JetBlue Airlines 2005 Annual Report Download - page 51

Download and view the complete annual report

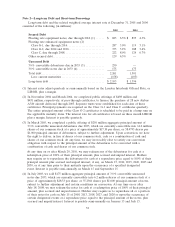

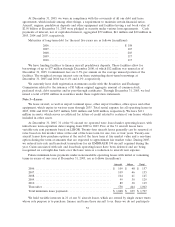

Please find page 51 of the 2005 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.million for 2005 measured as of December 31, 2004. As of December 31, 2005, we had hedged

approximately 30%of our projected 2006 fuel requirements. All existing hedge contracts settle by the

end of 2006.

Interest. Our earnings are affected by changes in interest rates due to the impact those changes

have on interest expense from variable-rate debt instruments and on interest income generated from

our cash and investment balances. At December 31, 2005, all of our debt, other than our convertible

debt and equipment notes for one A320 aircraft, had floating interest rates. If interest rates average

10%higher in 2006 than they did during 2005, our interest expense would increase by approximately

$7 million, compared to an estimated $2 million for 2005 measured as of December 31, 2004. If

interest rates average 10%lower in 2006 than they did during 2005, our interest income from cash and

investment balances would decrease by approximately $2 million, compared to $1 million for 2005

measured as of December 31, 2004. These amounts are determined by considering the impact of the

hypothetical interest rates on our variable-rate debt, cash equivalents and investment securities

balances at December 31, 2005 and 2004.

Fixed Rate Debt. On December 31, 2005, our convertible debt had an aggregate estimated fair

value of $438 million, based on quoted market prices. If interest rates were 10%higher than the stated

rate, the fair value of this debt would have been $432 million as of December 31, 2005.

43