Kraft 2008 Annual Report Download

Download and view the complete annual report

Please find the complete 2008 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Morningstar® Document Research℠

FORM 10-K

KRAFT FOODS INC - KFT

Filed: February 25, 2008 (period: December 31, 2007)

Annual report which provides a comprehensive overview of the company for the past year

Table of contents

-

Page 1

Morningstar Document Research ® ℠FORM 10-K KRAFT FOODS INC - KFT Filed: February 25, 2008 (period: December 31, 2007) Annual report which provides a comprehensive overview of the company for the past year -

Page 2

... annual meeting of shareholders to be held on May 13, 2008, to be filed with the Securities and Exchange Commission (the "SEC") in March 2008, are incorporated in Part III hereof and made a part hereof. Source: KRAFT FOODS INC, 10-K, February 25, 2008 Powered by Morningstar® Document Research℠-

Page 3

... Registered Public Accounting Firm Other Information 15 17 18 43 45 82 82 83 84 85 Part III Item 10. Item 11. Item 12. Item 13. Item 14. Directors, Executive Officers and Corporate Governance Executive Compensation Security Ownership of Certain Beneficial Owners and Management and Related... -

Page 4

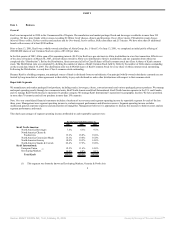

... currently are not limited by long-term debt or other agreements in their ability to pay cash dividends or make other distributions with respect to their common stock. Reportable Segments We manufacture and market packaged food products, including snacks, beverages, cheese, convenient meals... -

Page 5

...: 2007 2006 2005 Cheese Biscuits Coffee Confectionery 19% 15% 14% 11% 19% 15% 14% 10% 19% 14% 14% 10% Our major brands within each reportable segment and consumer sector are: Kraft North America: North America Beverages Beverages: Maxwell House, General Foods International, Starbucks (under... -

Page 6

... pudding snacks; Kraft and Miracle Whip spoonable dressings; Kraft and Good Seasons salad dressings; A.1.steak sauce; Kraft and Bull's-Eye barbecue sauces; Grey Poupon premium mustards; Shake N' Bake coatings; and Kraft peanut butter. North America Snacks & Cereals Snacks: Cheese: Grocery: Kraft... -

Page 7

... are also moving our macaroni & cheese category as well as other dinner products from our Convenient Meals segment to our Grocery segment to take advantage of operating synergies. Canada and North America Foodservice will be structured as a standalone reportable segment. This change will allow us to... -

Page 8

... food outlets. In general, the retail trade for food products is consolidating. Food products are distributed through distribution centers, satellite warehouses, company-operated and public cold-storage facilities, depots and other facilities. We currently distribute most products in North America... -

Page 9

... juice drinks for sale in the U.S., Canada and within our Developing Markets segment; Taco Bell Home Originals Mexican style food products for sale in U.S. grocery stores; California Pizza Kitchen frozen pizzas for sale in grocery stores in the U.S. and Canada; Pebbles ready-to-eat cereals for sale... -

Page 10

...regulating trade practices related to the sale of dairy products and imposing their own labeling requirements on food products. Many of the food commodities we use in our U.S. operations are subject to governmental agricultural programs. These programs have substantial effects on prices and supplies... -

Page 11

... Board of Trustees. Mr. Brearton was appointed to his current position effective January 1, 2008. Prior to that, he served as Executive Vice President, Global Business Services and Strategy, as Senior Vice President of Business Process Simplification and as Corporate Controller for Kraft Foods... -

Page 12

... by writing to: Corporate Secretary, Kraft Foods Inc., Three Lakes Drive, Northfield, IL 60093. Certain of these materials may also be found in the proxy statement relating to our 2008 Annual Meeting of Shareholders. Available Information Our Internet address is www.kraft.com. Our Annual Reports on... -

Page 13

... credit facility; the amount of our expected payment for tax liabilities; our expectation to complete the current authorization under our share repurchase program before the authorization expires in March 2009; and our 2008 Outlook, specifically diluted EPS, costs, savings and spending related... -

Page 14

... EU and our other major markets. These consolidations have produced large, sophisticated customers with increased buying power. These larger retailers are capable of operating with reduced inventories, they can resist price increases, and they demand lower pricing, increased promotional programs and... -

Page 15

..., adverse effects on existing business relationships with suppliers and customers, inaccurate estimates of fair value made in the accounting for acquisitions and amortization of acquired intangible assets which would reduce future reported earnings, potential loss of customers or key employees of... -

Page 16

... of North America, we have 123 facilities located in 44 countries. These manufacturing and processing facilities are located throughout the following territories: Number of Facilities Territory U.S. Canada European Union Eastern Europe, Middle East and Africa Latin America Asia Pacific Total 51... -

