JetBlue Airlines 2005 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2005 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

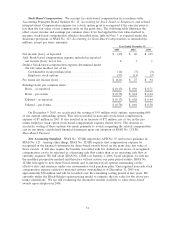

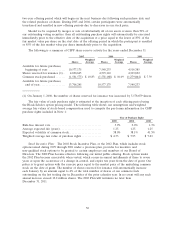

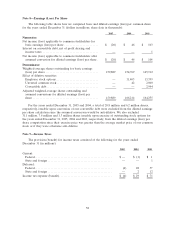

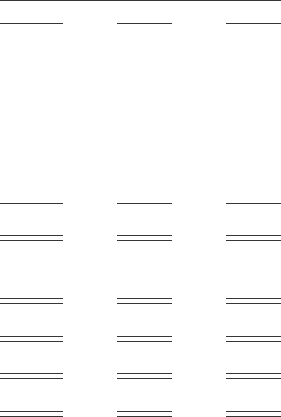

Stock-Based Compensation: We account for stock-based compensation in accordance with

Accounting Principles Board Opinion No. 25, Accounting for Stock Issued to Employees, and related

interpretations. Compensation expense for a stock option grant is recognized if the exercise price is

less than the fair value of our common stock on the grant date. The following table illustrates the

effect on net income and earnings per common share if we had applied the fair value method to

measure stock-based compensation, which is described more fully in Note 7, as required under the

disclosure provisions of SFAS No. 123, Accounting for Stock-Based Compensation, as amended (in

millions, except per share amounts):

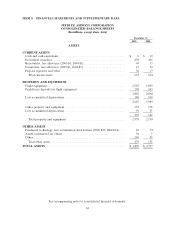

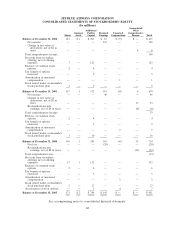

Year Ended December 31,

2005 2004 2003

Net income (loss), as reported ............................... $ (20) $ 46 $ 103

Add: Stock-based compensation expense included in reported

net income (loss), net of tax............................... 8 1 1

Deduct: Stock-based compensation expense determined under

the fair value method, net of tax

Crewmember stock purchase plan........................ (14) (7) (3)

Employee stock options ................................ (95) (13) (7)

Pro forma net income (loss)................................. $ (121) $ 27 $ 94

Earnings (loss) per common share:

Basic – as reported....................................... $ (0.13) $ 0.30 $ 0.71

Basic – pro forma........................................ $ (0.76) $ 0.18 $ 0.64

Diluted – as reported..................................... $ (0.13) $ 0.28 $ 0.64

Diluted – pro forma...................................... $ (0.76) $ 0.16 $ 0.58

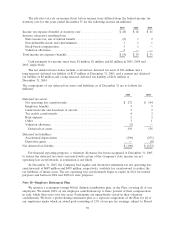

On December 9, 2005, we accelerated the vesting of 19.9 million stock options, representing 64%

of our current outstanding options. This action resulted in non-cash, stock-based compensation

expense of $7 million in 2005. It also resulted in an increase of $72 million, net of tax, in the pro

forma employee stock option stock-based compensation expense shown above. The decision to

accelerate vesting of these options was made primarily to avoid recognizing the related compensation

cost in our future consolidated financial statements upon our adoption of SFAS No. 123(R),

Share-Based Payment.

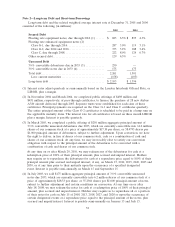

New Accounting Standard: SFAS No. 123(R) supersedes APB No. 25 and revises guidance in

SFAS No. 123. Among other things, SFAS No. 123(R) requires that compensation expense be

recognized in the financial statements for share-based awards based on the grant date fair value of

those awards. It will also require the benefits associated with tax deductions in excess of recognized

compensation cost to be reported as a financing cash flow rather than as an operating cash flow as

currently required. We will adopt SFAS No. 123(R) on January 1, 2006. Upon adoption, we will use

the modified prospective method and therefore will not restate our prior period results. SFAS No.

123(R) will apply to new share-based awards and to unvested stock options outstanding on the

effective date and issuances under our crewmember stock purchase plan. Unrecognized non-cash stock

compensation expense related to unvested options outstanding as of December 31, 2005 was

approximately $16 million and will be recorded over the remaining vesting period of five years. We

currently utilize the Black-Scholes option pricing model to estimate the fair value for the above pro

forma calculations. We are still evaluating the alternative models available to value share-based

awards upon adoption in 2006.

51