JetBlue Airlines 2005 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2005 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION

AND RESULTS OF OPERATIONS

Overview

We are a low-fare, low-cost passenger airline that provides high-quality customer service primarily

on point-to-point routes. We offer our customers a differentiated product, with new aircraft, low fares,

leather seats, up to 36 channels of free LiveTV and movie selections from FOX InFlight at every seat,

pre-assigned seating and reliable performance. We focus on serving markets that previously were

underserved and/or metropolitan areas that have had high average fares. We currently serve 34

destinations in 15 states, Puerto Rico, the Dominican Republic and The Bahamas, and intend to

maintain a disciplined growth strategy. As of December 31, 2005, we operated 395 flights a day with a

fleet of 85 Airbus A320 aircraft and seven EMBRAER 190 aircraft. We are committed to operating

our scheduled flights whenever possible, as we believe our customers highly value completion rate.

Although we delivered a 99.2%completion rate, this philosophy, along with operating at three of the

most congested and delay-prone domestic airports, contributed to a 71.4%on-time performance in

2005, a decrease of 10.2 points from 2004, which was lower than all but one major U.S. airline.

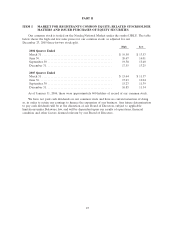

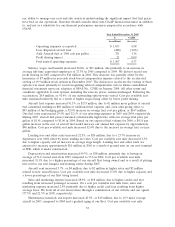

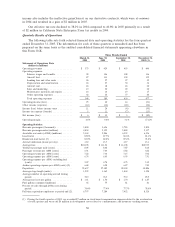

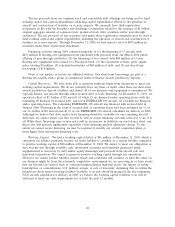

The following chart demonstrates our growth:

At Period Ended Destinations

Number of

Full and

Part-Time

Employees

Operating Aircraft

Owned Leased Total

December 31, 2000 ..................... 12 1,174 4 6 10

December 31, 2001 ..................... 18 2,361 9 12 21

December 31, 2002 ..................... 20 4,011 21 16 37

December 31, 2003 ..................... 21 5,433 29 24 53

December 31, 2004 ..................... 30 7,211 44 25 69

March 31, 2005 ......................... 30 7,511 48 25 73

June 30, 2005 .......................... 33 8,051 52 25 77

September 30, 2005 ..................... 33 8,439 56 25 81

December 31, 2005 ..................... 33 9,021 61 31 92

We expect to continue to grow. As of December 31, 2005, our firm aircraft orders consisted of 98

Airbus A320 aircraft and 94 EMBRAER 190 aircraft, plus options for an additional 50 Airbus A320

aircraft and 100 EMBRAER 190 aircraft. Our growth strategy involves adding additional frequencies

on our existing routes, connecting new city pairs among destinations we already serve and entering

new markets. During 2005, we initiated service from New York’s John F. Kennedy International

Airport, or JFK, to Boston, MA, Burbank, CA, Portland, OR and Ponce, Puerto Rico. We also

increased our presence in the New York metropolitan market by commencing service from New

Jersey’s Newark International Airport to Fort Lauderdale, Fort Myers, Orlando, Tampa and West

Palm Beach, FL, and San Juan, Puerto Rico. In addition, we increased the frequency of service in

many of our existing markets. In January 2006, we commenced service to Austin, Texas.

We derive our revenue primarily from transporting passengers on our aircraft. Passenger revenue

was 95.3%of our operating revenues for the year ended December 31, 2005. Revenues generated

from international routes accounted for 1.6%of our total passenger revenues in 2005. Because all of

our fares are nonrefundable, revenue is recognized either when the transportation is provided or after

the ticket or customer credit expires. We measure capacity in terms of available seat miles, which

represents the number of seats available for passengers multiplied by the number of miles the seats

are flown. Yield, or the average amount one passenger pays to fly one mile, is calculated by dividing

passenger revenue by revenue passenger miles.

We strive to increase passenger revenue primarily by maintaining our high load factor, which is

the percentage of aircraft seating capacity that is actually utilized. Based on published fares at our

time of entry, our advance purchase fares were often 30%to 40%below those existing in markets

29