Kraft 2008 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2008 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

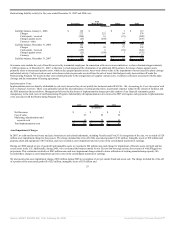

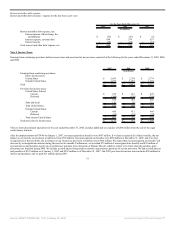

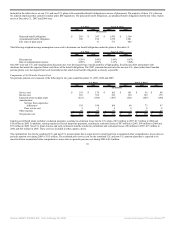

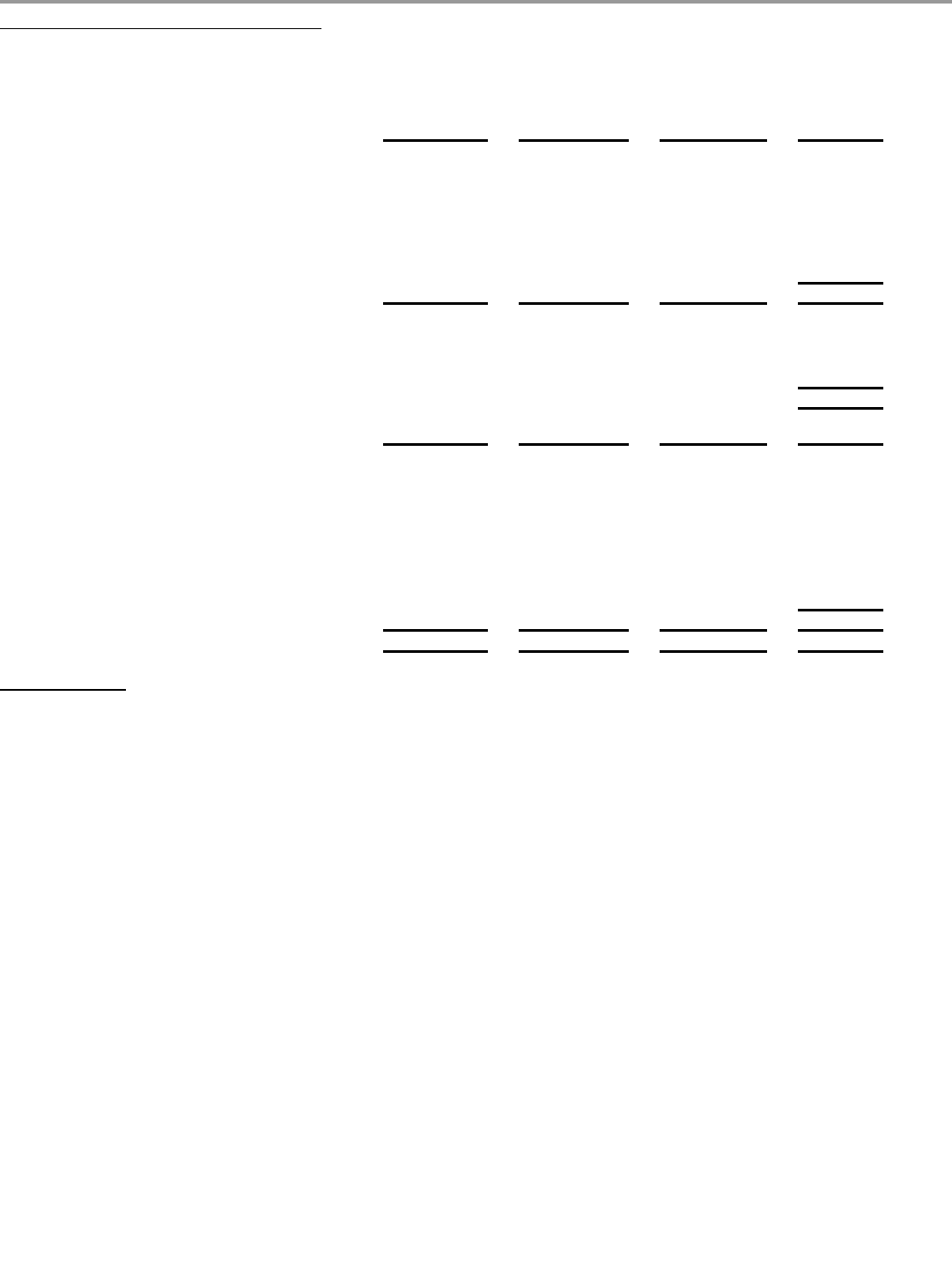

Note 7. Accumulated Other Comprehensive Losses:

