JetBlue Airlines 2005 Annual Report Download - page 62

Download and view the complete annual report

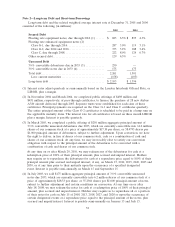

Please find page 62 of the 2005 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.in these trusts and we are not at risk for losses, we are not required to include these trusts in our

consolidated financial statements. Our maximum exposure is the remaining lease payments, which are

reflected in the future minimum lease payments in the table above.

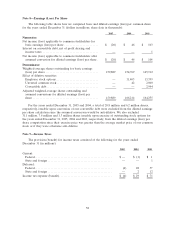

Note 4—Assets Constructed for Others

In November 2005, we executed a lease agreement with the Port Authority of New York and

New Jersey, or PANYNJ, for the construction and operation of a new terminal at JFK. Under this

lease, we are responsible for construction, on behalf of the PANYNJ, of a 635,000 square foot 26-gate

terminal, a parking garage, roadways and an AirTrain Connector, collectively referred to as the

Project. The lease term ends on the earlier of the thirtieth anniversary of the date of beneficial

occupancy of the new terminal or November 21, 2039. We have a one-time early termination option

five years prior to the end of the scheduled lease term.

The aggregate cost of the Project is estimated at $740 million and is expected to be completed in

early 2009. We will be making various payments under the lease, including ground rents for the new

terminal site which began on lease execution and facility rents that are anticipated to commence upon

the date of beneficial occupancy. The facility rents are based on the number of passengers enplaned

out of the new terminal, subject to annual minimums. The PANYNJ will reimburse us for the costs of

constructing the Project in accordance with the lease, except for approximately $80 million in

leasehold improvements that will be provided by us. At December 31, 2005, we have a current

receivable from the PANYNJ for $29 million.

In accordance with Emerging Issues Task Force Issue 97-10, The Effect of Lessee Involvement in

Asset Construction, we are considered the owner of the Project for financial reporting purposes and,

accordingly, we will reflect an asset and liability related to in-process construction. The Project costs to

date are reflected on our balance sheets as Assets Constructed for Others in other long-term assets

and as a Long-Term Construction Obligation in other long-term liabilities in the accompanying

consolidated balance sheet at December 31, 2005. We do not currently expect to meet the criteria

necessary to derecognize Assets Constructed for Others and the related liability when construction of

the asset is complete and the lease term for the facility begins.

Assets Constructed for Others will be amortized over the shorter of the lease term or their

economic life. Facility rents will be recorded as debt service on the construction obligation, with the

portion not relating to interest reducing the principal balance. Ground rents are being recognized on a

straight-line basis over the lease term and are reflected in Note 3. Minimum estimated facility

payments, including escalations, associated with this lease are estimated to be $19 million in 2008,

$29 million in 2009, $33 million in 2010 and $943 million thereafter.

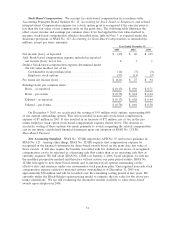

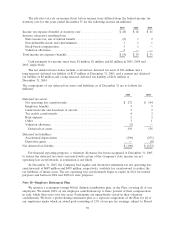

Note 5—Stockholders’ Equity

Our authorized shares of capital stock consist of 500 million shares of common stock and

25 million shares of preferred stock. The holders of our common stock are entitled to one vote per

share on all matters which require a vote by the Company’s stockholders as set forth in our Amended

and Restated Certificate of Incorporation and Bylaws.

We distributed 57 million and 51 million shares of common stock in connection with our

December 2005 and November 2003 three-for-two stock splits, respectively. All common share and per

share data for periods presented in the accompanying consolidated financial statements and notes

thereto give effect to these stock splits.

In November 2005, we completed a public offering of 12.9 million shares of our common stock at

$12.00 per share, raising net proceeds of $153 million, after deducting discounts and commissions paid

to the underwriters and other expenses incurred in connection with the offering. In July 2003, we

completed a public offering of 6.7 million shares of our common stock at $18.89 per share, raising net

proceeds of $123 million, after deducting discounts and commissions paid to the underwriters and

other expenses incurred in connection with the offering. Net proceeds from these offerings were

initially used to purchase investment securities pending their use to fund working capital and capital

expenditures.

54