosure of contingent liabilities at the dates of the financial statements and the reported amounts of net revenues and

expenses during the reporting periods. Significant accounting policy elections, estimates and assumptions include, among others, pension and benefit plan

assumptions, lives and valuation assumptions of goodwill and intangible assets, marketing programs and income taxes. Actual results could differ from those

estimates.

We have discussed the selection and disclosure of our critical accounting policies and estimates with our Audit Committee. The following is a review of the more

significant assumptions and estimates, as well as the accounting policies we used to prepare our consolidated financial statements.

32

Source: KRAFT FOODS INC, 10-K, February 25, 2008 Powered by Morningstar® Document Research℠