Kraft 2008 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2008 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

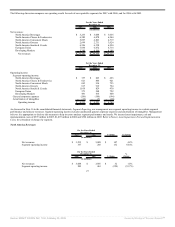

We acquired assets consisting primarily of goodwill of $5,239 million (which will not be deductible for statutory tax purposes), intangible assets of $2,196

million (substantially all of which are expected to be indefinite lived), property, plant and equipment of $561 million, receivables of $759 million and inventories

of $198 million. These amounts represent the preliminary allocation of purchase price and are subject to revision when appraisals are finalized, which will occur

during 2008.

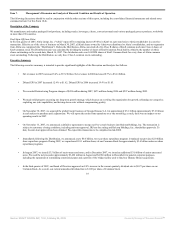

United Biscuits:

In 2006, we acquired the Spanish and Portuguese operations of United Biscuits (“UB”) for approximately $1.1 billion. The non-cash acquisition was financed by

our assumption of $541 million of debt issued by the acquired business immediately prior to the acquisition, as well as $530 million of value for the redemption

of our outstanding investment in UB, primarily deep-discount securities. The redemption of our outstanding investment resulted in a gain on closing of

approximately $251 million, or $0.09 per diluted share, in the third quarter of 2006. As part of the transaction, we also recovered the rights to all Nabisco

trademarks in the European Union, Eastern Europe, the Middle East and Africa, which UB had held since 2000. The Spanish and Portuguese operations of UB

include its biscuits, dry desserts and canned meats, tomato and fruit juice businesses. The operations also include seven manufacturing facilities and 1,300

employees. These businesses contributed net revenues of approximately $466 million for the year ended December 31, 2007 and approximately $111 million for

the period from September 2006 to December 31, 2006.

We acquired assets consisting primarily of goodwill of $730 million, intangible assets of $217 million, property, plant and equipment of $149 million,

receivables of $101 million and inventories of $34 million.

Post Distribution:

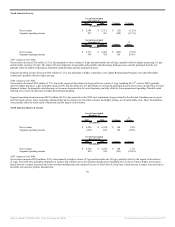

On November 15, 2007, we announced a definitive agreement to merge our Post cereals business (“Post Business”) into Ralcorp Holdings, Inc. (“Ralcorp”) after

a tax-free distribution to our shareholders (the “Post Distribution”). We have signed an agreement with Ralcorp to execute the Post Distribution by means of a

“Reverse-Morris Trust” transaction. This transaction is subject to customary closing conditions, including anti-trust approval, IRS tax-free ruling and Ralcorp

shareholder approvals. To date, the anti-trust approval has been obtained. We anticipate that this transaction will be completed in mid-2008.

The Post Business had net revenues of approximately $1.1 billion in 2007, and includes such cereals as Honey Bunches of Oats, Pebbles, Shredded Wheat,

Selects, Grape Nuts and Honeycomb. The brands in this transaction are distributed primarily in North America. In addition to the Post brands, the transaction

includes four manufacturing facilities and certain manufacturing equipment. We anticipate that approximately 1,250 employees will join Ralcorp following the

consummation of the transaction.

Our shareholders will receive at least 30.3 million shares of Ralcorp stock after the Post Distribution and the subsequent merger of the Post Business with

Ralcorp. Based on market conditions prior to closing, we will determine whether the shares will be distributed in a spin-off or a split-off transaction. Either type

of transaction is expected to be tax-free to our U.S. shareholders. In a spin-off transaction, our shareholders would receive a pro rata number of Ralcorp shares. In

a split-off transaction, our shareholders would have the option to exchange their Kraft shares and receive Ralcorp shares at closing, resulting in a reduction in the

number of shares of our Common Stock outstanding. In addition, Kraft will receive approximately $960 million of cash-equivalent value, which will be used to

repay debt.

Other:

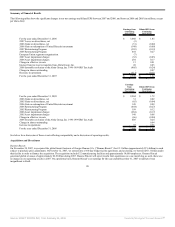

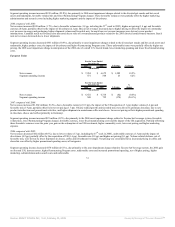

In 2007, we received $216 million in proceeds, and recorded pre-tax gains of $15 million on the divestitures of our hot cereal assets and trademarks, our sugar

confectionery assets in Romania and related trademarks and our flavored water and juice brand assets and related trademarks, including Veryfine and Fruit2O.

We recorded an after-tax loss of $3 million on these divestitures, which reflects the differing book and tax bases of our hot cereal assets and trademarks

divestiture.

In 2006, we received $946 million in proceeds, and recorded pre-tax gains of $117 million on the divestitures of our pet snacks brand and assets, rice brand and

assets, certain Canadian assets, our industrial coconut assets, a small U.S. biscuit brand and a U.S. coffee plant. We recorded after-tax gains of $31 million, or

$0.02 per diluted share, on these divestitures, which reflects the tax expense of $57 million related to the differing book and tax bases on our pet snacks brand

and assets divestiture.

In 2005, we received $238 million in proceeds, and recorded pre-tax gains of $108 million, or $0.04 per diluted share, on the divestitures of our fruit snacks

assets, our U.K. desserts assets, our U.S. yogurt assets, a small operation in Colombia, a minor trademark in Mexico and a small equity investment in Turkey.

We also sold substantially all of our sugar confectionery business in June 2005 for pre-tax proceeds of approximately $1.4 billion. The sale included the Life

Savers, Creme Savers, Altoids, Trolli and Sugus brands. We reflected the results of our

21

Source: KRAFT FOODS INC, 10-K, February 25, 2008 Powered by Morningstar® Document Research℠