Page 17

... stock and rights, and used shares to pay the related taxes. As such, these are non-cash transactions. The principal stock exchange on which our Common Stock is listed is the NYSE. At January 31, 2008, there were approximately 87,000 holders of record of our Common Stock. 15 Source: KRAFT FOODS... -

Page 18

...Common Stock with the cumulative total return of the S&P 500 Index and the performance peer group index. The graph assumes the reinvestment of all dividends on a quarterly basis. Date December 2002 December 2003 December 2004 December 2005 December 2006 December 2007 $ $ $ $ $ $ Kraft Foods 100... -

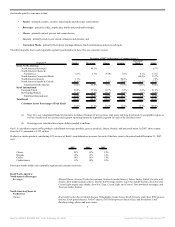

Page 19

... assets Long-term debt Total debt Shareholders' equity Common dividends declared as a % of Basic EPS Common dividends declared as a % of Diluted EPS Book value per common share outstanding Market price per Common Stock share - high/low Closing price of Common Stock at year end Price/earnings ratio... -

Page 20

...) for general corporate purposes, including the repayment of outstanding commercial paper and a portion of the bridge facility used to fund our Danone Biscuit acquisition. In the third quarter of 2007, our Board of Directors approved an 8.0% increase in the current quarterly dividend rate to $0.27... -

Page 21

... shelves more quickly; and increase the number and quality of displays. We plan to complete the full rollout in North America by mid-2008. We plan to build profitable scale by expanding our distribution reach in countries with rapidly growing demand. The acquisition of Danone Biscuit is part of our... -

Page 22

...of United Biscuits investment 2006 Restructuring Program 2005 Restructuring Program 2006 Asset impairment charges 2005 Asset impairment charges Change in effective tax rate 2006 favorable resolution of the Altria Group, Inc. 1996-1999 IRS Tax Audit Change in shares outstanding Increase in operations... -

Page 23

...sold substantially all of our sugar confectionery business in June 2005 for pre-tax proceeds of approximately $1.4 billion. The sale included the Life Savers, Creme Savers, Altoids, Trolli and Sugus brands. We reflected the results of our 21 Source: KRAFT FOODS INC, 10-K, February 25, 2008 Powered... -

Page 24

... capacity. As part of the Restructuring Program we anticipate incurring approximately $2.8 billion in pre-tax charges reflecting asset disposals, severance and implementation costs; closing at least 35 facilities and eliminating approximately 13,500 positions; using cash to pay for approximately... -

Page 25

...2007, we sold our flavored water and juice brand assets and related trademarks, and incurred an asset impairment charge of $120 million, or $0.03 per diluted share, in recognition of the sale. The charge, which included the write-off of the associated goodwill of $3 million, intangible assets of $70... -

Page 26

... tax rate also benefited from an increased domestic manufacturing deduction and the divestiture of our flavored water and juice brand assets and related trademarks. These benefits were partially offset by state tax expense. During 2006, the IRS concluded its examination of Altria's consolidated tax... -

Page 27

...divested pet snacks and hot cereal assets and trademarks, Tassimo hot beverage system and biscuits assets in Egypt (totaling $424 million), lower Restructuring Program charges ($214 million) and the 2006 loss on the sale of a U.S. coffee plant ($95 million). Currency fluctuations increased operating... -

Page 28

... Cheese & Foodservice; North America Convenient Meals; North America Grocery; and North America Snacks & Cereals. The two international segments are European Union; and Developing Markets (formerly known as Developing Markets, Oceania & North Asia), the latter to reflect our increased management... -

Page 29

... for each of our reportable segments for 2007 with 2006, and for 2006 with 2005. 2007 Net revenues: North America Beverages North America Cheese & Foodservice North America Convenient Meals North America Grocery North America Snacks & Cereals European Union Developing Markets Net revenues For... -

Page 30

... by an asset impairment charge related to our flavored water and juice brand assets and related trademarks and higher total manufacturing costs, including higher commodity costs (primarily related to coffee and packaging), net of higher pricing. 2006 compared with 2005: Net revenues increased $32... -

Page 31

... sale of industrial coconut assets, partially offset by favorable costs (primarily cheese commodity costs), net of lower net pricing, lower fixed manufacturing costs and favorable currency. North America Convenient Meals For the Years Ended December 31, 2007 2006 (in millions) rd $ change % change... -

Page 32

... Snack bars net revenues increased due to new product introductions and continued success of South Beach Living bars. Snack nuts net revenues increased due to favorable mix and new product introductions. 30 Source: KRAFT FOODS INC, 10-K, February 25, 2008 Powered by Morningstar® Document Research... -

Page 33

... divested U.K. desserts assets, higher Restructuring Program costs, unfavorable costs and increased promotional spending, net of higher pricing, higher marketing, administration and research costs and unfavorable 31 Source: KRAFT FOODS INC, 10-K, February 25, 2008 Powered by Morningstar® Document... -

