JetBlue Airlines 2005 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2005 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

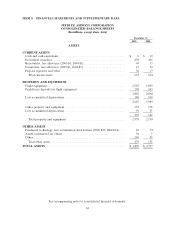

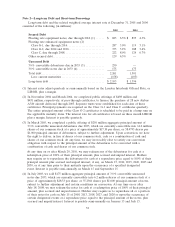

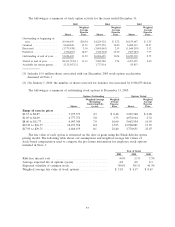

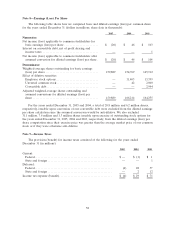

Note 2—Long-term Debt and Short-term Borrowings

Long-term debt and the related weighted average interest rate at December 31, 2005 and 2004

consisted of the following (in millions):

2005 2004

Secured Debt

Floating rate equipment notes, due through 2016 (1) ...... $ 825 6.3%$ 895 4.3%

Floating rate enhanced equipment notes (2)

Class G-1, due through 2016.......................... 287 5.0%119 3.1%

Class G-2, due 2014 and 2016......................... 373 5.2%188 3.4%

Class C, due through 2008............................ 222 8.0%124 6.7%

Other secured debt.................................... 129 6.3%—

Unsecured Debt

3

3

⁄

4

%convertible debentures due in 2035 (3).............. 250 —

3

1

⁄

2

%convertible notes due in 2033 (4)................... 175 175

Total debt ............................................ 2,261 1,501

Less: current maturities .............................. (158) (105)

Long-term debt ....................................... $ 2,103 $ 1,396

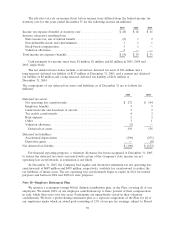

(1) Interest rates adjust quarterly or semi-annually based on the London Interbank Offered Rate, or

LIBOR, plus a margin.

(2) In November 2004 and March 2004, we completed public offerings of $498 million and

$431 million, respectively, of pass-through certificates, to finance the purchase of 28 new Airbus

A320 aircraft delivered through 2005. Separate trusts were established for each class of these

certificates. Principal payments are required on the Class G-1 and Class C certificates quarterly.

The entire principal amount of the Class G-2 certificates is scheduled to be paid in a lump sum on

the applicable maturity dates. The interest rate for all certificates is based on three month LIBOR

plus a margin. Interest is payable quarterly.

(3) In March 2005, we completed a public offering of $250 million aggregate principal amount of

3

3

⁄

4

%convertible unsecured debentures due 2035, which are currently convertible into 14.6 million

shares of our common stock at a price of approximately $17.10 per share, or 58.4795 shares per

$1,000 principal amount of debentures, subject to further adjustment. Upon conversion, we have

the right to deliver, in lieu of shares of our common stock, cash or a combination of cash and

shares of our common stock. At any time, we may irrevocably elect to satisfy our conversion

obligation with respect to the principal amount of the debentures to be converted with a

combination of cash and shares of our common stock.

At any time on or after March 20, 2010, we may redeem any of the debentures for cash at a

redemption price of 100%of their principal amount, plus accrued and unpaid interest. Holders

may require us to repurchase the debentures for cash at a repurchase price equal to 100%of their

principal amount plus accrued and unpaid interest, if any, on March 15, 2010, 2015, 2020, 2025 and

2030, or at any time prior to their maturity upon the occurrence of a specified designated

event. Interest is payable semi-annually on March 15 and September 15.

(4) In July 2003, we sold $175 million aggregate principal amount of 3

1

⁄

2

%convertible unsecured

notes due 2033, which are currently convertible into 6.2 million shares of our common stock at a

price of approximately $28.33 per share, or 35.2941 shares per $1,000 principal amount of notes,

subject to further adjustment and certain conditions on conversion. At any time on or after

July 18, 2008, we may redeem the notes for cash at a redemption price of 100%of their principal

amount, plus accrued and unpaid interest. Holders may require us to repurchase all or a portion

of their notes for cash on July 15 of 2008, 2013, 2018, 2023, and 2028 or upon the occurrence of

certain designated events at a repurchase price equal to the principal amount of the notes, plus

accrued and unpaid interest. Interest is payable semi-annually on January 15 and July 15.

52