JetBlue Airlines 2005 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2005 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

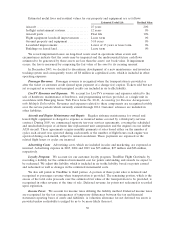

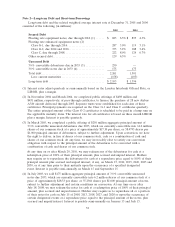

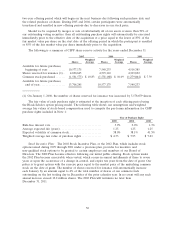

Estimated useful lives and residual values for our property and equipment are as follows:

Estimated Useful Life Residual Value

Aircraft .................................... 25years 20%

In-flight entertainment systems ................ 12years 0%

Aircraft parts ............................... Fleet life 10%

Flight equipment leasehold improvements ...... Lease term 0%

Ground property and equipment .............. 3-10 years 0%

Leasehold improvements ..................... Lower of 15 years or lease term 0%

Buildings on leased land...................... Lease term 0%

We record impairment losses on long-lived assets used in operations when events and

circumstances indicate that the assets may be impaired and the undiscounted future cash flows

estimated to be generated by these assets are less than the assets’ net book value. If impairment

occurs, the loss is measured by comparing the fair value of the asset to its carrying amount

In December 2005, we decided to discontinue development of a new maintenance and inventory

tracking system and consequently wrote off $6 million in capitalized costs, which is included in other

operating expenses.

Passenger Revenues: Passenger revenue is recognized when the transportation is provided or

after the ticket or customer credit (issued upon payment of a change fee) expires. Tickets sold but not

yet recognized as revenue and unexpired credits are included in air traffic liability.

LiveTV Revenues and Expenses: We account for LiveTV’s revenues and expenses related to the

sale of hardware, maintenance of hardware, and programming services provided, as a single unit in

accordance with Emerging Issues Task Force Issue No. 00-21, Accounting for Revenue Arrangements

with Multiple Deliverables. Revenues and expenses related to these components are recognized ratably

over the service periods which currently extend through 2014. Customer advances are included in

other liabilities.

Aircraft and Engine Maintenance and Repair: Regular airframe maintenance for owned and

leased flight equipment is charged to expense as incurred unless covered by a third-party services

contract. During 2005, we commenced separate ten-year services agreements, covering the scheduled

and unscheduled repair of airframe line replacement unit components and the engines on our Airbus

A320 aircraft. These agreements require monthly payments at rates based either on the number of

cycles each aircraft was operated during each month or the number of flight hours each engine was

operated during each month, subject to annual escalations. These payments are expensed as the

related flight hours or cycles are incurred.

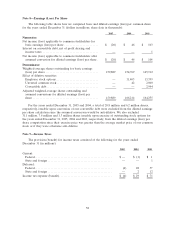

Advertising Costs: Advertising costs, which are included in sales and marketing, are expensed as

incurred. Advertising expense in 2005, 2004 and 2003 was $35 million, $27 million and $26 million,

respectively.

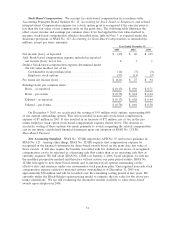

Loyalty Program: We account for our customer loyalty program, TrueBlue Flight Gratitude, by

recording a liability for the estimated incremental cost for points outstanding and awards we expect to

be redeemed. We adjust this liability, which is included in air traffic liability, based on points earned

and redeemed as well as changes in the estimated incremental costs.

We also sell points in TrueBlue to third parties. A portion of these point sales is deferred and

recognized as passenger revenue when transportation is provided. The remaining portion, which is the

excess of the total sales proceeds over the estimated fair value of the transportation to be provided, is

recognized in other revenue at the time of sale. Deferred revenue for points not redeemed is recorded

upon expiration.

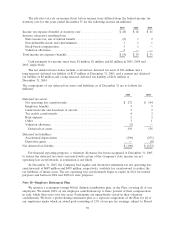

Income Taxes: We account for income taxes utilizing the liability method. Deferred income taxes

are recognized for the tax consequences of temporary differences between the tax and financial

statement reporting bases of assets and liabilities. A valuation allowance for net deferred tax assets is

provided unless realizability is judged by us to be more likely than not.

50