Kraft 2008 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2008 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

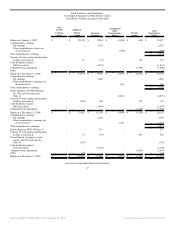

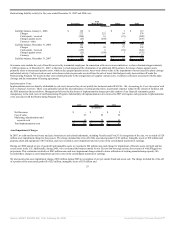

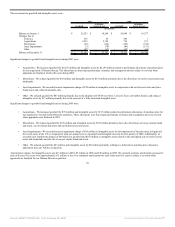

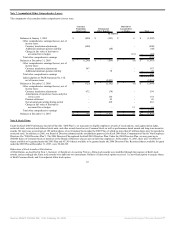

Restructuring liability activity for the years ended December 31, 2007 and 2006 was:

Severance

Asset

Write-downs Other Total

(in millions)

Liability balance, January 1, 2006 $ 114 $ - $ 1 $ 115

Charges 272 252 54 578

Cash (spent) / received (204) 16 (21) (209)

Charges against assets (25) (268) - (293)

Currency / other 8 - (2) 6

Liability balance, December 31, 2006 165 - 32 197

Charges 156 99 77 332

Cash (spent) / received (155) 6 (94) (243)

Charges against assets (25) (109) 1 (133)

Currency 13 4 - 17

Liability balance, December 31, 2007 $ 154 $ - $ 16 $ 170

Severance costs include the cost of benefits received by terminated employees. In connection with our severance initiatives, we have eliminated approximately

11,000 positions as of December 31, 2007; at that time we had announced the elimination of an additional 400 positions. Severance charges against assets

primarily relate to incremental pension costs, which reduce prepaid pension assets. Asset write-downs relate to the impairment of assets caused by plant closings

and related activity. Cash received on asset write-downs relates to proceeds received from the sale of assets that had previously been written-off under the

Restructuring Program. We incurred other costs related primarily to the renegotiation of supplier contract costs, workforce reductions associated with the plant

closings and the termination of leasing agreements.