Page 34

... and expenses during the reporting periods. Significant accounting policy elections, estimates and assumptions include, among others, pension and benefit plan assumptions, lives and valuation assumptions of goodwill and intangible assets, marketing programs and income taxes. Actual results could... -

Page 35

... the first quarter of 2006, we completed our annual review of goodwill and intangible assets and recorded a $24 million non-cash charge for impairment of biscuits assets in Egypt and hot cereal assets in the U.S. The charge is included 33 Source: KRAFT FOODS INC, 10-K, February 25, 2008 Powered by... -

Page 36

... No. 109, Accounting for Income Taxes. Prior to the Distribution, we were included in Altria's consolidated federal income tax return. We generally computed income taxes on a separate company basis; however some of our foreign tax credits, capital losses and other credits could not have been used on... -

Page 37

... plan costs related to the Restructuring Program. The 2006 net expense for employee benefit plans of $1,036 million increased by $154 million over the 2005 amount. This cost increase primarily related 35 Source: KRAFT FOODS INC, 10-K, February 25, 2008 Powered by Morningstar® Document Research... -

Page 38

...amounts reported for the health care plans. A one-percentage-point change in assumed health care cost trend rates would have the following effects as of December 31, 2007: One-Percentage-Point Increase Decrease Effect on total of service and interest cost Effect on postretirement benefit obligation... -

Page 39

... 5, Income Taxes, for information on how the closure of an IRS review of Altria's consolidated federal income tax return in 2006 impacted us. Financial Instruments: As Kraft operates globally, we use certain financial instruments to manage our foreign currency exchange rate and commodity price risks... -

Page 40

...-term financing will provide sufficient liquidity to meet our working capital needs (including the cash requirements of the Restructuring Program), planned capital expenditures, future contractual obligations, authorized share repurchases, and payment of our anticipated quarterly dividends. Net Cash... -

Page 41

... of future business requirements, market conditions and other factors. At December 31, 2007, we had approximately $9.5 billion remaining in long-term financing authority from our Board of Directors. 39 Source: KRAFT FOODS INC, 10-K, February 25, 2008 Powered by Morningstar® Document Research℠-

Page 42

... dividends. Prior to the Distribution, the amounts payable to Altria generally included accrued dividends, taxes and service fees. Credit Ratings: At December 31, 2007, our debt ratings by major credit rating agencies were: Short - term Long - term Moody's Standard & Poor's Fitch Off-Balance Sheet... -

Page 43

... awards were split into two instruments. Holders of Altria stock options received: 1) a new Kraft option to acquire shares of Kraft Common Stock; and 2) an adjusted Altria stock option for the same number of shares of Altria common stock 41 Source: KRAFT FOODS INC, 10-K, February 25, 2008 Powered... -

Page 44

... and service conditions and expire ten years after the grant date. In January 2007, we issued 5.2 million shares of restricted stock and stock rights to eligible U.S. and non-U.S. employees as part of our annual incentive program. Restrictions on these shares and rights lapse in the first quarter of... -

Page 45

... foreign currency and commodity price risk management policies that principally use derivative instruments to reduce significant, unanticipated earnings fluctuations that may arise from volatility in foreign currency exchange rates and commodity prices. We occasionally use related futures to cross... -

Page 46

..., foreign currency rates and commodity prices under normal market conditions. The computation does not represent actual losses in fair value or earnings to be incurred by Kraft, nor does it consider the effect of favorable changes in market rates. We cannot predict actual future movements in such... -

Page 47

... and Supplementary Data. Kraft Foods Inc. and Subsidiaries Consolidated Statements of Earnings for the years ended December 31, (in millions of dollars, except per share data) 2007 2006 2005 Net revenues Cost of sales Gross profit Marketing, administration and research costs Asset impairment and... -

Page 48

... Employment costs Dividends payable Other Income taxes Total current liabilities Long-term debt Deferred income taxes Accrued pension costs Accrued postretirement health care costs Other liabilities TOTAL LIABILITIES Contingencies (Note 15) SHAREHOLDERS' EQUITY Class A common stock, no par value... -

Page 49

... of income taxes Total comprehensive earnings Initial adoption of FIN 48 (Note 1) Exercise of stock options and issuance of other stock awards Net settlement of employee stock awards with Altria Group, Inc. (Note 8) Cash dividends declared ($1.04 per share) Common Stock repurchased Other Balances at... -

Page 50

..., net of cash paid Change in assets and liabilities, excluding the effects of acquisitions and divestitures: Receivables, net Inventories Accounts payable Income taxes Amounts due to Altria Group, Inc. and affiliates Other working capital items Change in pension assets and postretirement liabilities... -

