Kraft 2008 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2008 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

for the same number of shares of Altria common stock previously held, but with a proportionally reduced exercise price. For each employee stock option

outstanding, the aggregate intrinsic value immediately after the Distribution was not greater than the aggregate intrinsic value immediately prior to the

Distribution. Holders of Altria restricted stock or stock rights awarded before January 31, 2007, retained their existing awards and received restricted stock or

stock rights in Kraft Common Stock. Recipients of Altria restricted stock or stock rights awarded on or after January 31, 2007, did not receive Kraft restricted

stock or stock rights because Altria had announced the Distribution at that time. We reimbursed Altria $179 million for net settlement of the employee stock

awards as detailed below. We determined the fair value of the stock options using the Black-Scholes option valuation model; and adjusted the fair value of the

restricted stock and stock rights by the value of projected forfeitures.

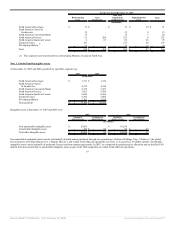

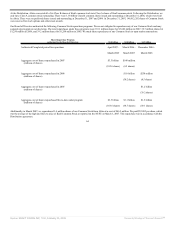

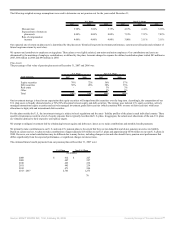

In April 2007, we paid the following to Altria (in millions):

Kraft stock options received by Altria employees $ 240

Altria stock options received by Kraft employees (440)

Kraft stock awards received by holders of Altria stock awards 33

Altria stock awards received by holders of Kraft stock awards (12)

Net payment to Altria $ (179)

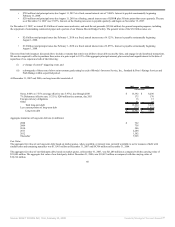

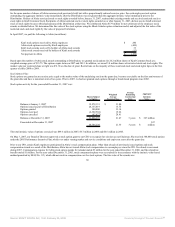

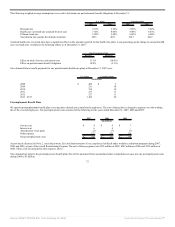

Based upon the number of Altria stock awards outstanding at Distribution, we granted stock options for 24.2 million shares of Kraft Common Stock at a

weighted-average price of $15.75. The options expire between 2007 and 2012. In addition, we issued 3.0 million shares of restricted stock and stock rights. The

market value per restricted share or right was $31.66 on the date of grant. Restrictions on the majority of these restricted stock and stock rights lapse in the first

quarter of either 2008 or 2009.

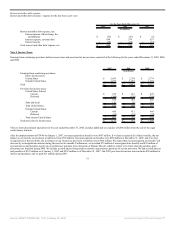

Stock Option Plan:

Stock options are granted at an exercise price equal to the market value of the underlying stock on the grant date, become exercisable on the first anniversary of

the grant date and have a maximum term of ten years. Prior to 2007, we had not granted stock options through a broad-based program since 2002.

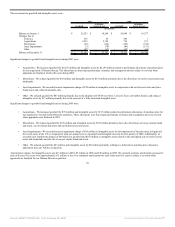

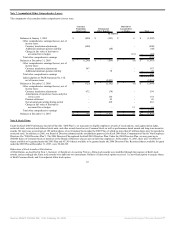

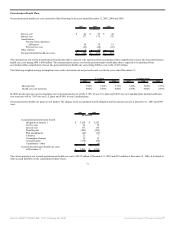

Stock option activity for the year ended December 31, 2007 was:

Shares Subject

to Option

Weighted

Average

Exercise Price

Average

Remaining

Contractual

Term

Aggregate

Intrinsic

Value

Balance at January 1, 2007 12,978,151 $ 31.00

Options issued as part of Distribution 24,153,019 15.75

Options granted 300,000 33.14

Options exercised (6,302,504) 19.66

Options cancelled (62,427) 28.41

Balance at December 31, 2007 31,066,239 21.47 3 years $ 347 million

Exercisable at December 31, 2007

30,766,239 21.36 3 years $

347

million

The total intrinsic value of options exercised was $89.6 million in 2007, $6.7 million in 2006 and $0.6 million in 2005.

On May 3, 2007, our Board of Directors approved a stock option grant to our CEO to recognize her election as our Chairman. She received 300,000 stock options

under the 2005 Performance Incentive Plan, which vest under varying market and service conditions and expire ten years after the grant date.

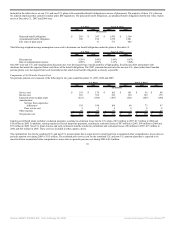

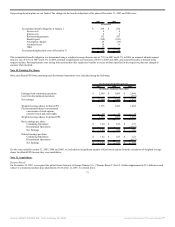

Prior to our IPO, certain Kraft employees participated in Altria’s stock compensation plans. Other than reloads of previously issued options and stock

compensation issued as a result of the Distribution, Altria has not issued Altria stock compensation to our employees since the IPO. No reloads were issued

during 2007. Compensation expense for Altria stock option awards for reloads totaled $3 million for the year ended December 31, 2006, and the related tax

benefit totaled $1 million. For the year ended December 31, 2005, stock compensation plans were accounted for in accordance with the intrinsic value-based

method permitted by SFAS No. 123, which did not result in compensation cost for stock options. The fair value of the awards was

66

Source: KRAFT FOODS INC, 10-K, February 25, 2008 Powered by Morningstar® Document Research℠