JetBlue Airlines 2005 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2005 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

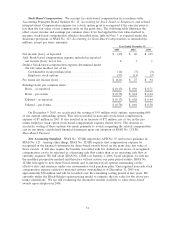

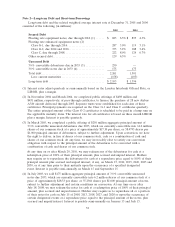

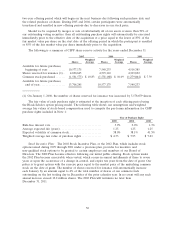

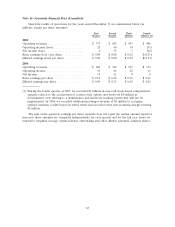

Note 8—Earnings (Loss) Per Share

The following table shows how we computed basic and diluted earnings (loss) per common share

for the years ended December 31 (dollars in millions; share data in thousands):

2005 2004 2003

Numerator:

Net income (loss) applicable to common stockholders for

basic earnings (loss) per share ........................ $ (20) $ 46 $ 103

Interest on convertible debt, net of profit sharing and

income taxes ....................................... — — 1

Net income (loss) applicable to common stockholders after

assumed conversion for diluted earnings (loss) per share . $ (20) $ 46 $ 104

Denominator:

Weighted-average shares outstanding for basic earnings

(loss) per share ..................................... 159,889 154,769 145,912

Effect of dilutive securities:

Employee stock options.............................. — 11,403 13,399

Unvested common stock ............................. — 42 2,000

Convertible debt .................................... — — 2,944

Adjusted weighted-average shares outstanding and

assumed conversions for diluted earnings (loss) per

share .............................................. 159,889 166,214 164,255

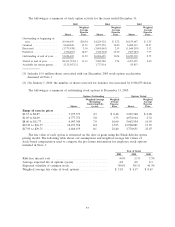

For the years ended December 31, 2005 and 2004, a total of 20.8 million and 6.2 million shares,

respectively, issuable upon conversion of our convertible debt were excluded from the diluted earnings

per share calculation since the assumed conversion would be anti-dilutive. We also excluded

31.1 million, 7.6 million and 1.3 million shares issuable upon exercise of outstanding stock options for

the years ended December 31, 2005, 2004 and 2003, respectively, from the diluted earnings (loss) per

share computation since their exercise price was greater than the average market price of our common

stock or if they were otherwise anti-dilutive.

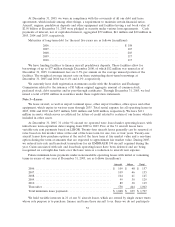

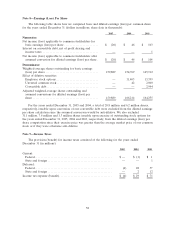

Note 9—Income Taxes

The provision (benefit) for income taxes consisted of the following for the years ended

December 31 (in millions):

2005 2004 2003

Current:

Federal...................................................... $ — $ (1) $ 1

State and foreign ............................................. — — 1

Deferred:

Federal...................................................... (4) 28 57

State and foreign ............................................. — 2 12

Income tax expense (benefit)..................................... $ (4) $ 29 $ 71

58