JetBlue Airlines 2005 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2005 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.January 2006. The airlines currently operating in bankruptcy may emerge with substantially lower

costs and be able to compete more vigorously. Also in the fall of 2005, two major domestic airlines,

US Airways and America West, merged, which could enable the combined entity to better compete.

In an effort to become more profitable, in 2005 other major airlines shifted some of their

domestic capacity to their international routes, where they are better able to include fuel surcharges in

their fares. As our route structure is primarily domestic U.S., we have been unable to completely

recover the increased cost of fuel through fare increases due to the more competitive nature of the

domestic airline industry. We expect the airline industry to remain intensely competitive, especially if

adverse economic conditions and high fuel prices persist. Our ability to meet these competitive

pressures depends on, among other things, operating at costs equal to or lower than our competitors

and providing high quality customer service. Although we have been able to raise capital and continue

to grow, the highly competitive nature of the airline industry could prevent us from attaining the

passenger traffic or yields required to maintain profitable operations in new and existing markets.

Outlook for 2006

We expect our operating capacity to increase approximately 28%to 30%over 2005 with the

addition of 16 new Airbus A320 and 19 EMBRAER 190 aircraft in 2006. The EMBRAER 190 is

expected to represent 6%of our total estimated 2006 available seat miles. Average stage length is

expected to decrease 8%in 2006 due to the shorter average stage length of the EMBRAER 190. We

will incur higher maintenance costs; however, the unit cost increase is expected to be partially offset

by our fixed costs being spread over higher projected available seat miles. Fuel costs have risen

sharply in 2005 and may increase further. Although we have hedged 30%of our anticipated fuel

requirements for 2006, we expect to incur higher fuel costs. Assuming fuel prices of $1.98 per gallon,

net of effective hedges, our cost per available seat mile is expected to increase by 10%to 12%over

2005 and our operating margin is expected to be between 2%and 4%with an anticipated net loss for

the full year.

We took delivery of and placed into revenue service seven EMBRAER 190 aircraft beginning in

November 2005. The addition of the EMBRAER 190 to our fleet will increase our flexibility and

better position us to take advantage of market opportunities. We intend to capitalize on revenue

opportunities that would not have been available to us with only one aircraft type in our fleet, such as

establishing non-stop service in markets where carriers currently do not provide non-stop service. Our

completion factor and utilization on this aircraft has been lower than we planned, which was not

unexpected for the launch of a new aircraft type. The operating performance and reliability of these

aircraft are expected to improve as we gain additional experience and fully integrate it into our

operations.

In December 2004, the Financial Accounting Standards Board, or FASB, issued SFAS

No. 123(R), Share-Based Payment, which will require us to record stock-based compensation expense

for all employee stock options and our stock purchase plan using the fair value method beginning in

2006. This change will have a significant impact on our results of operations, although it will have no

impact on our overall cash flow or financial position. It will also affect our ability to provide accurate

guidance on our future reported financial results due to the difficulty in projecting the stock price used

to establish the value of stock options. We estimate that we will record approximately $20 million in

non-cash stock-based compensation expense in 2006. See Note 1 to our consolidated financial

statements for the pro forma impact this standard would have had on our reported financial results.

We have made changes to our compensation strategies to reduce the future impact of this accounting

change by shortening vesting periods and eliminating large one-time grants. In addition, SFAS

No. 123(R) will impact how income taxes are recorded in our financial statements as the tax deduction

for certain option grants is only allowed at the time the taxable event takes place, which could cause

variability in our effective tax rate through the year as these events occur. SFAS 123(R) does not

permit companies to predict whether these events will occur.

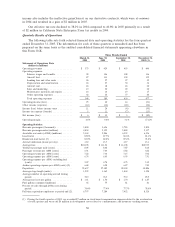

Results of Operations

The U.S. domestic airline environment continues to be extremely challenging as a result of two

predominant factors. First, is the extremely weak revenue environment caused by widespread price

31