JetBlue Airlines 2005 Annual Report Download - page 45

Download and view the complete annual report

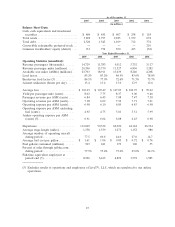

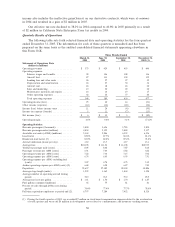

Please find page 45 of the 2005 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(2) Excludes results of operations and employees for LiveTV, LLC, which are unrelated to our airline operations.

Although we have continued to experience significant revenue growth, this trend may not

continue. We expect our expenses to continue to increase significantly as we acquire additional

aircraft, as our fleet ages and as we expand the frequency of flights in existing markets and enter into

new markets. Accordingly, the comparison of the financial data for the quarterly periods presented

may not be meaningful. In addition, we expect our operating results to fluctuate significantly from

quarter to quarter in the future as a result of various factors, many of which are outside our control.

Consequently, we believe that quarter-to-quarter comparisons of our operating results may not

necessarily be meaningful and you should not rely on our results for any one quarter as an indication

of our future performance.

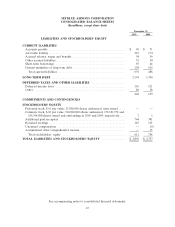

Liquidity and Capital Resources

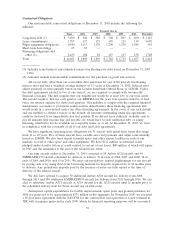

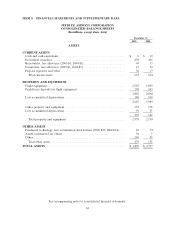

At December 31, 2005, we had cash and cash equivalents of $6 million and investment securities

of $478 million, compared to cash and cash equivalents of $19 million and investment securities of

$431 million at December 31, 2004. We presently have no lines of credit other than two short-term

borrowing facilities for certain aircraft predelivery deposits. In September 2005, we renewed and

increased the facility for our A320 deliveries to $58 million and, in December 2005, we entered into a

similar agreement for our EMBRAER 190 deliveries for up to $19 million. At December 31, 2005, we

had $65 million in borrowings outstanding under these facilities.

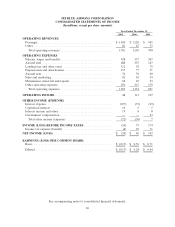

We rely primarily on cash flows from operations to provide working capital for current and future

operations. Cash flows from operating activities totaled $170 million in 2005, $199 million in 2004, and

$287 million in 2003. The $29 million decline in cash flows from operations in 2005 compared to 2004

was primarily a result of a 52.0%increase in fuel prices, partially offset by a 28.4%increase in revenue

passenger miles. Cash flows from operations in 2004 compared to 2003 declined due to 24.5%higher

fuel prices and 7.4%lower yields than in 2003 as well as the receipt of $23 million in government

compensation in 2003. Net cash used in investing and financing activities was $183 million in 2005,

$283 million in 2004 and $198 million in 2003.

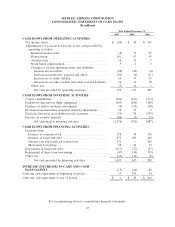

Investing Activities. During 2005, capital expenditures related to our purchase of flight

equipment included expenditures of $711 million for 16 Airbus A320, one EMBRAER 190 aircraft

and three spare engines, $183 million for flight equipment deposits and $81 million for spare part

purchases. Capital expenditures for other property and equipment, including ground equipment

purchases and facilities improvements, were $149 million. Net cash used in the sale and purchase of

available-for-sale securities was $79 million. Additional cash required for security deposits was

$86 million, of which $80 million related to our lease for a new terminal at JFK.

During 2004, capital expenditures related to our purchase of flight equipment included

expenditures of $511 million for 15 Airbus A320 aircraft and one spare engine, $180 million for flight

equipment deposits and $19 million for spare part purchases. Capital expenditures for other property

and equipment, including ground equipment purchases and facilities improvements, were $87 million.

Net cash provided from the sale and purchase of available-for-sale securities was $76 million.

Financing Activities. Financing activities during 2005 consisted primarily of (1) our

November 2005 public offering of 12.9 million shares of our common stock at $12.00 per share, as

adjusted for our December 2005 three-for-two stock split, raising net proceeds of $153 million, (2) the

sale and leaseback over 18 years of six EMBRAER 190 aircraft for $152 million by a U.S. leasing

institution, (3) the financing of 15 Airbus A320 aircraft with $498 in floating rate equipment notes

purchased with the proceeds from our November 2004 public offering of Series 2004-2 pass-through

certificates, (4) our issuance of a $33 million 12-year fixed rate equipment note issued to a European

bank secured by one Airbus A320 aircraft, (5) our March 2005 issuance of $250 million of 3

3

⁄

4

%

convertible debentures due 2035, raising net proceeds of approximately $243 million, (6) the financing

of flight training devices with $50 million in secured loan proceeds from Export Development Canada,

(7) the financing of a hangar and training center in Orlando, FL with $47 million in special facilities

bonds, of which $41 million was received by year end and (8) scheduled maturities of $117 million of

debt.

37