Page 51

... packaged foods and beverages worldwide in more than 150 countries. Prior to June 13, 2001, Kraft was a wholly-owned subsidiary of Altria Group, Inc. ("Altria"). On June 13, 2001, we completed an initial public offering of 280,000,000 shares of our Class A common stock ("Common Stock") at a price... -

Page 52

..., product liability and our obligation for employee healthcare benefits. Liabilities associated with the risks are estimated by considering historical claims experience and other actuarial assumptions. 50 Source: KRAFT FOODS INC, 10-K, February 25, 2008 Powered by Morningstar® Document Research... -

Page 53

...No. 109, Accounting for Income Taxes. Prior to the Distribution, we were included in Altria's consolidated federal income tax return. We generally computed income taxes on a separate company basis; however, some of our foreign tax credits, capital losses and other credits could not have been used on... -

Page 54

... pool of tax benefits resulting from tax deductions in excess of the stock-based employee compensation expense recognized in the statement of earnings under FASB Staff Position ("FSP") 123(R)-3, Transition Election Related to Accounting for the Tax Effects of Share-Based Payment Awards. Under SFAS... -

Page 55

...in our consolidated balance sheets as either current assets or current liabilities. Changes in the fair value of derivatives are recorded each period either in accumulated other comprehensive earnings / (losses) or in earnings, depending on whether a derivative is designated and effective as part of... -

Page 56

... capacity. As part of the Restructuring Program we anticipate incurring approximately $2.8 billion in pre-tax charges reflecting asset disposals, severance and implementation costs; closing up to 35 facilities and eliminating approximately 13,500 positions; and using cash to pay for approximately... -

Page 57

... during 2006 in recognition of our pet snacks brand and assets sale. The charge included the write-off of a portion of the associated goodwill of $25 million, intangible assets of $55 million and 55 Source: KRAFT FOODS INC, 10-K, February 25, 2008 Powered by Morningstar® Document Research℠-

Page 58

...Grocery North America Snacks & Cereals European Union (1) Developing Markets Total $ 21 $ 87 106 21 39 230 74 578 $ 56 75 $ 168 170 11 424 $ 96 $ 87 106 21 207 400 85 1,002 $ 12 $ 15 12 9 16 23 8 95 $ 108 102 118 30 223 423 93 1,097 $ Source: KRAFT FOODS INC, 10-K, February 25, 2008 Powered... -

Page 59

... 2006, goodwill by reportable segment was: 2007 (in millions) 2006 North America Beverages North America Cheese & Foodservice North America Convenient Meals North America Grocery North America Snacks & Cereals European Union Developing Markets Total goodwill Intangible assets at December 31, 2007... -

Page 60

... to intangible assets related to the anticipated sale of our hot cereal assets and trademarks and the sale of our pet snacks brand and assets. Other - We reduced goodwill by $47 million and intangible assets by $64 million primarily relating to a deferred tax purchase price allocation adjustment... -

Page 61

..., and used the net proceeds ($3,462 million) for general corporate purposes, including the repayment of outstanding commercial paper. The general terms of the $3.5 billion notes are 250 million total principal notes due August 11, 2010 at a fixed, annual interest rate of 5.625%. Interest is payable... -

Page 62

...) for general corporate purposes, including the repayment of outstanding commercial paper and a portion of our Danone Biscuit Bridge Facility. The general terms of the $3.0 billion notes are: • • $2.0 billion total principal notes due February 1, 2018 at a fixed, annual interest rate of 6.125... -

Page 63

... tax benefits and $30 million of accrued interest and penalties as part of our preliminary purchase price allocation of Danone Biscuit, which is subject to revision when the purchase price allocations are finalized during 2008. We include accrued interest and penalties related to uncertain tax... -

Page 64

.... The 2007 tax rate also benefited from an increased domestic manufacturing deduction and the divestiture of our flavored water and juice brand assets and related trademarks. These benefits were partially offset by state tax expense. 62 Source: KRAFT FOODS INC, 10-K, February 25, 2008 Powered by... -

Page 65

... benefits, joint venture earnings, and lower foreign tax rates enacted in 2006 (primarily Canada). These benefits were partially offset by state tax expense and by the tax costs associated with our 2006 divestitures. The 2005 effective tax rate includes tax benefits of $117 million from dividend... -

Page 66

.... We paid $32.085 per share, which was the average of the high and the low price of Kraft Common Stock as reported on the NYSE on March 1, 2007. This repurchase was in accordance with the Distribution agreement. 64 Source: KRAFT FOODS INC, 10-K, February 25, 2008 Powered by Morningstar® Document... -

Page 67

... taxes: Currency translation adjustments Amortization of experience losses and prior service costs Pension settlement Net actuarial gain arising during period Change in fair value of derivatives accounted for as hedges Total other comprehensive earnings Balances at December 31, 2007 Note 8. Stock... -