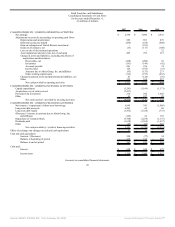

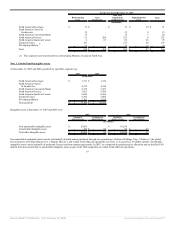

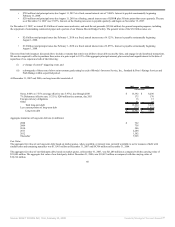

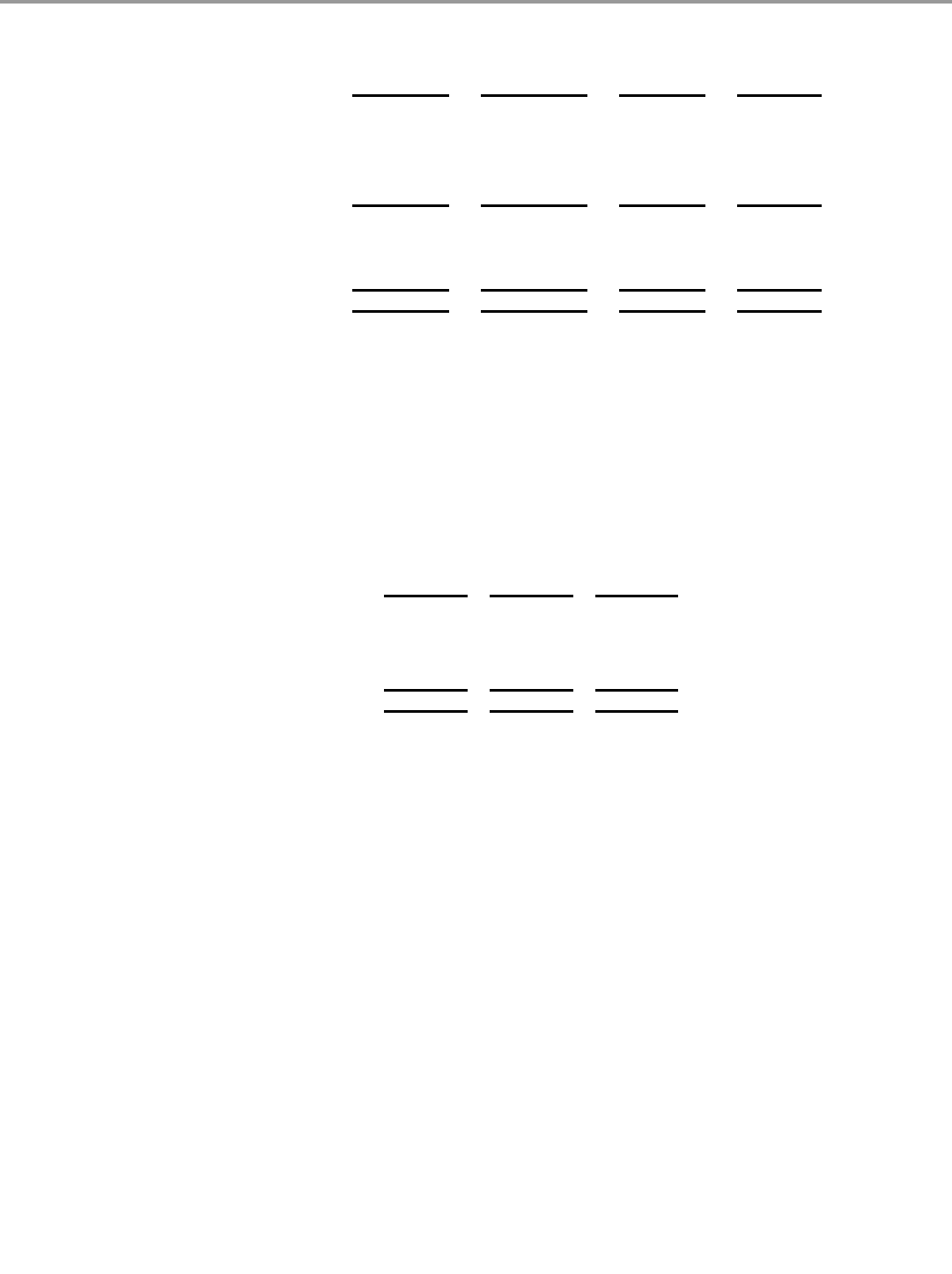

Implementation Costs:

Implementation costs are directly attributable to exit costs; however they do not qualify for treatment under SFAS No. 146, Accounting for Costs Associated with

Exit or Disposal Activities. These costs primarily include the discontinuance of certain product lines, incremental expenses related to the closure of facilities and

the EDS transition discussed above. Management believes the disclosure of implementation charges provides readers of our financial statements greater

transparency to the total costs of our Restructuring Program. Substantially all implementation costs incurred in 2007 will require cash payments. Implementation

costs associated with the Restructuring Program were:

2007 2006 2005

(in millions)

Net Revenues $ - $ - $ 2

Cost of sales 67 25 56

Marketing, administration and

research costs 60 70 29

Total implementation costs $ 127 $ 95 $ 87

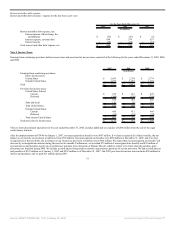

Asset Impairment Charges

In 2007, we sold our flavored water and juice brand assets and related trademarks, including Veryfine and Fruit2O. In recognition of the sale, we recorded a $120

million asset impairment charge for these assets. The charge included the write-off of the associated goodwill of $3 million, intangible assets of $70 million and

property, plant and equipment of $47 million, and was recorded as asset impairment and exit costs on the consolidated statement of earnings.

During our 2006 annual review of goodwill and intangible assets we recorded a $24 million non-cash charge for impairment of biscuits assets in Egypt and hot

cereal assets in the U.S. Additionally, during 2006, we re-evaluated the business model for our Tassimo hot beverage system, the revenues of which lagged our

projections. This evaluation resulted in a $245 million non-cash asset impairment charge related to lower utilization of existing manufacturing capacity. We

recorded these charges as asset impairment and exit costs on the consolidated statement of earnings.

We also incurred an asset impairment charge of $86 million during 2006 in recognition of our pet snacks brand and assets sale. The charge included the write-off

of a portion of the associated goodwill of $25 million, intangible assets of $55 million and

55

Source: KRAFT FOODS INC, 10-K, February 25, 2008 Powered by Morningstar® Document Research℠