Kraft 2008 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2008 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

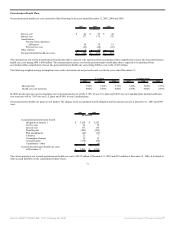

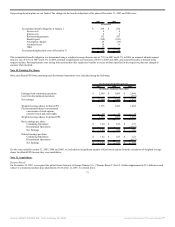

At the Distribution, Altria converted all of its Class B shares of Kraft common stock into Class A shares of Kraft common stock. Following the Distribution, we

only have Class A common stock outstanding. There were 1.18 billion Class B common shares issued and outstanding at December 31, 2006, which were held

by Altria. There were no preferred shares issued and outstanding at December 31, 2007 and 2006. At December 31, 2007, 148,912,292 shares of Common Stock

were reserved for stock options and other stock awards.

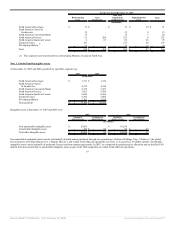

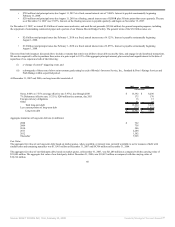

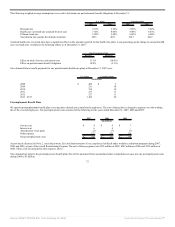

Our Board of Directors authorized the following Common Stock repurchase programs. We are not obligated to repurchase any of our Common Stock and may

suspend any program at our discretion. The total repurchases under these programs were 110.1 million shares for $3,640 million in 2007, 38.7 million shares for

$1,250 million in 2006, and 39.2 million shares for $1,200 million in 2005. We made these repurchases of our Common Stock in open market transactions.

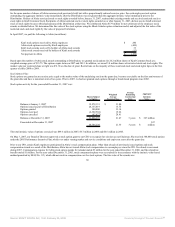

Share Repurchase Program

authorized by the Board of Directors $5.0 billion $2.0 billion $1.5 billion

Authorized/Completed period for repurchase

April 2007 -

March 2009

March 2006 -

March 2007

December 2004 -

March 2006

Aggregate cost of shares repurchased in 2007

(millions of shares)

$3.5 billion

(105.6 shares)

$140 million

(4.5 shares)

Aggregate cost of shares repurchased in 2006

(millions of shares)

$1.0 billion

(30.2 shares)

$250 million

(8.5 shares)

Aggregate cost of shares repurchased in 2005

(millions of shares)

$1.2 billion

(39.2 shares)

Aggregate cost of shares repurchased life-to-date under program

(millions of shares)

$3.5 billion

(105.6 shares)

$1.1 billion

(34.7 shares)

$1.5 billion

(49.1 shares)

Additionally, in March 2007, we repurchased 1.4 million shares of our Common Stock from Altria at a cost of $46.5 million. We paid $32.085 per share, which

was the average of the high and the low price of Kraft Common Stock as reported on the NYSE on March 1, 2007. This repurchase was in accordance with the

Distribution agreement.

64

Source: KRAFT FOODS INC, 10-K, February 25, 2008 Powered by Morningstar® Document Research℠