Kraft 2008 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2008 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In July 2006, the Financial Accounting Standards Board (“FASB”) issued FASB Interpretation No. 48, Accounting for the Uncertainty in Income Taxes - an

interpretation of FASB Statement No. 109 (“FIN 48”). We adopted the provisions of FIN 48 effective January 1, 2007. FIN 48 clarifies when tax benefits should

be recorded in the financial statements and provides measurement criteria for valuing such benefits. In order for us to recognize benefits, our tax position must be

more likely than not to be sustained upon audit. The amount we recognize is measured as the largest amount of benefit that is greater than 50 percent likely of

being realized upon ultimate settlement. Before the implementation of FIN 48, we established additional provisions for certain positions that were likely to be

challenged even though we believe that those existing tax positions were fully supportable. The adoption of FIN 48 resulted in an increase to shareholders’ equity

as of January 1, 2007 of $213 million.

We recognize deferred tax assets for deductible temporary differences, operating loss carryforwards and tax credit carryforwards. Deferred tax assets are reduced

by a valuation allowance if it is more likely than not that some portion, or all, of the deferred tax assets will not be realized.

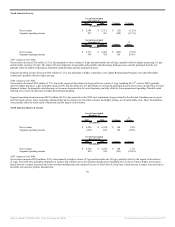

Employee Benefit Plans:

As discussed in Note 9, Benefit Plans, to the consolidated financial statements, we provide a range of benefits to our employees and retired employees. These

include pension plans, postretirement health care benefits and postemployment benefits, consisting primarily of severance. We record amounts relating to these

plans based on calculations specified by U.S. GAAP. These calculations require the use of various actuarial assumptions, such as discount rates, assumed rates of

return on plan assets, compensation increases, turnover rates and health care cost trend rates. We review our actuarial assumptions on an annual basis and make

modifications to the assumptions based on current rates and trends when appropriate. As permitted by U.S. GAAP, we generally amortize any effect of the

modifications over future periods. We believe that the assumptions used in recording our plan obligations are reasonable based on our experience and advice

from our actuaries. Refer to Note 9 to the consolidated financial statements for a discussion of the assumptions used.

In September 2006, the FASB issued SFAS No. 158, Employers’ Accounting for Defined Benefit Pension and Other Postretirement Plans (“SFAS No. 158”).

SFAS No. 158 requires us to recognize the funded status of our defined benefit pension and other postretirement plans on the consolidated balance sheet.

Subsequent changes in funded status that are not recognized as a component of net periodic benefit cost are recognized as a component of other comprehensive

income. We prospectively adopted the recognition and related disclosure provisions of SFAS No. 158 on December 31, 2006. The adoption resulted in a decrease

to total assets of $2,286 million, a decrease to total liabilities of $235 million and a decrease to shareholders’ equity of $2,051 million.

SFAS No. 158 also requires us to measure plan assets and benefit obligations as of the balance sheet date beginning in 2008. We currently measure our non-U.S.

pension plans (other than Canadian pension plans) at September 30 of each year. We expect to adopt the measurement date provision of SFAS No. 158 and

measure these plans as of our operating subsidiaries’ year-end close date, beginning in 2008. We are presently evaluating the impact of the measurement date

change, which is not expected to be significant.

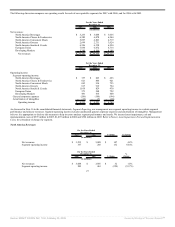

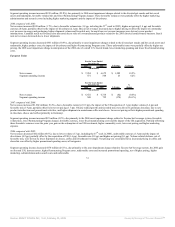

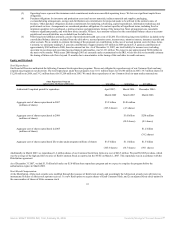

During the years ended December 31, 2007, 2006 and 2005, we recorded the following amounts in the consolidated statements of earnings for employee benefit

plans:

2007 2006 2005

(in millions)

U.S. pension plan cost $ 212 $ 289 $ 256

Non - U.S. pension plan cost 123 155 140

Postretirement health care cost 260 271 253

Postemployment benefit plan cost 140 237 139

Employee savings plan cost 83 84 94

Net expense for employee benefit plans $ 818 $ 1,036 $ 882

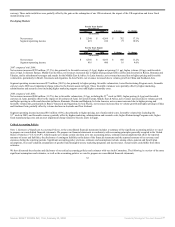

The 2007 net expense for employee benefit plans of $818 million decreased by $218 million over the 2006 amount. The cost decrease primarily relates to lower

U.S. pension plan costs, including lower amortization of the net loss from experience differences, and lower postemployment benefit plan costs related to the

Restructuring Program. The 2006 net expense for employee benefit plans of $1,036 million increased by $154 million over the 2005 amount. This cost increase

primarily related

35

Source: KRAFT FOODS INC, 10-K, February 25, 2008 Powered by Morningstar® Document Research℠