JetBlue Airlines 2005 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2005 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

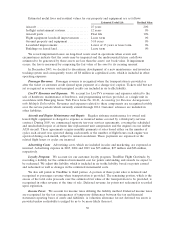

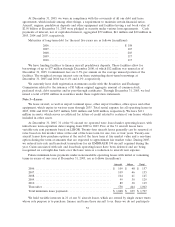

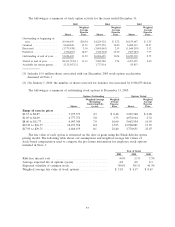

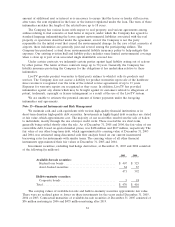

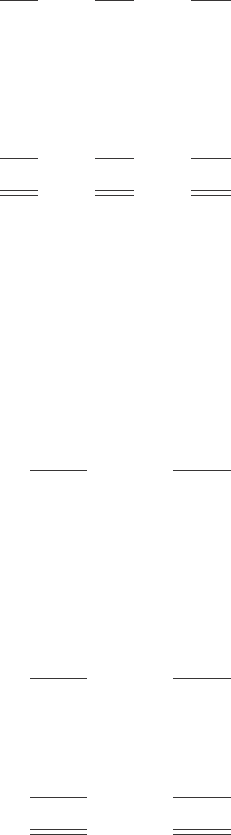

The effective tax rate on income (loss) before income taxes differed from the federal income tax

statutory rate for the years ended December 31 for the following reasons (in millions):

2005 2004 2003

Income tax expense (benefit) at statutory rate...................... $ (8) $ 26 $ 61

Increase (decrease) resulting from:

State income tax, net of federal benefit .......................... (2) 1 9

Non-deductible meals and entertainment ........................ 1 1 1

Stock-based compensation ..................................... 3 1 —

Valuation allowance........................................... 2 — —

Total income tax expense (benefit)................................ $ (4) $ 29 $ 71

Cash payments for income taxes were $1 million, $1 million and $2 million in 2005, 2004 and

2003, respectively.

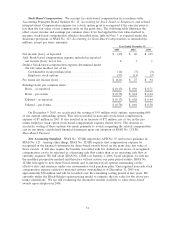

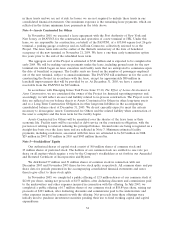

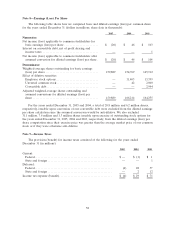

The net deferred taxes below include a current net deferred tax asset of $11 million and a

long-term net deferred tax liability of $117 million at December 31, 2005, and a current net deferred

tax liability of $2 million and a long-term net deferred tax liability of $121 million at

December 31, 2004.

The components of our deferred tax assets and liabilities as of December 31 are as follows (in

millions):

2005 2004

Deferred tax assets:

Net operating loss carryforwards................................ $ 272 $ 144

Employee benefits ............................................ 9 5

Gains from sale and leaseback of aircraft ........................ 5 2

Tax credits carryforwards...................................... 4 2

Rent expense ................................................ 2 2

Other ....................................................... 3 1

Valuation allowance........................................... (2) —

Deferred tax assets ......................................... 293 156

Deferred tax liabilities:

Accelerated depreciation ...................................... (399) (271)

Derivative gains .............................................. — (8)

Net deferred tax liability......................................... $ (106) $ (123)

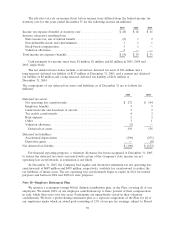

For financial reporting purposes, a valuation allowance has been recognized at December 31, 2005

to reduce the deferred tax assets associated with certain of the Company’s state income tax net

operating loss carryforwards, as realization is not likely.

At December 31, 2005, the Company had regular and alternative minimum tax net operating loss

carryforwards of $687 million and $493 million, respectively, available for carryforward to reduce the

tax liabilities of future years. The net operating loss carryforwards begin to expire in 2021 for federal

purposes and between 2010 and 2026 for state purposes.

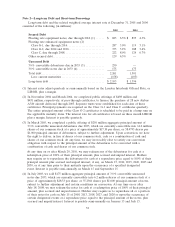

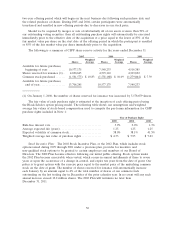

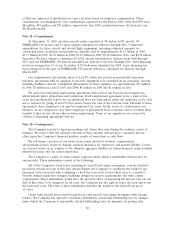

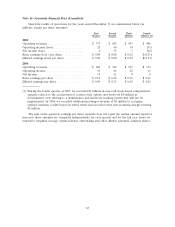

Note 10—Employee Retirement Plan

We sponsor a retirement savings 401(k) defined contribution plan, or the Plan, covering all of our

employees. We match 100%of our employee contributions up to three percent of their compensation

in cash, which then vests over five years. Participants are immediately vested in their voluntary

contributions. We have a profit sharing retirement plan as a separate component of the Plan for all of

our employees under which an award pool consisting of 15%of our pre-tax earnings, subject to Board

59