Page 68

... plans were accounted for in accordance with the intrinsic value-based method permitted by SFAS No. 123, which did not result in compensation cost for stock options. The fair value of the awards was 66 Source: KRAFT FOODS INC, 10-K, February 25, 2008 Powered by Morningstar® Document Research... -

Page 69

... FASB issued SFAS No. 158, Employers' Accounting for Defined Benefit Pension and Other Postretirement Plans ("SFAS No. 158"). SFAS No. 158 requires us to recognize the funded status of our defined benefit pension and other postretirement plans on the consolidated balance sheet. Subsequent changes in... -

Page 70

... to most retired employees. Local government plans generally cover health care benefits for retirees outside the U.S. and Canada. The plan assets and benefit obligations of our U.S. and Canadian pension plans are measured at December 31 of each year and all other non-U.S. pension plans are currently... -

Page 71

... rate 6.30% 5.90% 5.44% 4.67% Rate of compensation increase 4.00% 4.00% 3.13% 3.00% Our 2007 year-end U.S. and Canadian plans discount rates were developed from a model portfolio of high quality, fixed-income debt instruments with durations that match the expected future cash flows of the benefit... -

Page 72

... rates. The estimated future benefit payments from our pension plans at December 31, 2007 were: U.S. Plans Non-U.S. Plans (in millions) 2008 2009 2010 2011 2012 2013 - 2017 $ 412 407 425 445 471 2,743 $ 227 227 232 239 244 1,275 70 Source: KRAFT FOODS INC, 10-K, February 25, 2008 Powered... -

Page 73

...$ The current portion of our accrued postretirement health care costs of $217 million at December 31, 2007 and $216 million at December 31, 2006, is included in other accrued liabilities on the consolidated balance sheets. 71 Source: KRAFT FOODS INC, 10-K, February 25, 2008 Powered by Morningstar... -

Page 74

...amounts reported for the health care plans. A one-percentage-point change in assumed health care cost trend rates would have the following effects as of December 31, 2007: One-Percentage-Point Increase Decrease Effect on total of service and interest cost Effect on postretirement benefit obligation... -

Page 75

... acquired the global biscuit business of Groupe Danone S.A. ("Danone Biscuit") for â,¬5.1 billion (approximately $7.6 billion) in cash subject to customary purchase price adjustments. On October 12, 2007, we entered into a 73 Source: KRAFT FOODS INC, 10-K, February 25, 2008 Powered by Morningstar... -

Page 76

... sale included the Life Savers, Creme Savers, Altoids, Trolli and Sugus brands. We reflected the results of our sugar confectionery business prior to the closing date as discontinued operations on the consolidated statements of earnings. 74 Source: KRAFT FOODS INC, 10-K, February 25, 2008 Powered... -

Page 77

... 1, 2008, ALCS no longer provides services to Kraft. On March 30, 2007, we also entered into Employee Matters and Tax Sharing Agreements with Altria. The Employee Matters Agreement sets out each company's obligations for employee transfers, equity compensation and other employee benefits matters... -

Page 78

... Taxes, for information on how the closure of an IRS review of Altria's consolidated federal income tax return in 2006 impacted us. Note 14. Financial Instruments: Commodity cash flow hedges: Kraft is exposed to price risk related to forecasted purchases of certain commodities that we primarily use... -

Page 79

... by product category, and its reportable segments are North America Beverages; North America Cheese & Foodservice; North America Convenient Meals; North America Grocery; and 77 $ 256 189 140 109 84 82 Source: KRAFT FOODS INC, 10-K, February 25, 2008 Powered by Morningstar® Document Research℠-

Page 80

... Snacks & Cereals. We manage Kraft International's operations by geographic location, and its reportable segments are European Union and Developing Markets (formerly known as Developing Markets, Oceania & North Asia). In February 2008, we announced the implementation of our new operating structure... -

Page 81

... the separation of Foodservice and Kraft International into sector components and Cereals into the Grocery sector, were: For the Year Ended December 31, 2007 Kraft North Kraft America International Total (in millions) Consumer Sector: Snacks Beverages Cheese Grocery Convenient Meals Total net... -

Page 82

...233 83 867 2 869 $ $ $ 2007 Capital expenditures from continuing operations: North America Beverages North America Cheese & Foodservice North America Convenient Meals North America Grocery North America Snacks & Cereals European Union Developing Markets Total capital expenditures For the Years... -

Page 83

... 36.26 $ 29.95 $ First 2006 Quarters Second Third (in millions, except per share data) Fourth Net revenues Gross profit Net earnings Weighted average shares for diluted EPS Per share data: Basic EPS Diluted EPS Dividends declared Market price - high - low 81 $ $ $ 8,123 $ 2,932 $ 1,006 $ 1,662... -

