JetBlue Airlines 2005 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2005 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

high fuel prices, has adversely impacted our operating results. In an effort to become profitable, other

major airlines have shifted some of their domestic capacity to their international routes, where they

are better able to include fuel surcharges in their fares. As our route structure is primarily domestic

U.S., we have been unable to recover all of the increased cost of fuel in our ticket prices. We

anticipate the extremely competitive nature of the industry to continue.

Airlines also frequently participate in marketing alliances, which generally provide for

code-sharing, frequent flyer program reciprocity, coordinated flight schedules that provide for

convenient connections and other joint marketing activities. These alliances also permit an airline to

market flights operated by other alliance airlines as its own. The benefits of broad networks offered to

customers could attract more customers to these networks. We do not currently participate in any

marketing alliances, interline or offer joint fares with other airlines, nor do we have any commuter

feeder relationships.

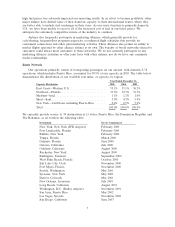

Route Network

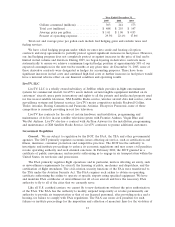

Our operations primarily consist of transporting passengers on our aircraft, with domestic U.S.

operations, which includes Puerto Rico, accounted for 98.5%of our capacity in 2005. The table below

demonstrates the distribution of our available seat miles, or capacity, by region:

Year Ended December 31,

Capacity Distribution 2005 2004 2003

East Coast—Western U.S. ......................... 55.1%55.1%56.2%

Northeast—Florida ............................... 33.5%32.7%31.7%

Medium—haul ................................... 1.1%1.2%1.0%

Short—haul ..................................... 3.9%4.5%5.9%

New York—Caribbean, including Puerto Rico ....... 6.4%6.5%5.2%

Total ........................................... 100.0%100.0%100.0%

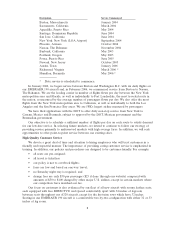

We currently provide service to 34 destinations in 15 states, Puerto Rico, the Dominican Republic and

The Bahamas, as set forth in the following table:

Destination Service Commenced

New York, New York (JFK Airport) February 2000

Fort Lauderdale, Florida February 2000

Buffalo, New York February 2000

Tampa, Florida March 2000

Orlando, Florida June 2000

Ontario, California July 2000

Oakland, California August 2000

Rochester, New York August 2000

Burlington, Vermont September 2000

West Palm Beach, Florida October 2000

Salt Lake City, Utah November 2000

Fort Myers, Florida November 2000

Seattle, Washington May 2001

Syracuse, New York May 2001

Denver, Colorado May 2001

New Orleans, Louisiana July 2001

Long Beach, California August 2001

Washington, D.C. (Dulles Airport) November 2001

San Juan, Puerto Rico May 2002

Las Vegas, Nevada November 2002

San Diego, California June 2003

7