Kraft 2008 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2008 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

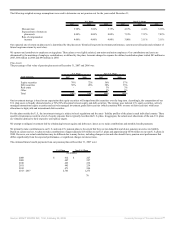

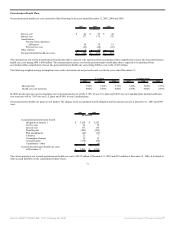

The 2006 effective tax rate includes the previously discussed $337 million reimbursement from Altria for federal tax reserves no longer required along with net

state tax reserve reversals of $39 million. The 2006 tax rate also benefited from the resolution of various tax items in our foreign operations, dividend repatriation

benefits, joint venture earnings, and lower foreign tax rates enacted in 2006 (primarily Canada). These benefits were partially offset by state tax expense and by

the tax costs associated with our 2006 divestitures.

The 2005 effective tax rate includes tax benefits of $117 million from dividend repatriation including the impact from the American Jobs Creation Act of 2004,

the resolution of outstanding items in our international operations, and the settlement of an outstanding U.S. tax claim. The 2005 tax rate also benefited from our

2005 divestitures, which was partially offset by state tax expense.

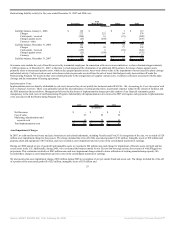

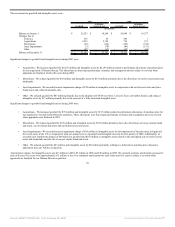

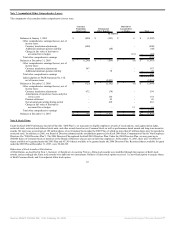

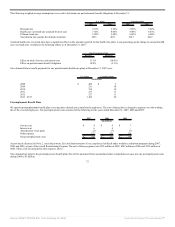

The tax effects of temporary differences that gave rise to deferred income tax assets and liabilities consisted of the following at December 31, 2007 and 2006:

2007 2006

(in millions)

Deferred income tax assets:

Accrued postretirement and postemployment benefits $ 1,408 $ 1,531

Other 1,841 1,690

Total deferred income tax assets 3,249 3,221

Valuation allowance (105) (100)

Net deferred income tax assets $ 3,144 $ 3,121

Deferred income tax liabilities:

Trade names (4,359) (4,157)

Property, plant and equipment (1,398) (1,627)

Prepaid pension costs (576) (161)

Other (1,060) (758)

Total deferred income tax liabilities (7,393) (6,703)

Net deferred income tax liabilities $ (4,249) $ (3,582)

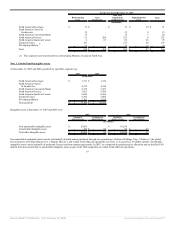

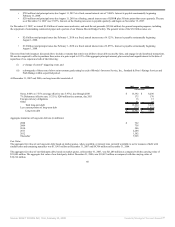

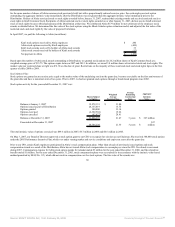

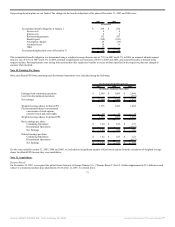

Note 6. Capital Stock:

Our articles of incorporation authorize 3.0 billion shares of Class A common stock, 2.0 billion shares of Class B common stock and 500 million shares of

preferred stock. Shares of Class A common stock issued, repurchased and outstanding were:

Shares Issued

Shares

Repurchased

Shares

Outstanding

Balance at January 1, 2005 555,000,000 (29,644,926) 525,355,074

Repurchase of shares - (39,157,600) (39,157,600)

Exercise of stock options and issuance of other stock awards 3,683,281 3,683,281

Balance at December 31, 2005 555,000,000 (65,119,245) 489,880,755

Repurchase of shares - (38,744,248) (38,744,248)

Exercise of stock options and issuance of other stock awards 4,836,138 4,836,138

Balance at December 31, 2006 555,000,000 (99,027,355) 455,972,645

Repurchase of shares - (111,516,043) (111,516,043)

Exercise of stock options and issuance of other stock awards - 9,321,018 9,321,018

Conversion of Class B common shares to Class A common shares 1,180,000,000 - 1,180,000,000

Balance at December 31, 2007 1,735,000,000 (201,222,380) 1,533,777,620

63

Source: KRAFT FOODS INC, 10-K, February 25, 2008 Powered by Morningstar® Document Research℠