The components of accumulated other comprehensive losses were:

Currency

Translation

Adjustments

Pension and

Other Benefits

Derivatives

Accounted for

as Hedges Total

(in millions)

Balances at January 1, 2005 $ (890) $ (321) $ 6 $ (1,205)

Other comprehensive earnings/(losses), net of

income taxes:

Currency translation adjustments (400) - - (400)

Additional minimum pension liability (48) (48)

Change in fair value of derivatives

accounted for as hedges - - (10) (10)

Total other comprehensive earnings (458)

Balances at December 31, 2005 $ (1,290) $ (369) $ (4) $ (1,663)

Other comprehensive earnings/(losses), net of

income taxes:

Currency translation adjustments 567 - - 567

Additional minimum pension liability - 78 - 78

Total other comprehensive earnings 645

Initial adoption of FASB Statement No. 158,

net of income taxes - (2,051) - (2,051)

Balances at December 31, 2006 $ (723) $ (2,342) $ (4) $ (3,069)

Other comprehensive earnings/(losses), net of

income taxes:

Currency translation adjustments 672 (78) - 594

Amortization of experience losses and prior

service costs - 154 - 154

Pension settlement - 45 - 45

Net actuarial gain arising during period - 410 - 410

Change in fair value of derivatives

accounted for as hedges - - 31 31

Total other comprehensive earnings 1,234

Balances at December 31, 2007 $ (51) $ (1,811) $ 27 $ (1,835)

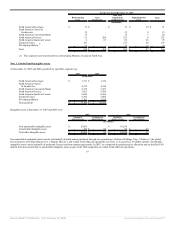

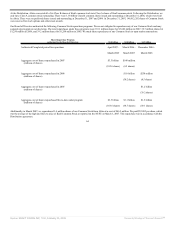

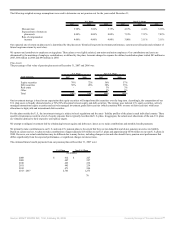

Note 8. Stock Plans:

Under the Kraft 2005 Performance Incentive Plan (the “2005 Plan”), we may grant to eligible employees awards of stock options, stock appreciation rights,

restricted stock, restricted and deferred stock units, and other awards based on our Common Stock, as well as performance-based annual and long-term incentive

awards. We may issue a maximum of 150 million shares of our Common Stock under the 2005 Plan, of which no more than 45 million shares may be awarded as

restricted stock. In addition, in 2006, our Board of Directors adopted and the stockholders approved, the Kraft 2006 Stock Compensation Plan for Non-Employee

Directors (the “2006 Directors Plan”). The 2006 Directors Plan replaced the Kraft 2001 Directors Plan. Under the 2006 Directors Plan, we may grant up to

500,000 shares of Common Stock to members of the Board of Directors who are not our full-time employees. At December 31, 2007, there were 110,980,293

shares available to be granted under the 2005 Plan and 457,018 shares available to be granted under the 2006 Directors Plan. Restricted shares available for grant

under the 2005 Plan at December 31, 2007, were 30,422,325.

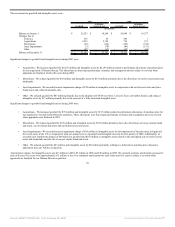

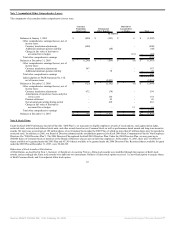

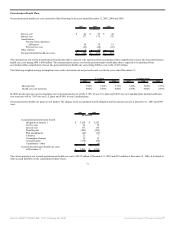

Bifurcation of Stock Awards at Distribution:

At Distribution, as described in Note 1, Summary of Significant Accounting Policies, Altria stock awards were modified through the issuance of Kraft stock

awards, and accordingly the Altria stock awards were split into two instruments. Holders of Altria stock options received: 1) a new Kraft option to acquire shares

of Kraft Common Stock; and 2) an adjusted Altria stock option

65

Source: KRAFT FOODS INC, 10-K, February 25, 2008 Powered by Morningstar® Document Research℠