Page 84

...Disclosure Controls and Procedures Management, together with our CEO and CFO, evaluated the effectiveness of our disclosure controls and procedures (as defined in Exchange Act Rule 13a-15(e)) as of the end of the period covered by this report. We acquired the global biscuit business of Groupe Danone... -

Page 85

...independent registered public accounting firm, who audited and reported on the consolidated financial statements included in this report, has audited our internal control over financial reporting as of December 31, 2007. February 22, 2008 83 Source: KRAFT FOODS INC, 10-K, February 25, 2008 Powered... -

Page 86

Report of Independent Registered Public Accounting Firm To the Board of Directors and Shareholders of Kraft Foods Inc.: In our opinion, the accompanying consolidated balance sheets and the related consolidated statements of earnings, of shareholders' equity and of cash flows present fairly, in all ... -

Page 87

...Management and Related Stockholder Matters. The number of shares to be issued upon exercise or vesting of awards issued under, and the number of shares remaining available for future issuance under, our equity compensation plans at December 31, 2007 were: Equity Compensation Plan Information Number... -

Page 88

...United Biscuits Southern Europe, dated as of July 8, 2006. *Master (7) Professional Services Agreement between Kraft Foods Global, Inc. and Electronic Data Systems Services Corporation dated as of April 27, 2006. (8) Tax Sharing Agreement by and between Altria Group, Inc and the Registrant, dated as... -

Page 89

... 32.1 + Form of Employee Grantor Trust Enrollment Agreement. (12) + 2006 Stock Compensation Plan for Non-Employee Directors. (9) + Form of Kraft Foods Inc. Change in Control Plan for Key Executives, dated April 24, 2007. (7) + Offer of Employment letter between the Registrant and Irene B. Rosenfeld... -

Page 90

... Officer February 25, 2008 Executive Vice President and Chief Financial Officer February 25, 2008 Senior Vice President and Corporate Controller February 25, 2008 Directors February 25, 2008 88 Source: KRAFT FOODS INC, 10-K, February 25, 2008 Powered by Morningstar® Document Research... -

Page 91

... PUBLIC ACCOUNTING FIRM ON FINANCIAL STATEMENT SCHEDULE To the Board of Directors and Shareholders of Kraft Foods Inc.: Our audits of the consolidated financial statements and of the effectiveness of internal control over financial reporting referred to in our report dated February 22, 2008... -

Page 92

...$ $ $ $ $ $ 5 118 105 228 7 103 100 210 11 107 135 253 Notes: (a) (b) Primarily related to divestitures, acquisitions and currency translation. Represents charges for which allowances were created. S-2 Source: KRAFT FOODS INC, 10-K, February 25, 2008 Powered by Morningstar® Document Research℠-

Page 93

... business to be transacted thereat. Notice of a shareholders' meeting to act on an amendment of the Articles of Incorporation, a plan of merger, share exchange, domestication or entity conversion, a proposed sale of the Corporation's assets that is subject to Section 13.1-724 of the Virginia Stock... -

Page 94

... the secretary of the meeting or to the inspector of election appointed in accordance with Section 9, at or prior to the time designated by the chairman or in the order of business for so delivering -2- Source: KRAFT FOODS INC, 10-K, February 25, 2008 Powered by Morningstar® Document Research℠-

Page 95

... in writing certify to the returns. No candidate for election as director shall be appointed or act as inspector. ARTICLE II Board of Directors Section 1. General Powers. - The business and affairs of the Corporation shall be managed under the direction of the Board of Directors. Section 2. Number... -

Page 96

..., age, business address and, if known, residence address of such person, (ii) the principal occupation or employment of such person, (iii) the class and number of shares of stock of the Corporation that are beneficially owned by such person, (iv) any other information relating to such person that is... -

Page 97

...- The executive committee may choose a chairman and secretary. The executive committee shall keep a record of its acts and proceedings and report the same from time to time to the Board of Directors. -5- Source: KRAFT FOODS INC, 10-K, February 25, 2008 Powered by Morningstar® Document Research℠-

Page 98

... of directors and preside at meetings of the shareholders and of the Board of Directors. The chairman and chief executive officer shall be devoted to the Corporation's business and affairs under the -6- Source: KRAFT FOODS INC, 10-K, February 25, 2008 Powered by Morningstar® Document Research℠-

Page 99

...a shareholder or otherwise in any other corporation, any of whose stock or securities may be held by the Corporation, at meetings of the holders of the stock or other securities of such other corporation, or to consent in writing to any action by -7- Source: KRAFT FOODS INC, 10-K, February 25, 2008... -

Page 100

... 6 of Article II shall read as follows: Any vacancy occurring in the Board of Directors may be filled by the affirmative vote of a majority of the directors present at a meeting of the Board of Directors called in accordance with these By-Laws. -8- Source: KRAFT FOODS INC, 10-K, February 25, 2008... -

