Kraft 2008 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2008 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

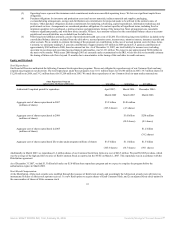

Inventories:

Inventories are stated at the lower of cost or market. The last-in, first-out (“LIFO”) method is used to cost a majority of domestic inventories. The cost of other

inventories is principally determined by the average cost method. We used the LIFO method to determine the cost of 37% of inventories at December 31, 2007

and 41% of inventories at December 31, 2006. The stated LIFO amounts of inventories were $142 million lower at December 31, 2007 and $70 million higher at

December 31, 2006 than the current cost of inventories. We also record inventory allowances for overstocked and obsolete inventories due to ingredient and

packaging changes.

We prospectively adopted the provisions of Statement of Financial Accounting Standards (“SFAS”) No. 151, Inventory Costs, on January 1, 2006. SFAS No. 151

requires us to: (i) recognize abnormal idle facility expense, spoilage, freight and handling costs as current-period charges; and (ii) allocate fixed production

overhead costs to inventories based on the normal capacity of the production facility. The effect of adoption did not have a material impact on our financial

statements.

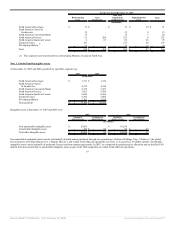

Long-lived assets:

Property, plant and equipment are stated at historical cost and depreciated by the straight-line method over the estimated useful lives of the assets. Machinery and

equipment are depreciated over periods ranging from 3 to 20 years, and buildings and building improvements over periods up to 40 years.

We review long-lived assets, including amortizable intangible assets, for impairment when conditions exist that indicate the carrying amount of the assets may

not be fully recoverable. We perform undiscounted operating cash flow analyses to determine if an impairment exists. When testing assets held for use for

impairment, we group assets and liabilities at the lowest level for which cash flows are separately identifiable. If an impairment is determined to exist, the loss is

calculated based on fair value. Impairment losses on assets to be disposed of, if any, are based on the estimated proceeds to be received, less costs of disposal.

During 2006, we recorded non-cash asset impairment charges of $245 million related to our Tassimo hot beverage system long-lived assets. The charges are

included in asset impairment and exit costs in the consolidated statement of earnings.

Software costs:

We capitalize certain computer software and software development costs incurred in connection with developing or obtaining computer software for internal use.

Capitalized software costs are included in property, plant and equipment on the consolidated balance sheets and amortized on a straight-line basis over the

estimated useful lives of the software, which do not exceed five years.

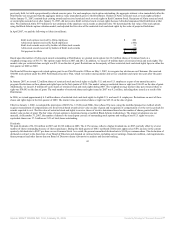

Goodwill and Intangible assets:

SFAS No. 142, Goodwill and Other Intangible Assets, (“SFAS No. 142”) requires us to test goodwill and non-amortizable intangible assets at least annually for

impairment. To test goodwill, we compare the fair value of each reporting unit with the carrying value of the reporting unit. If the carrying value exceeds the fair

value, goodwill is considered impaired. The impairment loss is measured as the difference between the carrying value and implied fair value of goodwill, which

is determined using discounted cash flows. To test non-amortizable intangible assets for impairment, we compare the fair value of the intangible asset with its

carrying value. If the carrying value exceeds fair value, the intangible asset is considered impaired and is reduced to fair value. Definite lived intangible assets are

amortized over their estimated useful lives.

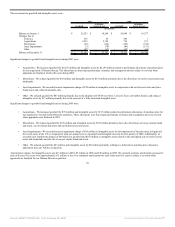

Since our adoption of SFAS No. 142, we have completed our annual impairment review of goodwill and non-amortizable intangible assets as of January 1.

During the first quarter of 2007, we completed our annual review of goodwill and non-amortizable intangible assets and found no impairments. Effective

October 1, 2007, we adopted a new accounting policy to perform our annual impairment review of goodwill and non-amortizable intangible assets as of

October 1 instead of January 1 of each year. The change in our testing date was made to align it with the revised timing of our annual strategic planning process

implemented in 2007. As a result, we performed our annual impairment tests again as of October 1, 2007 and found no impairments. During the first quarter of

2006, we completed our annual review of goodwill and intangible assets and recorded a $24 million non-cash charge for impairment of biscuits assets in Egypt

and hot cereal assets in the U.S. The charge is included in asset impairment and exit costs in the consolidated statement of earnings. During the first quarter of

2005, we completed our annual review of goodwill and intangible assets. No impairments resulted from this review.

Insurance & Self-Insurance:

We use a combination of insurance and self-insurance for a number of risks, including workers’ compensation, general liability, automobile liability, product

liability and our obligation for employee healthcare benefits. Liabilities associated with the risks are estimated by considering historical claims experience and

other actuarial assumptions.

50

Source: KRAFT FOODS INC, 10-K, February 25, 2008 Powered by Morningstar® Document Research℠