JetBlue Airlines 2005 Annual Report Download - page 14

Download and view the complete annual report

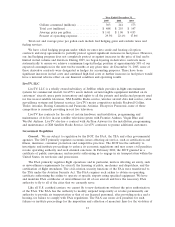

Please find page 14 of the 2005 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.productive in the use of its people and assets, providing a simplified fare structure and offering only a

single class of seating. This enabled Southwest to offer fares that were significantly lower than those

charged by other major U.S. airlines.

While Southwest remains the largest low-fare airline today, other low-fare airlines have also been

able to offer substantially lower fares than the major U.S. airlines, especially following the economic

downturn which started in early 2001 and was magnified by the September 11, 2001 terrorist attacks.

Low-fare airlines have been able to compete because of their low-cost structures and have been able

to stimulate demand by attracting fare-conscious leisure and business passengers who might have

otherwise used alternative forms of transportation or not traveled at all. As a result, low-fare airlines

with an acceptable level of service and frequency have seen a migration of travelers away from the

major U.S. airlines. These trends have contributed to significant growth in the low-fare airline sector,

which accounted for 24%of domestic capacity in 2005.

Competition

The airline industry is highly competitive. Airline profits are sensitive to even slight changes in

fuel costs, average fare levels and passenger demand. Passenger demand and fare levels have

historically been influenced by, among other things, the general state of the economy, international

events, industry capacity and pricing actions taken by other airlines. The principal competitive factors

in the airline industry are fare pricing, customer service, routes served, flight schedules, types of

aircraft, safety record and reputation, code-sharing relationships, in-flight entertainment systems and

frequent flyer programs. In addition, the migration of fare-conscious travelers away from traditional

major U.S. airlines and their deteriorating market share has forced some of these airlines to undertake

broad cost-cutting measures and to reevaluate their basic business models as they try to remain viable.

Our competitors and potential competitors include major U.S. airlines, low-fare airlines, regional

airlines and new entrant airlines. The other major airlines are larger, generally have greater financial

resources and serve more routes than we do. They also use some of the same advanced technologies

that we do, such as ticketless travel, laptop computers and website bookings. Since deregulation of the

airline industry in 1978, there has been continuing consolidation in the domestic airline industry. More

recently, there have been numerous bankruptcies or threatened bankruptcies by major airlines,

permitting them to reduce labor rates, restructure debt, terminate pension plans and generally reduce

their cost structure, which could enable them to compete more aggressively. In September 2005,

Northwest Airlines and Delta Air Lines each filed for bankruptcy. In the fall of 2005, US Airways,

which had been in bankruptcy, and America West completed a merger, which could enable the

combined entity to have lower costs and a more rationalized route structure and therefore be better

able to compete. Prior to this merger, airlines in bankruptcy accounted for approximately 45%of the

total available seat miles generated by all U.S. airlines in 2005. Delta Air Lines announced that in

2006 it would cease operating Song, the low-fare operation it started in 2003; however, the experience

it gained from operating Song may allow it to compete more effectively. In January 2006,

Independence Air ceased operations after having filed for bankruptcy in November 2005. Further

consolidation, restructuring or bankruptcies within the industry could result in a greater concentration

of assets and resources among the largest major U.S. airlines, the impact of which we cannot predict.

Price competition occurs through price discounting, fare matching, targeted sale promotions or

frequent flyer travel initiatives, all of which are usually matched by other airlines in order to maintain

their level of passenger traffic. A relatively small change in pricing or in passenger traffic could have a

disproportionate effect on an airline’s operating and financial results. These factors may have a greater

impact during time periods when the industry encounters continued financial losses, as airlines under

financial pressures may institute pricing structures to achieve near-term survival rather than long-term

viability. Our ability to meet this price competition depends on, among other things, our ability to

operate at costs equal to or lower than our competitors.

Competition within the domestic airline industry during 2005 resulted in sustained price

competition and increased capacity on the routes we fly, including capacity that was added by us. The

competitive industry environment has affected our ability to increase fares and, together with record

6