Kraft 2008 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2008 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Approximately $5.5 billion (approximately €3.8 billion) was earmarked for the refinancing of our Danone Biscuit Bridge Facility.

At December 31, 2007 we had no short-term amounts payable to Altria and its affiliates for transition services. At December 31, 2006 we had short-term

amounts payable to Altria and affiliates of $607 million, which included $364 million of accrued dividends. Prior to the Distribution, the amounts payable to

Altria generally included accrued dividends, taxes and service fees.

Credit Ratings:

At December 31, 2007, our debt ratings by major credit rating agencies were:

Short - term Long - term

Moody’s P-2 Baa2

Standard & Poor’s A-2 BBB+

Fitch F2 BBB

Off-Balance Sheet Arrangements and Aggregate Contractual Obligations

We have no off-balance sheet arrangements other than the guarantees and contractual obligations that are discussed below.

Guarantees:

As discussed in Note 15, Commitments and Contingencies, we have third-party guarantees because of our acquisition, divestiture and construction activities. As

part of those transactions, we guarantee that third parties will make contractual payments or achieve performance measures. At December 31, 2007, the

maximum potential payments under our third-party guarantees were $32 million, of which $8 million have no specified expiration dates. Substantially all of the

remainder expire at various times through 2016. The carrying amounts of these guarantees were $25 million on our consolidated balance sheet at December 31,

2007.

In addition, at December 31, 2007, we were contingently liable for $180 million of guarantees related to our own performance. These include surety bonds

related to dairy commodity purchases and guarantees related to the payment of custom duties and taxes, and letters of credit.

Guarantees do not have, and we do not expect them to have a significant impact on our liquidity.

Aggregate Contractual Obligations:

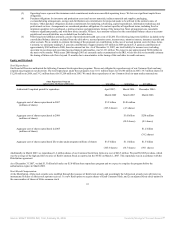

The following table summarizes our contractual obligations at December 31, 2007:

Payments Due

Total 2008 2009-10 2011-12

2013 and

Thereafter

(in millions)

Long - term debt (1)

$ 13,657 $ 722 $ 1,264 $ 3,706 $ 7,965

Interest expense (2)

8,916 814 1,534 1,275 5,293

Operating leases (3)

860 256 329 193 82

Purchase obligations (4):

Inventory and production

costs 4,316 3,423 621 272 -

Other 1,037 772 162 101 2

5,353 4,195 783 373 2

Other long - term liabilities (5)

2,336 221 496 456 1,163

$ 31,122 $ 6,208 $ 4,406 $ 6,003 $ 14,505

(1) Amounts represent the expected cash payments of our long-term debt and do not include unamortized bond premiums or discounts.

(2) Amounts represent the expected cash payments of our interest expense on our long-term debt. Interest calculated on our variable rate debt

was forecasted using a LIBOR rate forward curve analysis as of December 31, 2007. An insignificant amount of interest expense was

excluded from the table for a portion of our foreign debt due to the complexities involved in forecasting expected interest payments.

40

Source: KRAFT FOODS INC, 10-K, February 25, 2008 Powered by Morningstar® Document Research℠