Kraft 2008 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2008 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

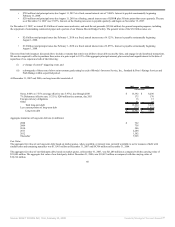

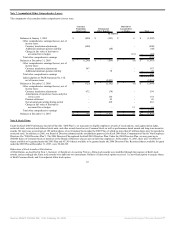

• $750 million total principal notes due August 11, 2037 at a fixed, annual interest rate of 7.000%. Interest is payable semiannually beginning

February 11, 2008.

• $250 million total principal notes due August 11, 2010 at a floating, annual interest rate of LIBOR plus 50 basis points that resets quarterly. The rate

as of December 31, 2007 was 5.387%. Interest on the floating rate notes is payable quarterly, and began on November 13, 2007.

On December 12, 2007, we issued $3.0 billion of senior unsecured notes, and used the net proceeds ($2,966 million) for general corporate purposes, including

the repayment of outstanding commercial paper and a portion of our Danone Biscuit Bridge Facility. The general terms of the $3.0 billion notes are:

• $2.0 billion total principal notes due February 1, 2018 at a fixed, annual interest rate of 6.125%. Interest is payable semiannually beginning

August 1, 2008.

• $1.0 billion total principal notes due February 1, 2038 at a fixed, annual interest rate of 6.875%. Interest is payable semiannually beginning

August 1, 2008.

The notes from both issuances discussed above include covenants that restrict our ability to incur debt secured by liens, and engage in sale/leaseback transactions.

We are also required to offer to purchase these notes at a price equal to 101% of the aggregate principal amount, plus accrued and unpaid interest to the date of

repurchase if we experience both of the following:

(i) a “change of control” triggering event, and

(ii) a downgrade of these notes below an investment grade rating by each of Moody’s Investors Service, Inc., Standard & Poor’s Ratings Services and

Fitch Ratings within a specified period.

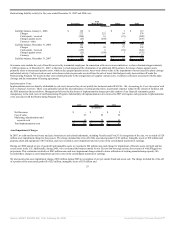

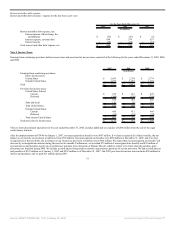

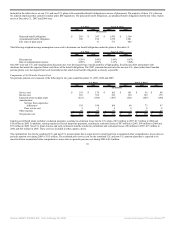

At December 31, 2007 and 2006, our long-term debt consisted of:

2007 2006

(in millions)

Notes, 4.00% to 7.55% (average effective rate 5.97%), due through 2038 $ 13,392 $ 8,290

7% Debenture (effective rate 11.32%), $200 million face amount, due 2011 175 170

Foreign currency obligations 16 15

Other 41 24

Total long-term debt 13,624 8,499

Less current portion of long-term debt (722) (1,418)

Long-term debt $ 12,902 $ 7,081

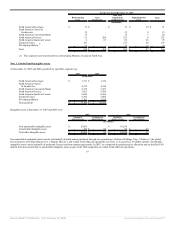

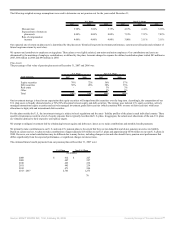

Aggregate maturities of long-term debt are (in millions):

2008 $ 722

2009 758

2010 506

2011 2,204

2012 1,502

Thereafter 7,965

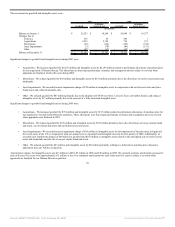

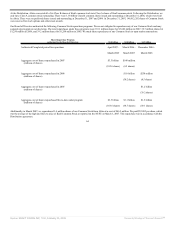

Fair Value:

The aggregate fair value of our long-term debt, based on market quotes, where available, or interest rates currently available to us for issuance of debt with

similar terms and remaining maturities was $13,903 million at December 31, 2007 and $8,706 million at December 31, 2006.

The aggregate fair value of our third-party debt, based on market quotes, at December 31, 2007, was $21,288 million as compared with the carrying value of

$21,009 million. The aggregate fair value of our third-party debt at December 31, 2006, was $10,421 million as compared with the carrying value of

$10,214 million.

60

Source: KRAFT FOODS INC, 10-K, February 25, 2008 Powered by Morningstar® Document Research℠