JetBlue Airlines 2005 Annual Report Download - page 61

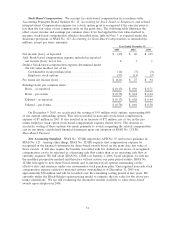

Download and view the complete annual report

Please find page 61 of the 2005 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

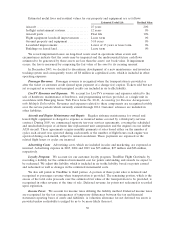

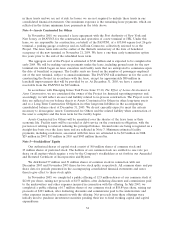

At December 31, 2005, we were in compliance with the covenants of all our debt and lease

agreements, which include among other things, a requirement to maintain certain financial ratios.

Aircraft, engines, predelivery deposits and other equipment and facilities having a net book value of

$2.50 billion at December 31, 2005 were pledged as security under various loan agreements. Cash

payments of interest, net of capitalized interest, aggregated $79 million, $41 million and $20 million in

2005, 2004 and 2003, respectively.

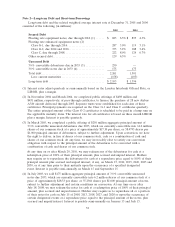

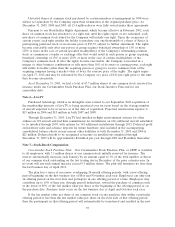

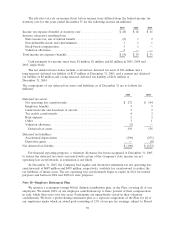

Maturities of long-term debt for the next five years are as follows (in millions):

2006 ................................................. $ 158

2007 ................................................. 167

2008 ................................................. 203

2009 ................................................. 117

2010 ................................................. 117

We have funding facilities to finance aircraft predelivery deposits. These facilities allow for

borrowings of up to $77 million through December 2008, of which $12 million was unused as of

December 31, 2005. Commitment fees are 0.5%per annum on the average unused portion of the

facilities. The weighted average interest rate on these outstanding short-term borrowings at

December 31, 2005 and 2004 was 6.1%and 4.1%, respectively.

We currently have shelf registration statements on file with the Securities and Exchange

Commission related to the issuance of $1 billion original aggregate amount of common stock,

preferred stock, debt securities and/or pass-through certificates. Through December 31, 2005, we had

issued a total of $903 million in securities under these registration statements.

Note 3—Leases

We lease aircraft, as well as airport terminal space, other airport facilities, office space and other

equipment, which expire in various years through 2035. Total rental expense for all operating leases in

2005, 2004 and 2003 was $137 million, $120 million and $100 million, respectively. We have $111

million in assets, which serves as collateral for letters of credit related to certain of our leases, which is

included in other assets.

At December 31, 2005, 31 of the 92 aircraft we operated were leased under operating leases, with

initial lease term expiration dates ranging from 2009 to 2023. Five of the 31 aircraft leases have

variable-rate rent payments based on LIBOR. Twenty-four aircraft leases generally can be renewed at

rates based on fair market value at the end of the lease term for one, two or four years. Twenty-one

aircraft leases have purchase options at the end of the lease term at fair market value and a one-time

option during the term at amounts that are expected to approximate fair market value. During 2005,

we entered into sale and leaseback transactions for six EMBRAER 190 aircraft acquired during the

year. Gains associated with sale and leaseback operating leases have been deferred and are being

recognized on a straight-line basis over the lease term as a reduction to aircraft rent expense.

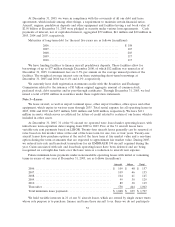

Future minimum lease payments under noncancelable operating leases with initial or remaining

terms in excess of one year at December 31, 2005, are as follows (in millions):

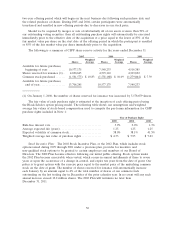

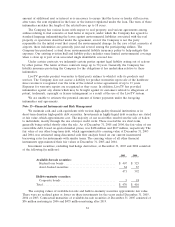

Aircraft Other Total

2006...................................................... $ 109 $ 48 $ 157

2007...................................................... 109 46 155

2008...................................................... 104 41 145

2009...................................................... 99 30 129

2010...................................................... 89 30 119

Thereafter ................................................ 558 444 1,002

Total minimum lease payments .............................. $ 1,068 $ 639 $ 1,707

We hold variable interests in 21 of our 31 aircraft leases, which are owned by single owner trusts

whose sole purpose is to purchase, finance and lease these aircraft to us. Since we do not participate

53