Kraft 2008 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2008 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

in the number of shares of our Common Stock outstanding. In addition, Kraft will receive approximately $960 million of cash-equivalent value, which will be

used to repay debt.

Customers

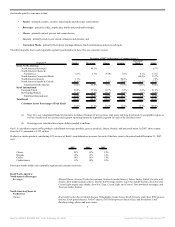

Our five largest customers accounted for approximately 28% of our net revenues in 2007, 29% in 2006 and 26% in 2005. Our ten largest customers accounted for

approximately 37% of our net revenues in 2007, 40% in 2006 and 37% in 2005. One of our customers, Wal-Mart Stores, Inc., accounted for approximately 15%

of our net revenues in 2007, 15% in 2006 and 14% in 2005.

Seasonality

Demand for some of our products may be influenced by holidays, changes in seasons or other annual events. However, sales of our products are generally evenly

balanced throughout the year due to the offsetting nature of demands for our diversified product portfolio.

Competition

We face competition in all aspects of our business. Competitors include large national and international companies and numerous local and regional companies.

Some competitors may have different profit objectives and some international competitors may be more or less susceptible to currency exchange rates. We also

compete with generic products and retailer brands, wholesalers and cooperatives. We compete primarily on the basis of product quality, brand recognition, brand

loyalty, service, marketing, advertising and price. Moreover, improving our market position or introducing a new product requires substantial advertising and

promotional expenditures.

Distribution

Kraft North America’s products are generally sold to supermarket chains, wholesalers, supercenters, club stores, mass merchandisers, distributors, convenience

stores, gasoline stations, drug stores, value stores and other retail food outlets. In general, the retail trade for food products is consolidating. Food products are

distributed through distribution centers, satellite warehouses, company-operated and public cold-storage facilities, depots and other facilities. We currently

distribute most products in North America through warehouse delivery, but we deliver biscuits and frozen pizza through two direct-store delivery systems. We

are in the process of combining the executional benefits of direct-store delivery with the economics of warehouse delivery and plan to complete the full rollout of

a wall-to-wall delivery system by mid-2008, where one sales representative covers an entire store. We support our selling efforts through three principal sets of

activities: consumer advertising in broadcast, print, outdoor and on-line media; consumer incentives such as coupons and contests; and trade promotions to

support price features, displays and other merchandising of our products by our customers. Subsidiaries and affiliates of Kraft International sell their food

products primarily in the same manner and also engage the services of independent sales offices and agents.

Raw Materials

We are major purchasers of dairy, coffee, cocoa, wheat, corn products, soybean and vegetable oils, nuts, meat products, and sugar and other sweeteners. We also

use significant quantities of glass, plastic and cardboard to package our products, and natural gas for our factories and warehouses. We continuously monitor

worldwide supply and cost trends of these commodities so we can act quickly to obtain ingredients and packaging needed for production. We purchase a

substantial portion of our dairy raw material requirements, including milk and cheese, from independent third parties such as agricultural cooperatives and

independent processors. The prices for milk and other dairy product purchases are substantially influenced by market supply and demand, as well as by

government programs. Dairy commodity costs on average were $750 million higher in 2007 than in 2006.

The most significant cost item in coffee products is green coffee beans, which are purchased on world markets. Green coffee bean prices are affected by the

quality and availability of supply, trade agreements among producing and consuming nations, the unilateral policies of the producing nations, changes in the

value of the U.S. dollar in relation to certain other currencies and consumer demand for coffee products. In 2007, coffee bean costs on average were higher than

in 2006. A significant cost item in chocolate confectionery products is cocoa, which is purchased on world markets, and the price of which is affected by the

quality and availability of supply and changes in the value of the British pound sterling and the U.S. dollar relative to certain other currencies. In 2007, cocoa

bean and cocoa butter costs on average were higher than in 2006. Significant cost items in our

6

Source: KRAFT FOODS INC, 10-K, February 25, 2008 Powered by Morningstar® Document Research℠