JetBlue Airlines 2005 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2005 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

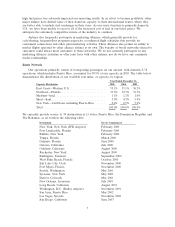

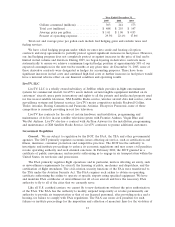

Year Ended December 31,

2005 2004 2003

Gallons consumed (millions) ............... 303 241 173

Total cost (millions) ....................... $ 488 $ 255 $ 147

Average price per gallon ................... $ 1.61 $ 1.06 $ 0.85

Percent of operating expenses .............. 29.5%22.1%17.8%

Total cost and average price per gallon each include fuel hedging gains and exclude taxes and

fueling services.

We have a fuel hedging program under which we enter into crude and heating oil option

contracts and swap agreements to partially protect against significant increases in fuel prices. However,

our fuel hedging program does not completely protect us against increases in the price of fuel and is

limited in fuel volume and duration. During 2005, we began layering in derivative contracts more

systematically to ensure we achieve a minimum targeted hedge position of approximately 30%of our

expected consumption for the next twelve months at any given time. At December 31, 2005, none of

these derivative contracts were designated as hedges for accounting purposes. There have been

significant increases in fuel costs and continued high fuel costs or further increases in fuel prices would

have a material adverse effect on our financial condition and operating results.

LiveTV, LLC

LiveTV, LLC is a wholly owned subsidiary of JetBlue which provides in-flight entertainment

systems for commercial aircraft. LiveTV’s assets include certain tangible equipment installed on its

customers’ aircraft, spare parts in inventory and rights to all the patents and intellectual property used

for live in-seat satellite television, XM Satellite Radio service, wireless aircraft data link service, cabin

surveillance systems and Internet services. LiveTV’s major competitors include Rockwell Collins,

Thales Avionics, Boeing Connexion and Panasonic Avionics. Except for Panasonic, none of these

competitors is currently providing in-seat live television.

LiveTV has contracts for the sale of certain hardware and installation, programming and

maintenance of its live in-seat satellite television system with Frontier Airlines, Virgin Blue and

WestJet Airlines. LiveTV also has a contract with AirTran Airways for the installation, programming

and maintenance of XM Satellite Radio Service. LiveTV continues to pursue additional customers.

Government Regulation

General. We are subject to regulation by the DOT, the FAA, the TSA and other governmental

agencies. The DOT primarily regulates economic issues affecting air service, such as certification and

fitness, insurance, consumer protection and competitive practices. The DOT has the authority to

investigate and institute proceedings to enforce its economic regulations and may assess civil penalties,

revoke operating authority and seek criminal sanctions. In February 2000, the DOT granted us a

certificate of public convenience and necessity authorizing us to engage in air transportation within the

United States, its territories and possessions.

The FAA primarily regulates flight operations and in particular, matters affecting air safety, such

as airworthiness requirements for aircraft, the licensing of pilots, mechanics and dispatchers, and the

certification of flight attendants. The civil aviation security functions of the FAA were transferred to

the TSA under the Aviation Security Act. The FAA requires each airline to obtain an operating

certificate authorizing the airline to operate at specific airports using specified equipment. We have

and maintain FAA certificates of airworthiness for all of our aircraft and have the necessary FAA

authority to fly to all of the cities that we currently serve.

Like all U.S. certified carriers, we cannot fly to new destinations without the prior authorization

of the FAA. The FAA has the authority to modify, suspend temporarily or revoke permanently our

authority to provide air transportation or that of our licensed personnel, after providing notice and a

hearing, for failure to comply with FAA regulations. The FAA can assess civil penalties for such

failures or institute proceedings for the imposition and collection of monetary fines for the violation of

13