Kraft 2008 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2008 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

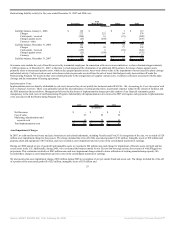

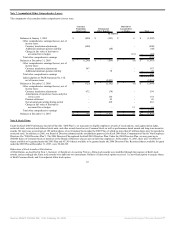

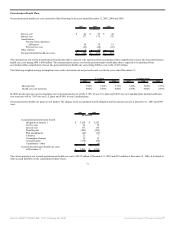

The change in our unrecognized tax benefits for the year ended December 31, 2007 was (in millions):

January 1, 2007 $ 667

Increases from positions taken during prior periods 131

Decreases from positions taken during prior periods (23)

Increases from positions taken during the current period 34

Increases from acquisitions 72

Decreases relating to settlements with taxing authorities (38)

Reductions resulting from the lapse of the applicable statute

of limitations (6)

Currency 13

December 31, 2007 $ 850

We are regularly examined by federal and various state and foreign tax authorities. The U.S. federal statute of limitations remains open for the year 2000 and

onward, with years 2000 through 2003 currently under examination by the IRS. We are also currently under examination by taxing authorities in various U.S.

state and foreign jurisdictions. U.S. state and foreign jurisdictions have statutes of limitations generally ranging from three to seven years. Years still open to

examination by foreign tax authorities in major jurisdictions include Germany (1999 onward), Brazil (2001 onward), Canada (2001 onward), Spain (2001

onward) and France (2004 onward).

During 2006, the IRS concluded its examination of Altria’s consolidated tax returns for the years 1996 through 1999. The IRS issued a final Revenue Agents

Report on March 15, 2006. Consequently, Altria reimbursed us $337 million for federal tax reserves that were no longer necessary and $46 million for interest

($29 million net of tax). We also recognized net state tax reversals of $39 million, for a total tax provision benefit of $376 million ($337 million federal plus $39

million state). The total benefit to net earnings that we recognized in the first quarter of 2006 due to the IRS settlement was $405 million.

In October 2004, the American Jobs Creation Act (“the Jobs Act”) was signed into law. The Jobs Act includes a deduction for 85% of certain foreign earnings

that are repatriated. In 2005, we repatriated approximately $500 million of earnings under the provisions of the Jobs Act. Deferred taxes had previously been

provided for a portion of the dividends remitted. The reversal of the deferred taxes more than offset the tax costs to repatriate the earnings and resulted in a net

tax reduction of $28 million in the consolidated income tax provision during 2005.

At December 31, 2007, applicable U.S. federal income taxes and foreign withholding taxes had not been provided on approximately $3.9 billion of accumulated

earnings of foreign subsidiaries that are expected to be permanently reinvested.

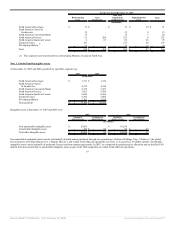

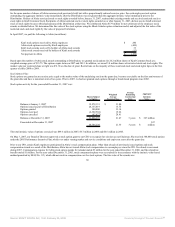

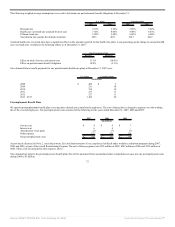

The effective income tax rate on pre-tax earnings differed from the U.S. federal statutory rate for the following reasons for the years ended December 31, 2007,

2006 and 2005:

2007 2006 2005

U.S. federal statutory rate 35.0% 35.0% 35.0%

Increase / (decrease) resulting from:

State and local income taxes, net of federal tax benefit

excluding IRS audit impacts 2.8% 1.8% 1.8%

Benefit principally related to reversal of federal and

state reserves on conclusion of IRS audit - (9.4%) -

Reversal of other tax accruals no longer required (1.3%) (1.3%) (2.6%)

Foreign rate differences, net of repatriation impacts (4.9%) (0.3%) (2.8%)

Other (1.1%) (2.1%) (2.0%)

Effective tax rate 30.5% 23.7% 29.4%

Our 2007 effective tax rate includes $184 million in favorable tax rate items, primarily including the effects of dividend repatriation benefits, foreign earnings

taxed below the U.S. federal statutory tax rate, foreign joint venture earnings, and the effect on foreign deferred taxes from lower foreign tax rates enacted in

2007, partially offset by other foreign tax expense items. The 2007 tax rate also benefited from an increased domestic manufacturing deduction and the

divestiture of our flavored water and juice brand assets and related trademarks. These benefits were partially offset by state tax expense.

62

Source: KRAFT FOODS INC, 10-K, February 25, 2008 Powered by Morningstar® Document Research℠