Kraft 2008 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2008 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

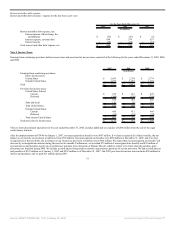

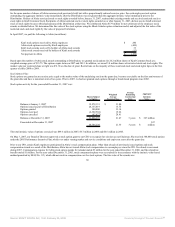

property, plant and equipment of $6 million, and was recorded as asset impairment and exit costs on the consolidated statement of earnings. In January 2007, we

announced the sale of our hot cereal assets and trademarks. We recorded an asset impairment charge of $69 million in the fourth quarter of 2006 in connection

with the anticipated sale. The charge included the write-off of a portion of the associated goodwill of $15 million, intangible assets of $52 million and property,

plant and equipment of $2 million, and was recorded as asset impairment and exit costs on the consolidated statement of earnings. The transaction closed in 2007

and no further impairment charges were incurred for this divestiture.

During 2005, we sold our fruit snacks assets and incurred an asset impairment charge of $93 million in recognition of the sale. During December 2005, we

reached agreements to sell certain assets in Canada and a small biscuit brand in the U.S. and incurred asset impairment charges of $176 million in recognition of

these sales. These transactions closed in 2006 and no further impairment charges were incurred for these divestitures. These aggregate charges, which included

the write-off of the associated goodwill of $13 million, intangible assets of $118 million and asset write-downs of $138 million were recorded as asset

impairment and exit costs on the consolidated statement of earnings.

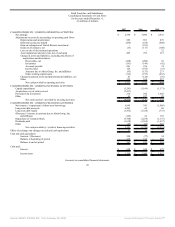

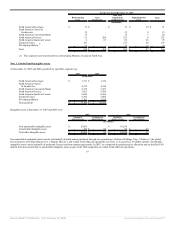

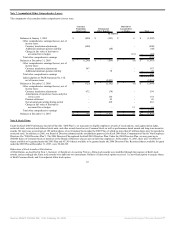

Total - Asset Impairment, Exit and Implementation Costs

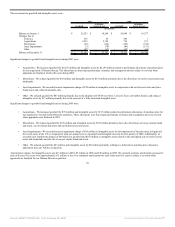

We included the asset impairment, exit and implementation costs discussed above, for the years ended December 31, 2007, 2006 and 2005 in segment operating

income as follows:

For the Year Ended December 31, 2007

Restructuring

Costs

Asset

Impairment

Total Asset

Impairment

and Exit Costs

Implementation

Costs

Total

(in millions)

North America Beverages $ 13 $ 120 $ 133 $ 7 $ 140

North America Cheese &

Foodservice 61 - 61 27 88

North America Convenient Meals 23 - 23 15 38

North America Grocery 71 - 71 7 78

North America Snacks & Cereals 18 - 18 15 33

European Union 108 - 108 44 152

Developing Markets (1)

38 - 38 12 50

Total $ 332 $ 120 $ 452 $ 127 $ 579

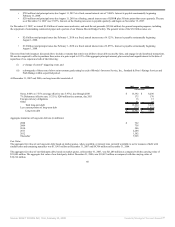

For the Year Ended December 31, 2006

Restructuring

Costs

Asset

Impairment

Total Asset

Impairment

and Exit Costs

Implementation

Costs

Total

(in millions)

North America Beverages $ 21 $ 75 $ 96 $ 12 $ 108

North America Cheese &

Foodservice 87 - 87 15 102

North America Convenient Meals 106 - 106 12 118

North America Grocery 21 - 21 9 30

North America Snacks & Cereals 39 168 207 16 223

European Union 230 170 400 23 423

Developing Markets (1)

74 11 85 8 93

Total $ 578 $ 424 $ 1,002 $ 95 $ 1,097

56

Source: KRAFT FOODS INC, 10-K, February 25, 2008 Powered by Morningstar® Document Research℠