Page 101

...sentence of Section 10 of Article II shall read as follows: Special meetings of the Board of Directors shall be held whenever called by order of any person having the powers and duties of the chairman of the Board of Directors. Section 3. Section 12 of Article II shall read as follows: The directors... -

Page 102

... PLAN RESTRICTED STOCK AGREEMENT FOR KRAFT COMMON STOCK KRAFT FOODS INC., a Virginia corporation, (the "Company"), hereby grants to the employee (the "Employee") named in the Award Statement (the "Award Statement") attached hereto, as of the date set forth in the Award Statement (the "Award Date... -

Page 103

...in accordance with such tax equalization policy. 7. Death of Employee. If any of the Restricted Shares shall vest upon the death of the Employee, they shall be registered in the name of the estate of the Employee. 2 Source: KRAFT FOODS INC, 10-K, February 25, 2008 Powered by Morningstar® Document... -

Page 104

..., redundancy, end of service payments, bonuses, long-service awards, pension or retirement benefits or similar payments and in no event should be any member of the Kraft Group; (g) in the event that the Employee is not an employee of any member of the Kraft Group, the Restricted Stock grant and the... -

Page 105

...which pension benefits under such plan or contract become payable without reduction for early commencement and without any requirement of a particular period of prior service). In any case in which (i) the meaning of "Normal Retirement" 4 Source: KRAFT FOODS INC, 10-K, February 25, 2008 Powered by... -

Page 106

...employment by the Kraft Group, in each case subject to any Board or Committee action specifically addressing any such adjustments, cash payments, or continued employment treatment. 15. Electronic Delivery. The Company may, in its sole discretion, decide to deliver any documents related to the Awards... -

Page 107

IN WITNESS WHEREOF, this Restricted Stock Agreement has been duly executed as of February 4, 2008. KRAFT FOODS INC. By: /S/ CAROL J. WARD Carol J. Ward, Vice President and Corporate Secretary 6 Source: KRAFT FOODS INC, 10-K, February 25, 2008 Powered by Morningstar® Document Research℠-

Page 108

Exhibit 10.10 KRAFT FOODS INC. 2005 PERFORMANCE INCENTIVE PLAN NON-QUALIFIED US STOCK OPTION AWARD AGREEMENT KRAFT FOODS INC. (the "Company"), a Virginia corporation, hereby grants to the employee identified in the Award Statement (the "Optionee" identified in the "Award Statement") and attached ... -

Page 109

..., or other benefits under the Kraft Foods Inc. Severance Pay Plan, or any similar plan maintained by the Kraft Group or through other such arrangements that may be entered into that give rise to separation or notice pay, except in any case in which the Optionee is eligible for Retirement upon the... -

Page 110

... date of this Agreement, the Board of Directors of the Company or the Committee may make adjustments to the terms and provisions of this Agreement (including, without limiting the generality of the foregoing, terms and provisions relating to the Grant Price and the number and kind of shares subject... -

Page 111

... shares of Common Stock; (n) the Optionee is hereby advised to consult with the Optionee's own personal tax, legal and financial advisors regarding the Optionee's participation in the Plan before taking any action related to the Plan; and 4 Source: KRAFT FOODS INC, 10-K, February 25, 2008 Powered... -

Page 112

...For the purposes of this Agreement, the term "Disability" means permanent and total disability as determined under the procedures established by the Company for purposes of the Plan and the term "Retirement" means retirement from active employment under a pension plan of the Kraft Group, or under an... -

Page 113

... 12.1 KRAFT FOODS INC. AND SUBSIDIARIES Computation of Ratios of Earnings to Fixed Charges (in millions of dollars) Years Ended December 31, 2006 2005 2004 Earnings from continuing operations before income taxes Add (Deduct): Equity in net earnings of less than 50% owned affiliates Dividends from... -

Page 114

... audited the consolidated financial statements included in the Company's Annual Report on Form 10-K for the year ended December 31, 2007 and issued our report thereon dated February 22, 2008. Note 1 to the financial statements describes a change in accounting principle related to changing the timing... -

Page 115

... 000 Kraft Foods Rus 000 Kraft Foods Sales & Marketing 152999 Canada Inc. 20th Century Denmark Limited 3072440 Nova Scotia Company AB Kraft Foods Lietuva Abades B.V. Aberdare Developments Limited Aberdare Two Developments Limited AGF Kanto, Inc. AGF SP, Inc. AGF Suzuka, Inc. Ajinomoto General Foods... -

Page 116

...SA Danone Biscuits Manufacturing (M) Sdn Bhd Danone Foods (Suzhou) Co., Ltd. Danone Foods Trading (China) Co., Ltd. Danone Malaysia Sdn Bhd Danone Mashreq Danone Singapore Pte Ltd Danone Snacks Malaysia Sdn Bhd Dong Suh Foods Corporation Dreadstar Limited El Gallito Industrial, S.A. Family Nutrition... -

