Kraft 2008 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2008 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

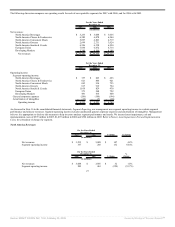

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operation.

The following discussions should be read in conjunction with the other sections of this report, including the consolidated financial statements and related notes

contained in Item 8 of this Form 10-K.

Description of the Company

We manufacture and market packaged food products, including snacks, beverages, cheese, convenient meals and various packaged grocery products, worldwide

in more than 150 countries.

Kraft Spin-Off from Altria:

In the first quarter of 2007, Altria Group, Inc. (“Altria”) spun off its remaining interest (89.0%) in Kraft on a pro rata basis to Altria stockholders in a tax-free

transaction. Effective as of the close of business on March 30, 2007, all Kraft shares owned by Altria were distributed to Altria’s stockholders, and our separation

from Altria was completed (the “Distribution”). Before the Distribution, Altria converted all of its Class B shares of Kraft common stock into Class A shares of

Kraft common stock. The Distribution ratio was calculated by dividing the number of shares of Kraft Common Stock held by Altria by the number of Altria

shares outstanding on the record date, March 16, 2007. The distribution ratio was 0.692024 shares of Kraft Common Stock for every share of Altria common

stock outstanding. Following the Distribution, we only have Class A common stock outstanding.

Executive Summary

The following executive summary is intended to provide significant highlights of the Discussion and Analysis that follows.

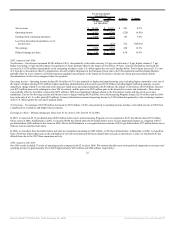

• Net revenues in 2007 increased 8.4% to $37.2 billion. Net revenues in 2006 increased 0.7% to $34.4 billion.

• Diluted EPS in 2007 decreased 12.4% to $1.62. Diluted EPS in 2006 increased 19.4% to $1.85.

• We recorded Restructuring Program charges of $459 million during 2007, $673 million during 2006 and $297 million during 2005.

• We made solid progress executing our long-term growth strategy, which focuses on: rewiring the organization for growth; reframing our categories;

exploiting our sales capabilities; and driving down costs without compromising quality.

• On November 30, 2007, we acquired the global biscuit business of Groupe Danone S.A. for approximately €5.1 billion (approximately $7.6 billion)

in cash subject to purchase price adjustments. We will report the results from operations on a one month lag; as such, there was no impact on our

operating results in 2007.

• On November 15, 2007, we announced a definitive agreement to merge our Post cereals business into Ralcorp Holdings, Inc. The transaction is

subject to customary closing conditions, including anti-trust approval, IRS tax-free ruling and Ralcorp Holdings, Inc. shareholder approvals. To

date, the anti-trust approval has been obtained. We expect this transaction to be completed in mid-2008.

• Immediately following the Distribution, we announced a new $5.0 billion, two-year share repurchase program. It replaced our previous $2.0 billion

share repurchase program. During 2007, we repurchased 110.1 million shares of our Common Stock for approximately $3.6 billion under our share

repurchase programs.

• In August 2007, we issued $3.5 billion of senior unsecured notes, and in December 2007, we issued an additional $3.0 billion of senior unsecured

notes. We used the net proceeds (approximately $3,462 million in August and $2,966 million in December) for general corporate purposes,

including the repayment of outstanding commercial paper and a portion of the bridge facility used to fund our Danone Biscuit acquisition.

• In the third quarter of 2007, our Board of Directors approved an 8.0% increase in the current quarterly dividend rate to $0.27 per share on our

Common Stock. As a result, our current annualized dividend rate is $1.08 per share of Common Stock.

18

Source: KRAFT FOODS INC, 10-K, February 25, 2008 Powered by Morningstar® Document Research℠