Page 117

... China Canada United States of America United States of America Australia Bahrain China China Malaysia New Zealand Philippines United States of America Singapore Thailand Trinidad and Tobago Argentina Source: KRAFT FOODS INC, 10-K, February 25, 2008 Powered by Morningstar® Document Research... -

Page 118

... Foods AS Kraft Foods Asia Pacific Services Pte Ltd Kraft Foods Ausser-Haus Service GmbH Kraft Foods Aviation, LLC Kraft Foods Bakery Companies, Inc. Kraft Foods Belgium N.V. Kraft Foods Biscuit B.V. Kraft Foods Bolivia S.A. Kraft Foods Brasil S.A. Kraft Foods Bulgaria AD Kraft Foods Caribbean Sales... -

Page 119

...Kraft Foods LA VA Holding B.V. Kraft Foods Latin America Holding LLC Kraft Foods Laverune Kraft Foods Limited Kraft Foods Limited (Asia) Kraft Foods Luxembourg S.a. r.l. Kraft Foods Manufacturing Midwest, Inc. Kraft Foods Manufacturing West, Inc. Kraft Foods Maroc SA Kraft Foods Middle East & Africa... -

Page 120

... South Africa France Sweden Sweden United States of America Taiwan Singapore United Kingdom Unknown Country Uruguay Venezuela Croatia United States of America Turkey China Mexico Ireland Australia France Hong Kong United States of America Source: KRAFT FOODS INC, 10-K, February 25, 2008 Powered by... -

Page 121

.... Ltd. Nabisco Brands Holdings Denmark Limited Nabisco Caribbean Export, Inc. Nabisco Chongqing Food Company Ltd. Nabisco Euro Holdings Ltd. Nabisco Europe, Middle East and Africa Trading, S.A. Nabisco Food (Suzhou) Co. Ltd. Nabisco Group Pensions Limited Nabisco Holdings I B.V. Nabisco Holdings II... -

Page 122

... Corporation Phenix Management Corporation Pollio Italian Cheese Company Productos Kraft, S. de R.L. de C.V. Produtos Alimenticios Pilar Ltda. PT Danone Biscuits Indonesia PT Danone Sales and Marketing PT Kraft Foods Indonesia PT Kraft Indonesia Regentrealm Limited Riespri, S.L. Ritz Biscuit Company... -

Page 123

.... Uni-Foods Corporation United Biscuits (Holdings) Plc United Biscuits Asia Pacific Limited United Biscuits Iberia, Lda. United Biscuits Snacks (Shenzhen) Ltd. United Biscuits Tunisia S.A. Veryfine Products, Inc. Vict. Th. Engwall & Co., Inc. Votesor BV West Indies Yeast Company Limited Yili-Nabisco... -

Page 124

...333-133559 and 333-137021) of Kraft Foods Inc. of our report dated February 22, 2008 relating to the financial statements, financial statement schedule and the effectiveness of internal control over financial reporting, which appears in this Annual Report on Form 10-K. /s/ PricewaterhouseCoopers LLP... -

Page 125

... may lawfully do or cause to be done by virtue hereof. This Power of Attorney may be executed in multiple counterparts, each of which shall be deemed an original with respect to the person executing it. Source: KRAFT FOODS INC, 10-K, February 25, 2008 Powered by Morningstar® Document Research℠-

Page 126

... L. Schapiro /S/ DEBORAH C. WRIGHT Deborah C. Wright /S/ FRANK G. ZARB Director February 25, 2008 Director February 25, 2008 Director February 25, 2008 Frank G. Zarb Director February 25, 2008 Source: KRAFT FOODS INC, 10-K, February 25, 2008 Powered by Morningstar® Document Research℠-

Page 127

...involves management or other employees who have a significant role in the registrant's internal control over financial reporting. (b) Date: February 25, 2007 /s/ IRENE B. ROSENFELD Irene B. Rosenfeld Chairman and Chief Executive Officer Source: KRAFT FOODS INC, 10-K, February 25, 2008 Powered by... -

Page 128

... or other employees who have a significant role in the registrant's internal control over financial reporting. (b) Date: February 25, 2007 /s/ TIMOTHY R. MCLEVISH Timothy R. McLevish Executive Vice President and Chief Financial Officer Source: KRAFT FOODS INC, 10-K, February 25, 2008 Powered by... -

Page 129

... to Kraft Foods Inc. and will be retained by Kraft Foods Inc. and furnished to the Securities and Exchange Commission or its staff upon request. _____ Created by Morningstar® Document Research℠http://documentresearch.morningstar.com Source: KRAFT FOODS INC, 10-K, February 25, 2008 Powered by...